XRP Price Stalls Despite $1B ETF Inflows - Analysts Reveal the Hidden Pressure

XRP can't catch a break. A billion dollars floods into its ETF, yet the price charts refuse to budge. What gives?

The Liquidity Conundrum

Forget simple supply and demand. Analysts point to a massive, hidden overhang—a tidal wave of tokens held by institutions and early backers, all waiting for the right moment to cash out. Every price bump meets a wall of selling pressure that $1 billion in fresh ETF money just can't punch through. It's classic 'buy the rumor, sell the news,' but on institutional steroids.

Regulatory Ghosts & Market Sentiment

The SEC's long shadow still looms. While the legal fog has cleared somewhat, the uncertainty scarred the asset's reputation with big money. Traditional finance moves slowly, and that skepticism translates into weaker price momentum than pure fundamentals would suggest. Meanwhile, the broader crypto market chases the next shiny narrative, leaving XRP in a curious limbo.

The Institutional Double-Edged Sword

Here's the cynical finance jab: Wall Street's embrace is a two-way street. That $1 billion inflow provides legitimacy and stability, sure. But it also turns XRP into just another asset to be traded, hedged, and arbitraged—dampening the volatile rocketship moves retail crypto degens crave. The very thing that promises long-term growth might be killing its short-term moonshot.

The takeaway? Real-world adoption and ETF flows are one thing. Moving the needle on price in a market haunted by its past and weighed down by its own success? That's a whole other battle. The money is here. Now XRP needs a catalyst that's bigger than the baggage.

XRP Price remains under pressure as the broader altcoin market continues to weaken. The token is trading NEAR $1.84, down about 14% year-to-date and more than 17% over the past month. While long-term confidence in XRP has not faded, analysts agree that the current market lacks the strength to support a sustained move higher.

XRP ETF Demand and Shrinking Exchange Supply

Despite weak price action, spot XRP ETFs in the U.S. have crossed $1 billion in assets under management, signaling steady institutional demand. XRP’s long trading history and regulatory clarity make it easier for traditional investors to gain exposure.

On-chain data strengthens the long-term outlook. Around 750 million XRP has moved off exchanges in recent weeks, leaving roughly 1.5 billion XRP on trading platforms. If this trend continues, a supply squeeze could develop by early 2026, especially if institutional inflows increase.

XRP Price To Move Sideways Before Any Upside

Nansen senior research analyst Jake Kennis expects XRP to remain range-bound in the near term. He notes that altcoins usually struggle until Bitcoin stabilizes or forms a clear bottom. According to Kennis, better conditions may emerge in the second half of 2026, supported by improved macro trends and investor sentiment.

However, he adds that XRP’s next major MOVE will depend on clear catalysts, such as ETF growth, real-world use in payment systems, and stronger institutional participation, not short-term price momentum.

Ripple Price Levels to Watch in the Coming Days

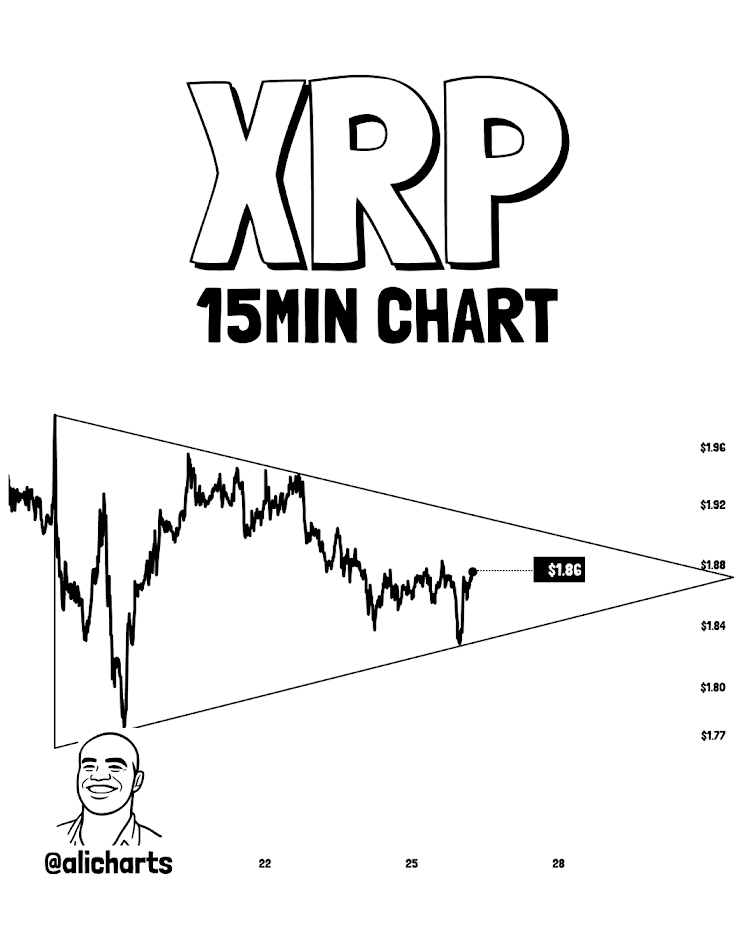

From a technical standpoint, analyst Ali Charts says XRP is consolidating within a triangle pattern, which often leads to a sharp move. He estimates a 10% price swing once a breakout or breakdown occurs.

Key levels remain crucial. $1.80 is a critical support zone. A clear break below this level could push XRP toward $1.37. On the upside, a bullish reversal WOULD require higher trading volume and a break in the current bearish structure signals that have not appeared yet.

Price forecasts vary. Conservative estimates suggest XRP Price could stay near $1.80–$1.90 if major catalysts fail to emerge. More bullish projections place XRP between $3.00 and $4.00 or higher in the second half of 2026, assuming ETF inflows grow, regulation remains favorable, and the broader crypto market recovers.