Where TradFi Meets DeFi: Luminary’s Hybrid Infrastructure is Bridging the $400T Gap

The walls between Wall Street and crypto are crumbling—and a new player just swung the biggest wrecking ball yet.

Luminary's hybrid financial stack isn't just another protocol. It's a full-scale interoperability engine, stitching together legacy banking rails with decentralized finance's permissionless core. Think of it as a diplomatic passport for capital, letting institutional money flow where it was once barred.

The Seamless Bridge No One Saw Coming

Forget clunky gateways and compliance nightmares. Luminary's architecture cuts the red tape by design, creating a unified ledger that speaks the language of both SEC filings and smart contracts. It bypasses the middlemen without triggering the alarms—a feat that's more political than technical.

Why This Hybrid Model Hits Different

Traditional finance brings the scale—hundreds of trillions in dormant capital. DeFi brings the speed and transparency. Luminary's fusion doesn't ask either side to change its DNA; it just builds a secure, auditable handshake protocol. Suddenly, yield-bearing treasuries can interact with algorithmic markets, all while keeping the suits in compliance. (A minor miracle, really.)

The Cynical Take: A Necessary Evil?

Let's be real—the old guard isn't embracing decentralization out of philosophical enlightenment. They're following the yield. Luminary's real innovation might be giving traditional finance a 'plausibly deniable' on-ramp to the crypto economy, complete with the regulatory fig leaf they desperately need. It's the financial equivalent of eating your cake and having it too—something Wall Street has always been suspiciously good at.

The verdict? This isn't just infrastructure. It's the endgame play for mass adoption—proving that the future of finance isn't about choosing sides, but finally building a reliable bridge between them.

Web3 businesses face an operational problem that rarely makes headlines: they need both traditional banking and crypto infrastructure, yet these systems largely don’t talk to each other.

Behind every blockchain startup sits the mundane reality of paying employees in fiat, managing multi-currency accounts, issuing corporate cards, and reconciling all of this with onchain treasury activity. The result is fragmentation, the juggling of relationships with banks that are often crypto-averse, alongside exchanges, payment processors, and custody providers that don’t fully address operational needs.

As crypto matures beyond speculation and into operational infrastructure, this bottleneck has become harder to ignore. DeFi solved programmable settlement. Neobanks improved user experience. But the fiat-digital interface remains unresolved, forcing companies into awkward trade-offs.

Luminary positions itself as infrastructure for this gap: not a bank, not a DeFi protocol, but a regulated financial services platform offering unified fiat and crypto operations across jurisdictions. The question is not whether such a LAYER should exist, but whether Luminary can execute on it.

Luminary’s Offering and Why It Matters

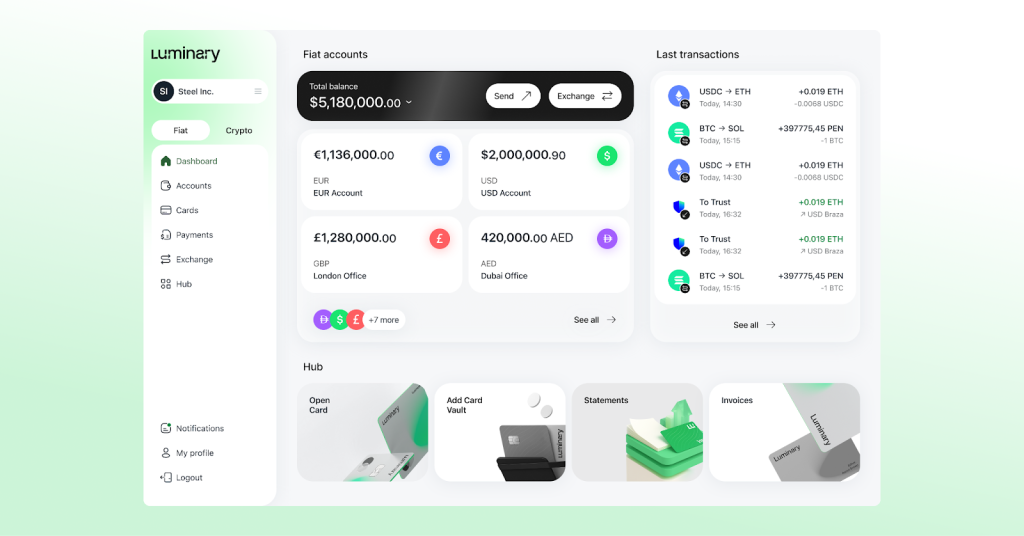

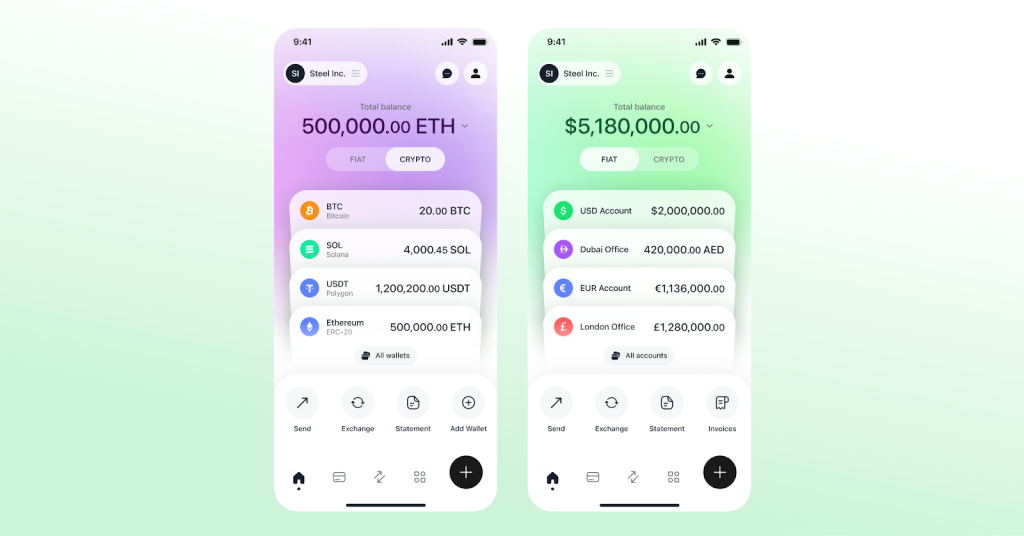

Luminary’s multi-currency IBAN accounts support international fiat payments and currency holdings alongside crypto operations, reducing the need to maintain parallel banking and exchange relationships.

Both asset types are managed from a single dashboard, reducing the need to maintain parallel relationships with banks, exchanges, and payment processors. The platform also provides corporate cards – physical and VIRTUAL – supporting spending in fiat or directly from crypto balances. The company reports instant virtual issuance, an approval rate of approximately 99%, and acceptance in 150+ countries. The value proposition is consolidation: finance teams operate through a single, regulated interface rather than reconciling activity across fragmented providers.

For businesses holding digital assets while facing fiat obligations, Luminary says it facilitates access to Bitcoin-backed borrowing that can unlock fiat or stablecoin liquidity without requiring asset sales. This addresses a common inefficiency: crypto-heavy balance sheets that remain operationally cash-constrained. The platform also integrates staking services through partners such as Colossus Digital, enabling businesses to generate yield across more than 20 blockchain networks while retaining full asset control. The stated aim is to treat digital assets as working capital rather than passive holdings.

Beyond financial services, Luminary bundles global eSIM connectivity and airport lounge access, aimed at internationally distributed teams common in crypto-native businesses. These features extend the platform’s positioning beyond banking alone, though their relevance depends on user profile and operating model.

Luminary has introduced $LUMI as a utility token tied to platform access tiers and premium features. The company has announced a private pre-sale phase and frames the token as an infrastructure credential rather than an investment product, with potential future roles in governance and ecosystem participation. At present, token utility remains largely developmental and contingent on broader platform adoption. According to Luminary, $LUMI has the potential to evolve into a network token for the expansion of its proprietary financial infrastructure.

It is also worth noting how the pre-sale platform is structured. Instead of using third-party services, the Luminary team developed its own platform to accept crypto payments in multiple currencies in exchange for the $LUMI token, with an integrated KYC process. This demonstrates how vertical integration of fiat–crypto services can enable faster and more relevant execution. It also hints at Luminary’s potential future direction in banking-as-a-service.

Regulatory Structure and Target Users

Luminary is not currently a bank and does not conduct activities requiring a full banking license. Instead, services are delivered through licensed entities across jurisdictions. Luminary Digital Corp is registered as a Money Service Business with FINTRAC in Canada; Luminary Inc Finance Ltd is authorized by the UK Financial Conduct Authority as a Small Electronic Money Institution; and Luminary Digital S.R.O. is registered as a Virtual Asset Service Provider in the Czech Republic. The company states it intends to pursue banking authorizations in the future, but for now operates through this multi-entity structure.

Luminary targets operationally complex users: Web3 companies managing payroll, vendor payments, and treasury across fiat and digital assets; crypto funds navigating multi-jurisdiction compliance; fintechs building on blockchain rails while maintaining traditional banking relationships; and international businesses requiring efficient cross-border operations with crypto optionality. This is not infrastructure for casual retail crypto users or simple financial setups.

Competitive Positioning

Traditional banks offer strong regulatory standing and DEEP balance sheets but remain broadly crypto-averse, with opaque policies and a persistent risk of account closures for digital asset businesses. Neobanks improve user experience and foreign exchange costs but typically lack depth in crypto infrastructure and skew toward consumer rather than institutional use cases. Crypto exchanges excel at digital asset operations but provide limited traditional banking functionality, particularly around payroll, vendor payments, and multi-currency operational accounts. Pure DeFi protocols deliver programmable, permissionless settlement but cannot interface with fiat payment rails or provide licensed compliance frameworks required by most regulated businesses.

Luminary positions itself between these categories. It is not attempting to outperform specialists in either DeFi or traditional banking; its value proposition is integration. For businesses operating simultaneously in fiat and crypto, the platform offers a middle layer that reduces vendor fragmentation and operational friction. This positioning aligns with crypto’s maturity phase, where reliability and coordination matter more than speculative upside.

Limitations and Open Questions

Luminary’s multi-entity regulatory structure enables cross-jurisdiction operations but adds complexity: users interact with different legal entities depending on service and location. The platform is relatively new, with a limited track record at scale, and network effects are still emerging. Geographic coverage remains uneven, and not all services are available in every market.

The $LUMI token’s utility is still emerging. Governance mechanisms are under development, and its long-term value will depend on platform adoption and ecosystem growth. For businesses with simpler requirements, Luminary may be over-engineered; the infrastructure only makes sense when operational complexity justifies the coordination cost.

Strategic questions remain open. Can a hybrid platform compete with best-in-class specialists? What happens if incumbent banks become crypto-competent faster than expected? And does the market ultimately prefer integrated infrastructure, or continued specialization? These execution risks are inherent to building infrastructure in an emerging category.

Infrastructure for the In-Between

Luminary is not trying to replace DeFi protocols or reinvent consumer banking. Its value proposition is pragmatic: making blockchain-based businesses workable within existing regulatory frameworks. The platform is aimed at operators running companies on digital rails while meeting traditional finance obligations from unified infrastructure rather than stitching together fragmented providers.

The real test is whether crypto businesses need this integration layer or can continue managing fragmentation through specialized services. As crypto shifts from speculative activity to operational infrastructure, platforms attempting this fiat-digital integration merit attention, not for revolutionary claims, but for execution at the junction where regulatory compliance meets programmable money.