LIT Token Ignites: Why This Crypto Just Rocketed 13% in a Single Session

Forget the slow burn—today's market saw a full-blown flare-up. The LIT token, a lighter digital asset, just scorched the charts with a blistering 13% intraday surge. What sparked the sudden heat?

The Fuel Behind the Fire

While the usual suspects—speculation, exchange listings, or a major partnership—often fan these flames, today's move cuts through the typical noise. It's a sharp reminder that in crypto, momentum can ignite from the smallest ember, bypassing traditional valuation models that traditional finance analysts clutch like sacred texts. One day it's dormant; the next, it's lighting up portfolios.

Reading the Market's Temperature

A jump of this magnitude doesn't happen in a vacuum. It signals concentrated buying pressure, a vote of confidence from the market's most risk-tolerant players. These moves often precede increased volatility, drawing in both opportunistic traders and nervous spectators waiting for a pullback—or the next leg up.

The Takeaway: Volatility is the Feature, Not the Bug

Today's 13% leap for LIT is more than just a number on a screen. It's a masterclass in crypto's core dynamic: breathtaking, nerve-wracking, and utterly unpredictable price action that continues to baffle spreadsheet warriors and delight degens. In the end, it's just another day where the market decides that fundamentals are, well, kind of boring.

Lighter, a decentralized perpetuals exchange built as a zero-knowledge rollup on Ethereum, has seen its native token LIT price jump nearly 13% today.

This sudden rally came right after the Lighter team announced that all fees generated by its core DEX product and future services WOULD be used for LIT tokens.

LIT Protocol Buybacks Plan Drive Price Up

The biggest trigger behind today’s LIT rally is Lighter’s protocol fee buyback program. On January 6, on-chain data showed Lighter’s treasury using protocol fees to buy back LIT tokens directly from the market. Community members tracked transactions where the treasury spent over $10,000 in USDC to purchase roughly 180,700 LIT tokens.

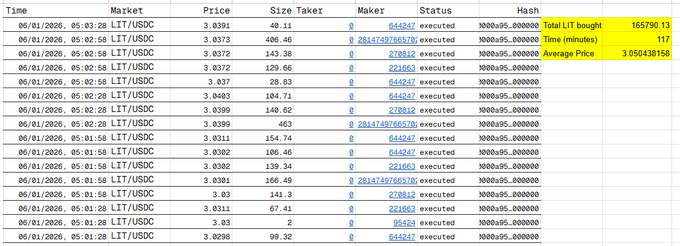

In addition, the Lighter Assistance Fund also bought 165,790 LIT tokens over a short period, at an average price close to $3.05.

These purchases are fully transparent and visible on-chain through a dedicated treasury account, confirming that buybacks are already active, not just a plan.

Trading Volume and Whale Activity Spark Rally

In addition to this, trading activity surged alongside the buybacks. LIT’s 24-hour trading volume jumped nearly 89%, reaching around $36 million. This spike suggests renewed interest from both retail and large traders.

Interestingly, on-chain data also shows whale involvement. One large transaction involved the sale of 52.1 Wrapped Bitcoin worth around $4.86 million, followed by a $3.36 million USDC deposit into Lighter.

Those funds were later used to buy over 1.119 million LIT tokens, adding strong upward pressure to the price.

Lighter LIT Token Price Outlook

Looking at the 1-hour price chart, LIT has shifted into a strong short-term uptrend after breaking out from a consolidation phase NEAR the $2.50–$2.60 zone. The price is currently trading around $3.09, holding above key short-term support.

LIT price has broken above a descending corrective trendline, confirming trend reversal.

So, as long as the price holds above $2.95, the bullish structure remains intact. A sustained MOVE above would open the door for upside targets near $3.60.

Meanwhile, RSI remains healthy around 66 and below extreme overbought levels, leaving room for further upside.