Pakistan Partners With Binance to Tokenize $2B in Government Bond - A Game-Changer for Digital Finance

Pakistan just placed a $2 billion bet on blockchain—and it's partnering with Binance to make it happen.

The move signals a seismic shift in how sovereign debt gets issued, traded, and settled. Forget paper certificates and slow clearinghouses. Pakistan's government bond is going digital, tokenized on a global crypto exchange.

Why This Isn't Just Another Pilot

Most 'blockchain in finance' projects are small-scale experiments. This isn't one of them. Two billion dollars is real money—the kind that moves markets and forces traditional finance to pay attention. It's a sovereign nation bypassing decades-old infrastructure to tap directly into the liquidity and efficiency of crypto markets.

The Mechanics of a Tokenized Bond

Think of it as a government IOU, but one that lives on a blockchain. Each token represents a slice of the $2 billion bond, programmable, instantly transferable, and available 24/7. It cuts out layers of intermediaries—the custodians, the transfer agents, the whole costly back-office apparatus that hasn't changed much since the 1970s.

What This Means for Crypto Adoption

This is institutional adoption on steroids. It's not a hedge fund dabbling in Bitcoin; it's a national treasury using blockchain for its core funding operations. It validates the entire premise of tokenization: that real-world assets, from real estate to bonds, are migrating on-chain. Watch for other emerging economies to follow—especially those looking to attract capital without the traditional Wall Street gatekeepers.

The Cynical Finance Jab

Of course, the old guard will call it risky. The same institutions that brought you the 2008 financial crisis with opaque derivatives will suddenly become concerned about 'transparency.' How quaint.

The bottom line? A major government just chose a crypto exchange over a traditional investment bank for a flagship deal. The walls between traditional and digital finance aren't just cracking—they're being demolished with a $2 billion sledgehammer.

The Pakistan government has accelerated its web3 adoption through a strategic collaboration with Binance. The country is keen to access global liquidity through the web industry to revitalize its local economy.

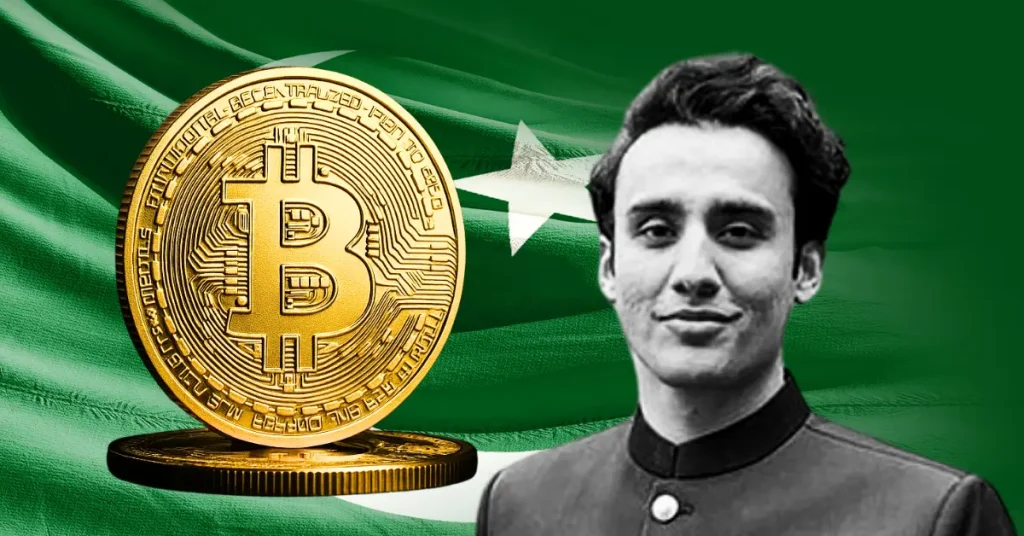

Pakistan Signs MoU with Binance to Tokenize $2B in Sovereign Assets

On December 12, 2025, Finance Minister Muhammad Aurangzeb and Binance CEO Richard Teng, with Changpeng Zhao (CZ)present, signed a non-binding MoU to tokenize sovereign assets. According to the announcement, Binance will help Pakistan access global liquidity as it seeks to tokenize up to $2 billion in sovereign assets.

“This is a great signal for the global blockchain industry and for Pakistan. It has a very big impact on the country’s future and its technology-driven generation,” CZ noted.

Industrial Rebirth Via Blockchain and Crypto

According to Bilal Bin Saqib, Pakistan’s Minister of Blockchain and Crypto, the country is keen to legalize the web3 industry to revitalize the local economy. Furthermore, Saqib noted during the Bitcoin MENA Conference 2025 that 70% of 240 million people in Pakistan are aged 30 years and below.

With over 100 million Pakistani individuals still unbanked by the traditional system, Saqib stated that bitcoin and crypto are a relief for the vast majority. As such, he reassured investors that regulatory clarity is a priority to ensure a seamless mainstream adoption of the web3 industry.

Moreover, Pakistan ranked 3rd after India and the United States in Chainalysis’ 2025 global adoption index. Additionally, the country has cheap and excess electricity of over 20GW, which can be harnessed to mine Bitcoin or train artificial intelligence models.