Ethereum’s $5K Target Looms: ETH Surged 120% Last Time This Signal Flashed - Digitap ($TAP) FOMO Hits Fever Pitch

Ethereum's price chart is whispering a familiar, bullish secret. A technical pattern that preceded a 120% rally is flashing again, and the $5,000 psychological barrier is back in the crosshairs.

The Echo of a Previous Rally

Market analysts are glued to a specific on-chain or chart formation—the same one that ignited the last major leg up. History doesn't repeat, but it often rhymes, and traders are betting the rhyme scheme points to another explosive move. The sheer scale of the previous gain has institutional desks and retail wallets alike recalculating their risk models.

FOMO Spills Over to Digitap ($TAP)

While ETH dominates headlines, the speculative frenzy is bleeding into select altcoins. Digitap ($TAP) is seeing parabolic social volume and trading activity, a classic symptom of market-wide euphoria. It’s the kind of momentum where fundamentals get ignored in favor of the green candle—until they don't.

A Cynical Nod to Finance

It’s the age-old cycle: a credible signal emerges, early money piles in, narratives get stretched, and suddenly everyone’s a genius—right before the ‘smart money’ quietly takes profits. The real test isn't spotting the pattern; it's knowing when the music stops.

All eyes are on Ethereum to see if it can engineer a repeat performance. If it does, $5,000 isn't just a target; it becomes a stepping stone. And if it fails? Well, there's always another narrative waiting in the wings.

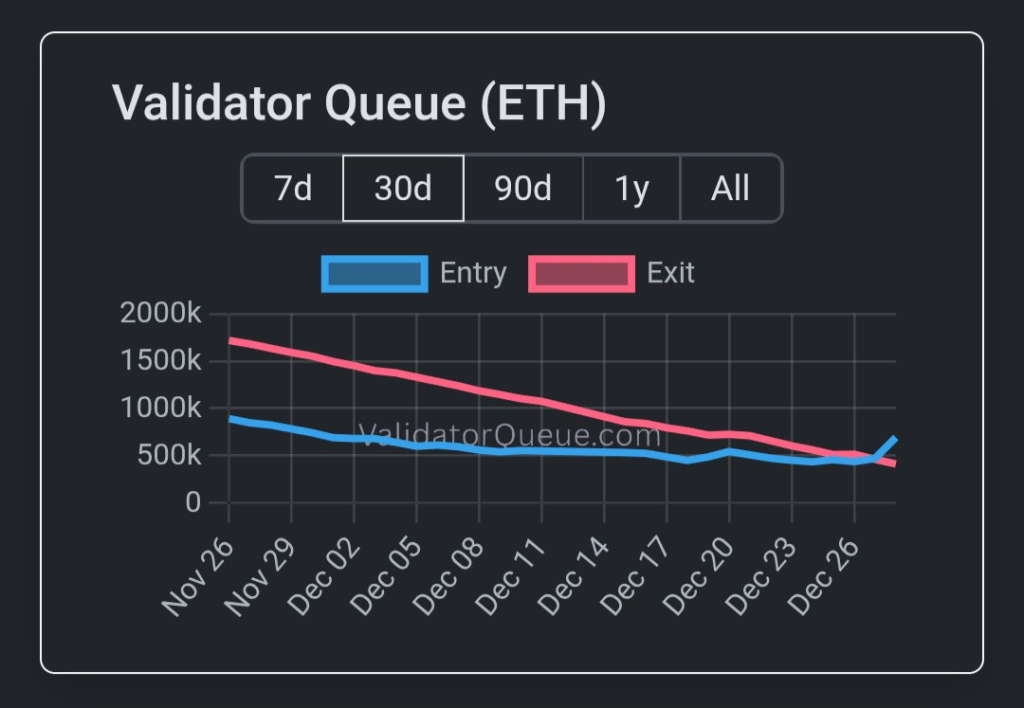

Ethereum is once again pulling traders back into the debate between large-cap conviction and early-stage opportunity. ETH is trading NEAR $2,974, and on-chain data shows a shift that historically has not gone unnoticed. The amount of Ether entering the staking queue has now surpassed the amount waiting to exit, a dynamic that has previously aligned with powerful upside moves.

At the same time, many investors are questioning how much upside is realistically left in large caps over the next 12 months. While ETH moving to $5,000 WOULD still be a strong return, early-stage infrastructure plays are drawing more attention in this environment. That is whereexcels as aproducing great numbers during a cautious market.

Ethereum holders focus on whether the next leg higher arrives, but Digitap supporters are watching steady presale progress, a live product, and a model built for defensive positioning. For those searching for theheading into 2026, the contrast between ETH and $TAP has become increasingly clear.

Ethereum Staking Data Points Toward a Possible $5K Move

Ethereum’s validator entry queue has grown to more than 745,000 ETH, worth roughly $2.2 billion at current prices. This has overtaken the exit queue for the first time since June, when a similar setup preceded a major price expansion. Nearly 29.3% of the total ETH supply is now staked, reducing immediate sell-side pressure and tightening liquid supply.

Historically, this type of imbalance has aligned with sharp rallies. In March and June of the previous cycle, ETH advanced roughly 90% and 126% after staking inflows overtook exits. If a comparable move plays out again, ethereum could revisit the $5,000 region in 2026, assuming broader market conditions cooperate.

From a technical perspective, ETH continues to hold above the $2,750 level. The current range between $2,750 and $3,200 resembles earlier consolidation phases that resolved higher. A hold above this zone keeps the $5,000 narrative alive, even though some market participants remain cautious about bull traps.

Still, even a clean MOVE from $3,000 to $5,000 represents less than a 2x return. That reality explains why capital is not only watching ETH, but also rotating intothat offer asymmetric upside with defined structure. This is where Digitap enters the conversation.

Why Digitap ($TAP) Looks Different From Typical Crypto Presales

Most crypto presales ask investors to buy into a roadmap. Digitap does the opposite. The platform already has a live app, active users, and real financial rails connected to traditional banking systems. That alone places it in a different category from many early-stage projects.

Digitap operates as a crypto-first banking platform. Users can store digital assets, convert crypto to fiat, and move funds through established networks such as SEPA and SWIFT. During volatile markets, this functionality becomes more important than speculative trading tools. It allows users to manage risk, preserve value, and maintain flexibility when price action turns unpredictable.

Security and transparency also play a role. Digitap’s smart contracts have been audited byand, addressing one of the biggest concerns in the presale space. On top of that, staking is already integrated into the ecosystem, offering yield without relying on inflationary token issuance.

Staking rewards are drawn from a fixed pool, not from newly minted tokens. Early participants can access elevated yields, while long-term lockups and exit penalties help reduce short-term flipping. In a market where confidence is fragile, this design places Digitap firmly amongfocused on durability rather than hype.

Why $TAP Is More Interesting Than ETH Right Now

Ethereum remains a cornerstone asset. It anchors DeFi, smart contracts, and institutional exposure. But its size also limits short-term upside. A $5,000 ETH is meaningful, yet the return profile is modest compared to early-stage infrastructure plays.

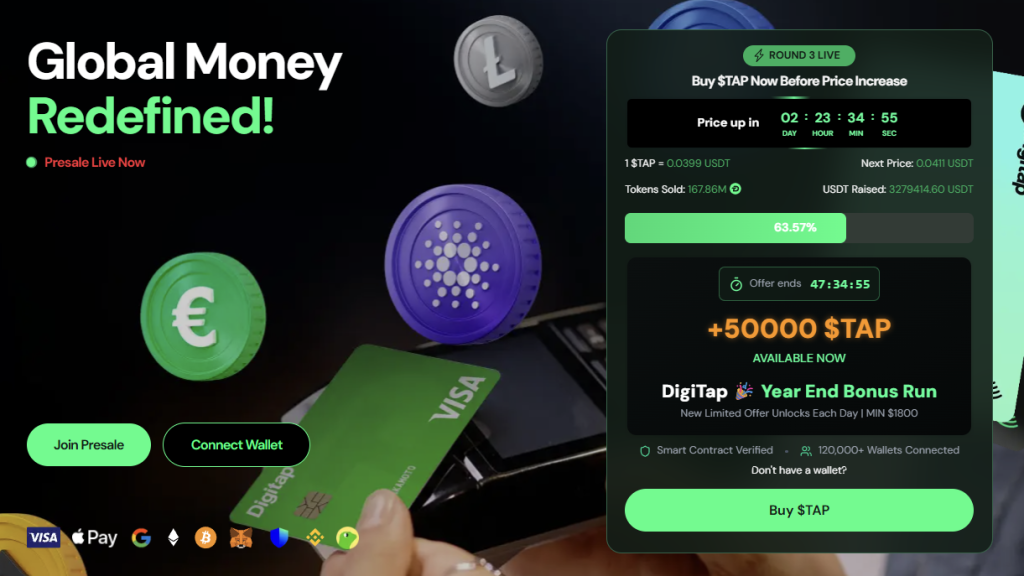

illustrates a different story. The token launched at $0.0125 in its earliest phase and has already climbed through multiple structured increases. The current price sits at $0.0399, with the next increase to $0.0411 approaching. The planned listing price is set at $0.14, creating a clear gap between presale entry and market debut.

Presale participation has continued even during weak market conditions. Nearly 170 million $TAP tokens have already been sold, and the raise is approaching the $3.5 million mark. This steady progression reflects controlled demand rather than speculative spikes.

Beyond pricing, Digitap also incorporates a buyback-and-burn model tied to platform revenue. A portion of profits is used to repurchase $TAP from the market, with half of those tokens permanently removed from circulation and the remainder allocated to staking rewards. Over time, this structure reduces supply while reinforcing long-term holding incentives.

For investors weighing ETH’s potential $5,000 move against Digitap’s multi-stage growth path, the choice becomes one of scale versus structure. Ethereum offers stability. Digitap offers asymmetry.

ETH Momentum vs. Digitap Opportunity – Best Altcoin to Buy Now?

Ethereum’s staking dynamics point toward a possible continuation higher, and a $5,000 ETH in 2026 remains a reasonable scenario if market conditions improve. For large-cap exposure, ETH still plays an important role.

However, periods of consolidation in majors often coincide with capital rotating into early-stage projects that continue building regardless of sentiment. Digitap ($TAP) fits that profile.

With a live banking app, audited contracts, structured staking, and disciplined token economics, Digitap has positioned itself as one of thefor investors thinking beyond short-term charts. As abuilt around real utility, it stands apart from narrative-driven launches and “short-term pump” stories.

Digitap is Live NOW. Learn more about their project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway