Bitcoin Soars Past $94k as Whales Gobble Supply While Retail Takes Profits

Bitcoin just smashed through another psychological barrier. The $94,000 price tag isn't just a number—it's a battleground where deep-pocketed investors and everyday traders are making radically different moves.

The Whale Feeding Frenzy

While headlines scream about the price, the real story is playing out in the order books. On-chain data reveals a classic accumulation pattern from addresses holding substantial BTC. These entities aren't spooked by all-time highs; they're treating them as an invitation to buy more, aggressively soaking up liquidity and adding to their long-term holdings. It's a powerful vote of confidence that suggests they see far more runway ahead.

The Retail Exodus

Flip the script, and you'll find a different narrative. A significant portion of the selling pressure at these levels is coming from smaller wallets. After a grueling bear market, the temptation to finally book a profit—or simply break even—is overwhelming. It's a rational, if historically poorly timed, reaction. This profit-taking creates the very supply that the whales are happily absorbing, a dynamic that's become a recurring theme in crypto's boom cycles.

The Engine Behind the Rally

This push-pull between fear and greed is the rocket fuel. Whale accumulation provides a solid price floor, absorbing sell orders that would normally cause a sharp correction. Retail profit-taking, meanwhile, prevents the market from overheating into a pure speculative bubble—at least for now. It's a volatile, self-correcting mechanism that keeps the ascent steep, but not entirely vertical.

So, is this sustainable? In the short term, the whales hold the cards. Their continued buying can easily propel Bitcoin into six-figure territory. But let's not ignore the cynical truth of finance: every 'smart money' accumulation phase looks brilliant in a bull market and reckless in a bear one. For now, the trend is their friend, and it's taking the price on a wild ride north.

Bitcoin price has rebounded over 7% since the calendar flipped for 2026 last week. The flagship coin has since retested a crucial liquidity level around $94k on Monday, January, 2025.

Why Is Bitcoin Up Today?

Capitulation of retailers amid renewed whales demand

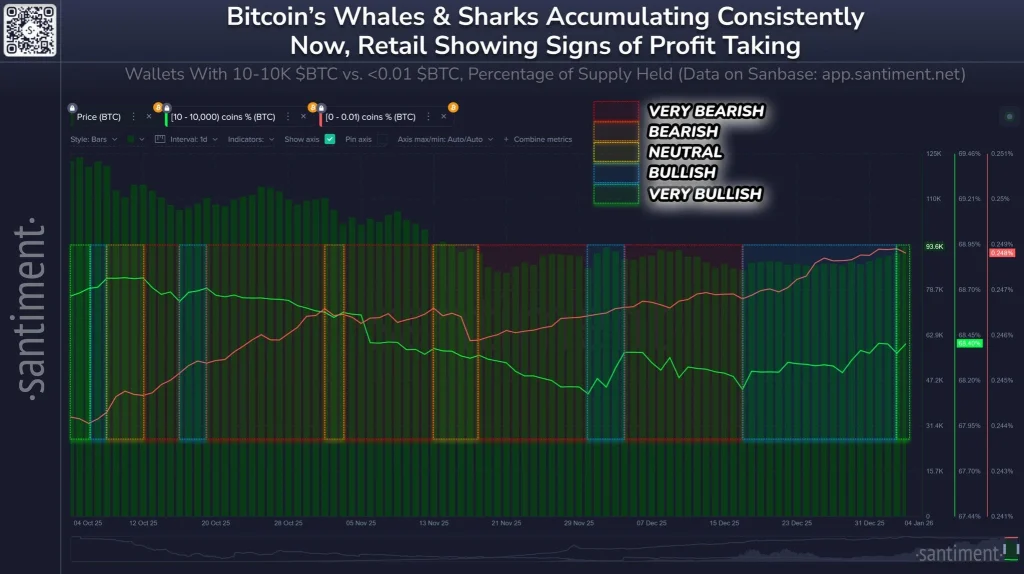

According to onchain data analysis from Santiment, Bitcoin whales, with a balance of between 10 and 10k have gradually increased their holdings in the past few days. On the other hand, Bitcoin holders, with less than 0.01 BTC have increased their profit taking.

Historically, Santiment has shown that a rising accumulation from whales amid retail capitulation is a bullish recipe and vice versa.

The rising demand for bitcoin from whale investors can be demonstrated through major treasury companies. For instance, American Bitcoin, a treasury company backed by President Donald Trump, increased its holdings to 5,427 BTCs, valued at over $505 million.

Strategy Inc also increased its Bitcoin holdings by 1,287 BTCs to currently hold about 673,783 coins. The risk-on investment behavior in Bitcoin from institutions is backed by the robust cumulative fundamentals in 2025, including notable cash inflows to the spot BTC ETFs.

Bullish technical tailwinds

From a technical analysis standpoint, BTC price is well positioned to rally beyond $100k towards a new all-time high in the near term. In the daily timeframe, Bitcoin price rallied beyond a crucial supply level around $93k to trade about $94,316 at press time.

Crypto analyst @Osemka8 on X noted that bitcoin price has been following a similar bullish pattern to its 2023 market reversal. With the rising global money supply amid the notable predictions of a gold topout, Bitcoin price is well positioned to experience a parabolic rally in the near future.