Bitcoin Long-term Holders Flip the Script: Accumulation Begins After Months of Selling—Is the Rebound Imminent?

After a prolonged exodus, Bitcoin's most committed investors are finally buying back in. This isn't just a blip—it's a potential regime change. The smart money is placing its bets, signaling a major shift in market sentiment.

The Whale Watch is On

Forget the day traders and the noise. The real story unfolds in the wallets of long-term holders. Their recent pivot from consistent selling to active accumulation cuts through the market's short-term panic. It's a classic case of 'buy when there's blood in the streets,' and the streets have been plenty red lately.

Decoding the Accumulation Signal

This behavior isn't random. It's a calculated move by investors with the deepest pockets and the longest time horizons. They're not swayed by hourly charts or influencer hype. Their return suggests a fundamental belief that current prices represent a generational buying opportunity, a cynical nod to the fact that true wealth transfers happen when the weak hands capitulate to the strong.

The Rebound Question

So, is Bitcoin primed for a rebound? History shows these players often get the timing right, even if their patience infuriates the get-rich-quick crowd. Their renewed accumulation builds a foundation of support that can fuel the next leg up. While no indicator is perfect, when the hodlers start hoarding again, the market usually listens.

The tide is turning. The quiet accumulation by Bitcoin's steadfast believers may well be the prelude to the roar of the next bull run. Watch the holders, not the headlines.

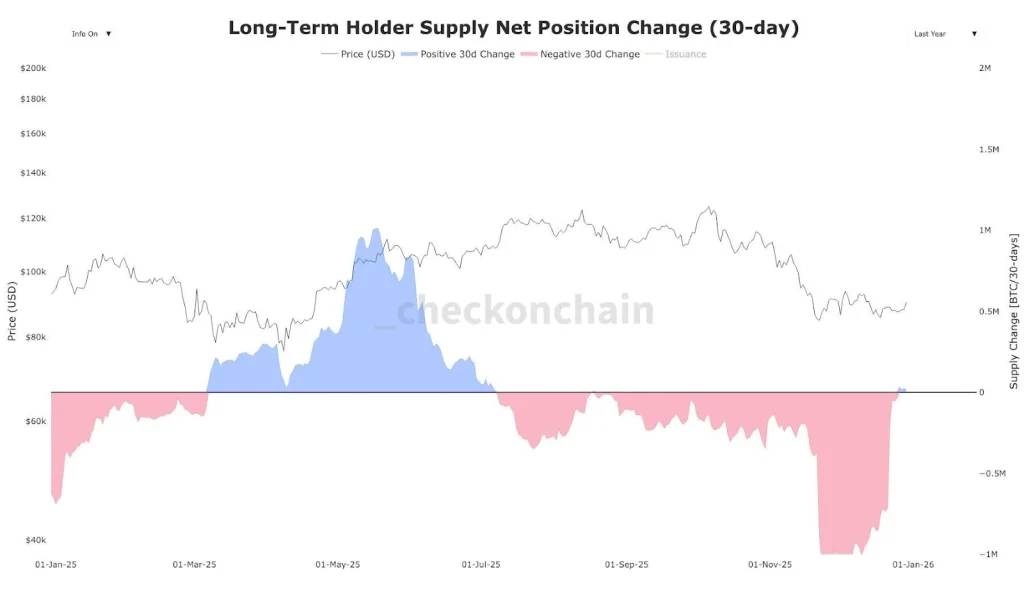

The long term Bitcoin (BTC) holders have begun accumulating for the first time since July 2025. The ongoing Bitcoin price consolidation has been achieved through the reduced selling pressure from long term investors and antidote rising demand from retail holders.

Bitcoin Long-term Holders Shifts Bullish?

According to onchain data analysis from checkonchain, the long-term holder supply net position, on a timeframe of 30 days, has turned positive for the first time since July 2025. bitcoin price has since dropped over 26% since July to trade at about $87.3k at press time, catalyzed by significant selling pressure from whale investors.

During the past 24 hours, the long-term Bitcoin holders, led by Strategy that acquired 1229 BTC, have recorded a net positive change in their holdings. As such, it is safe to assume that long-term Bitcoin holders are predicting a continuation of the ‘Santa Claus rally’ in 2026.

Source: X

Is BTC Price Ready for Bullish Rebound Before End of 2025?

Technical Tailwind Favors Bullish Reboud

The renewed bitcoin demand by long-term holders has supported bullish sentiments in the coming days and weeks. In the weekly timeframe, the BTC/USD pair has been retesting a crucial demand zone, likely to yield its rebound towards a new all-time high (ATH).

The midterm bullish outlook for BTC will, however, be invalidated if BTC price drops below $80k as traders will be looking for further drop towards the support level around $77k.

Supportive macroeconomic backdrop

The midterm outlook for Bitcoin remains bullish fueled by the supportive macroeconomic backdrop. The renewed demand from long-term investors has surged amid rising global money supply and the ongoing bull rally in the precious metal industry.

Although Bitcoin price is down over 7% year-to-date, its rising demand on a fixed supply of 21 million coins and cumulative fundamentals is expected to trigger a bullish outlook.