Ripple’s $50 Billion IPO in 2026? Analysts Rank XRP Firm Among Top Public Listing Candidates

Forget waiting for the next crypto bull run—Wall Street might be carving its own slice of the digital pie.

Analysts are now circling a potential blockbuster: Ripple, the heavyweight behind the XRP token, landing among the top candidates for a public offering that could crack a staggering $50 billion valuation. The chatter points to 2026 as the target window.

Why Ripple, and Why Now?

The speculation isn't pulled from thin air. Ripple's core business—streamlining cross-border payments for financial institutions—has long operated in a gray zone, tangling with regulators while building real-world utility. An IPO represents the ultimate legitimacy play, a move to transcend 'crypto company' status and become a full-fledged, publicly-traded financial technology giant.

It’s a classic corporate metamorphosis: start with a disruptive token, build enterprise-grade infrastructure, then court the public markets for a war chest that makes venture capital rounds look like pocket change.

The $50 Billion Question

Hitting that valuation isn't just about current revenue—it's a bet on the entire future of blockchain-based settlement. Success would signal that institutional adoption isn't just a buzzword but a revenue-generating machine. It would force traditional finance to stop looking at crypto through a speculative lens and start seeing it as a direct competitor in the plumbing of global finance.

Of course, the path is littered with hurdles. Regulatory clarity, especially in the U.S., remains the elephant in the boardroom. Market sentiment can turn on a dime. And let's be honest—Wall Street has a knack for taking a revolutionary idea, packaging it in a slick ticker symbol, and selling it back to you at a premium that would make a Satoshi-era maximalist weep.

A Ripple IPO wouldn't just be a liquidity event for early investors. It would be a referendum. Is blockchain infrastructure ready for its mainstream close-up, or is this just another chapter in the long-running saga of finance co-opting the revolution?

Ripple, the blockchain payments company behind XRP, is once again in the spotlight as reports suggest that it may be preparing for a possible initial public offering (IPO) in 2026.

Industry analysts now rank Ripple among the biggest potential public listings, with valuations estimated near $50 billion

Here’s what Ripple’s leadership is saying about these IPO talks.

Sign Shows Ripple Preparing for a 2026 IPO

According to multiple sources, Ripple is reportedly holding advanced internal discussions around a potential IPO in 2026. These are not rumors or casual considerations, but signs that the company may be actively preparing for a public listing.

The company has also strengthened its internal structure, with better reporting and governance, which are common steps before going public. At the same time, Ripple is expanding bank partnerships and payment services to build steady, real-world revenue.

Indeed, Ripple continues to position XRP as a liquidity tool within its payment system. IPO-ready companies usually highlight utility and long-term value rather than market hype.

Ripple Ranks Among Top IPO Candidates for 2026

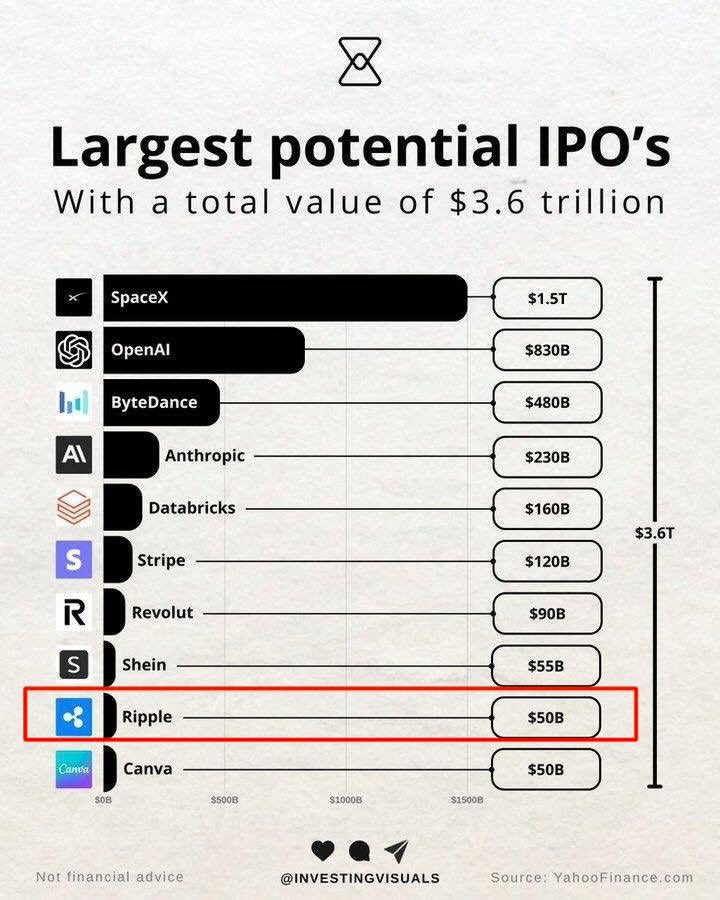

Adding to the excitement, market data and industry visuals now place Ripple among the largest potential IPOs heading into 2026. According to recent comparisons, Ripple ranks ninth among top private companies expected to go public, with an estimated valuation of $50 billion.

The list includes major global names such as SpaceX, OpenAI, ByteDance, and Stripe, highlighting just how significant Ripple’s position has become.

Analysts point to strong momentum, improving regulation, and growing global adoption as key reasons Ripple continues to stand out.

Ripple Leadership Pushes Back

Despite growing speculation, Ripple executives have consistently denied IPO rumors. Ripple President Monica Long has said the company has “no plan and no timeline” to go public, stressing that Ripple is well-funded and does not need public markets to raise capital.

Even Ripple CEO Brad Garlinghouse has echoed this view, noting that any IPO discussion WOULD be a long-term consideration, not an immediate move.

Other Crypto Firms Move Closer to IPO

According to recent research reports, public markets are becoming the preferred next step for mature crypto firms. Circle has already gone public, and other major names such as Kraken, Grayscale, and BitGo have filed paperwork or entered advanced talks.

In Asia, Dunamu, the operator of Upbit, is also preparing a public debut through a merger. This broader trend has fueled speculation that Ripple could follow a similar path.