BitMNR Makes $219M Ethereum Bet: Crypto Giant Goes All-In on ETH Staking

One of crypto's biggest whales just parked a quarter-billion dollars in Ethereum's staking pool—and the market's taking notice.

The Staking Move That Shook the Network

BitMNR, a name that moves markets, didn't just dip a toe in the water. They plunged $219 million worth of ETH into the network's proof-of-stake engine. That's not casual investing; that's a strategic declaration of faith in Ethereum's long-term mechanics. It's the kind of capital allocation that makes other institutional wallets suddenly feel underweight.

Why This Isn't Just Another Deposit

Forget the passive HODL. Staking this scale is active, engaged capital. It locks liquidity, earns yield, and—crucially—buttresses the network's security from the inside. When a player this large commits, they're not just betting on price. They're betting on the protocol's very survival and utility. It signals a shift from speculative trading to infrastructure building. Or, in the cynical parlance of traditional finance, they're finally doing something vaguely resembling 'productive asset management.'

The Ripple Effect Across Crypto

A move this size sends a tremor. It validates the staking thesis for other institutional holders sitting on the sidelines. It soaks up liquid supply, potentially tightening market dynamics. Most importantly, it broadcasts a high-conviction signal: one of the sector's most watched treasuries sees more future in Ethereum's yield-generating spine than on its volatile trading sheets. The message is clear—the smart money isn't just trading the asset anymore; it's becoming part of the machine.

The world’s largest ethereum treasury firm, BitMNR, has officially entered Ethereum staking for the first time, marking a major shift in how large ETH holders manage their assets.

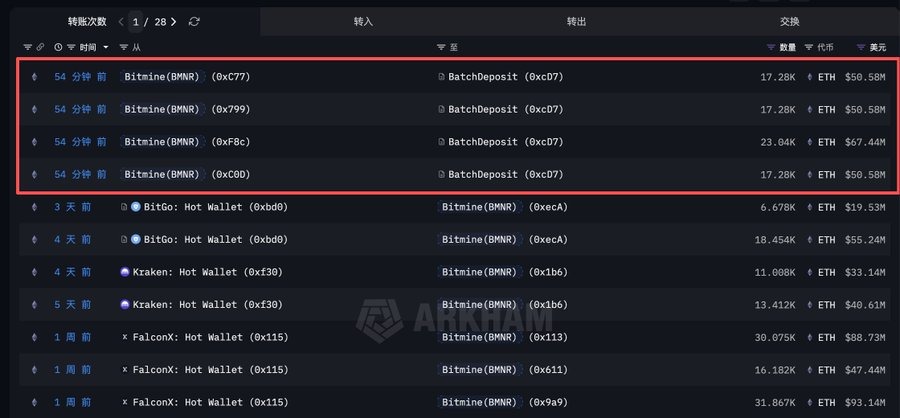

On-chain data shows the firm deposited around 74,880 ETH into Ethereum’s proof-of-stake system, worth nearly $219 million.

Bitmine Stakes $219 Million in Ethereum

According to on-chain data shared by Arkham Intelligence, BitMNR deposited around 74,880 ETH into Ethereum’s proof-of-stake system, roughly valued at nearly $219 million, making it one of the most notable staking moves by a corporate treasury in recent times.

This is the first time Bitmine has staked any of its Ethereum holdings. Until now, the company had kept its ETH untouched, even though it holds one of the biggest Ethereum treasuries in the market.

Instead of relying only on long-term price growth, the company is now aiming to earn steady income directly from the Ethereum network. By staking its ETH, Bitmine helps secure the blockchain while earning regular rewards in return.

How Much ETH Does BitMNR Hold?

On-chain data shows Bitmine holds about 4.066 million ETH, valued at $11.9 billion. This represents roughly 3.37% of Ethereum’s total supply, making Bitmine one of the largest ETH holders globally.

With Ethereum’s current staking yield around 3.12% per year, the potential returns are significant. If Bitmine were to stake all of its ETH, it could earn close to 126,800 ETH annually. As of today’s price of around $2,927, that WOULD be worth roughly $371 million.

Commenting on the move, Thomas Tom Lee, Chairman of Bitmine, said the company is moving quickly toward its 5% return goal and is already seeing clear benefits from its large Ethereum holdings.

Ethereum Price Outlook

Ethereum’s price has been moving in a tight range between $2,900 and $3,000, as low year-end trading activity keeps the market quiet. Recently, Thomas Tom Lee has remained optimistic, saying asset tokenization could push ETH to $7,000–$9,000 range by early 2026.

![]() BREAKING:

BREAKING:

TOM LEE PREDICTIONS:

– $9,000 $ETH in early 2026

– $200,000 $BTC in 2026

– $20,000 ETH long-term

– crypto Supercycle

Here we go![]() pic.twitter.com/T2ydRBI8yh

pic.twitter.com/T2ydRBI8yh

As of now, Ethereum is trading NEAR $2,928, down about 1% in the last 24 hours, with its market value standing around $354 billion.