Dogecoin Shatters Critical Resistance—Will DOGE Power Through Three Selling Walls to Hit $0.20?

Dogecoin just bulldozed through a major price barrier. The meme coin's next challenge? A gauntlet of three distinct selling zones standing between it and the psychologically significant $0.20 mark.

The Path to Twenty Cents

Clearing key resistance is one thing; sustaining momentum is another. Traders are now eyeing the order books, mapping out where sell-side pressure could emerge. Each of these zones represents a cluster of previous buyers looking to break even or take profits—a classic test of any rally's strength.

Market Mechanics in Play

This isn't just about sentiment. It's a raw display of market microstructure. Can buying volume absorb the latent sell orders waiting at these levels? If DOGE can sequentially absorb the supply in these zones, the path upward opens significantly. Fail, and it risks a swift pullback to reconsoildate.

The $0.20 Dream—or Reality?

Reaching twenty cents would mark a major milestone, turning the 'joke' into a serious contender in the mid-cap arena. It would require not just retail enthusiasm, but a convincing show of force against seasoned traders looking to cash in. After all, in crypto, every rally is just a future selling opportunity waiting for greater fools—or so the cynical old guard in finance loves to mutter into their overpriced coffee.

The coming days will reveal if Dogecoin has the bark and the bite to chew through this resistance.

Memecoins have staged a sharp resurgence at the start of the year, with the sector turning decisively bullish over the past few sessions. The total memecoin market capitalization has expanded by over $30 billion in just a few days, reflecting renewed risk appetite and aggressive trader participation. Amid this surge, Dogecoin (DOGE) price has led the move higher, posting strong upside momentum. Importantly, price action continues to show resilience even after the initial push, suggesting the rally may still be in its early stages rather than nearing exhaustion.

Increased Trader Participation

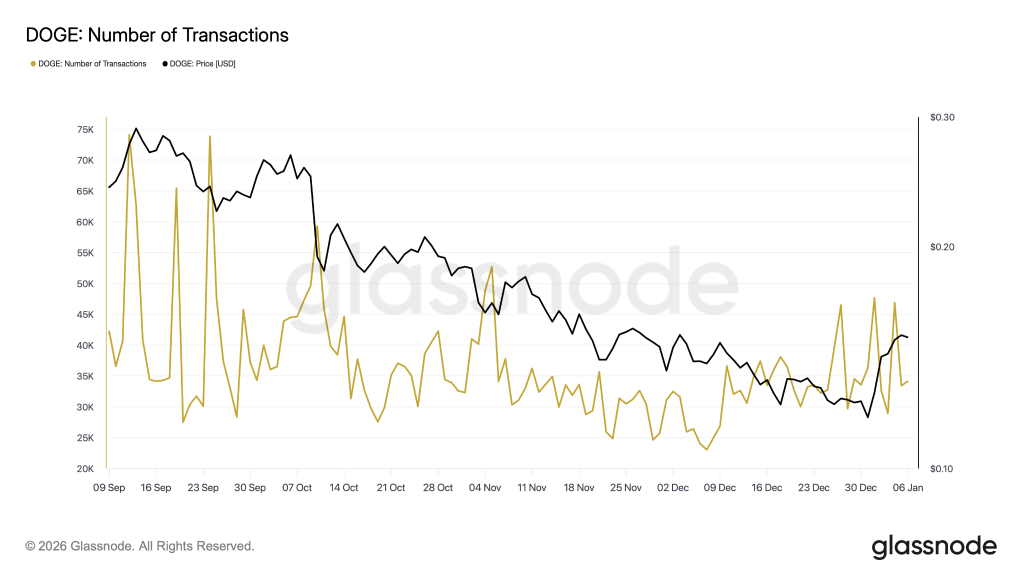

During the first week of December, the Doge price slipped below the local support at around $0.136. This was when the number of successful transactions began to rise, signalling a notable rise in the traders’ participation.

After a prolonged decline through Q4, Doge transactions have begun to trend higher from late December, coinciding with price stabilization and the latest upside breakout. For traders, this is important: rising transaction activity often signals renewed participation and capital rotation, not just speculative price spikes. The recent pickup suggests the rally is being supported by improving on-chain engagement. This strengthens the case that DOGE’s move is driven by broader market interest rather than short-lived momentum alone.

DOGE Volatility Likely to Expand

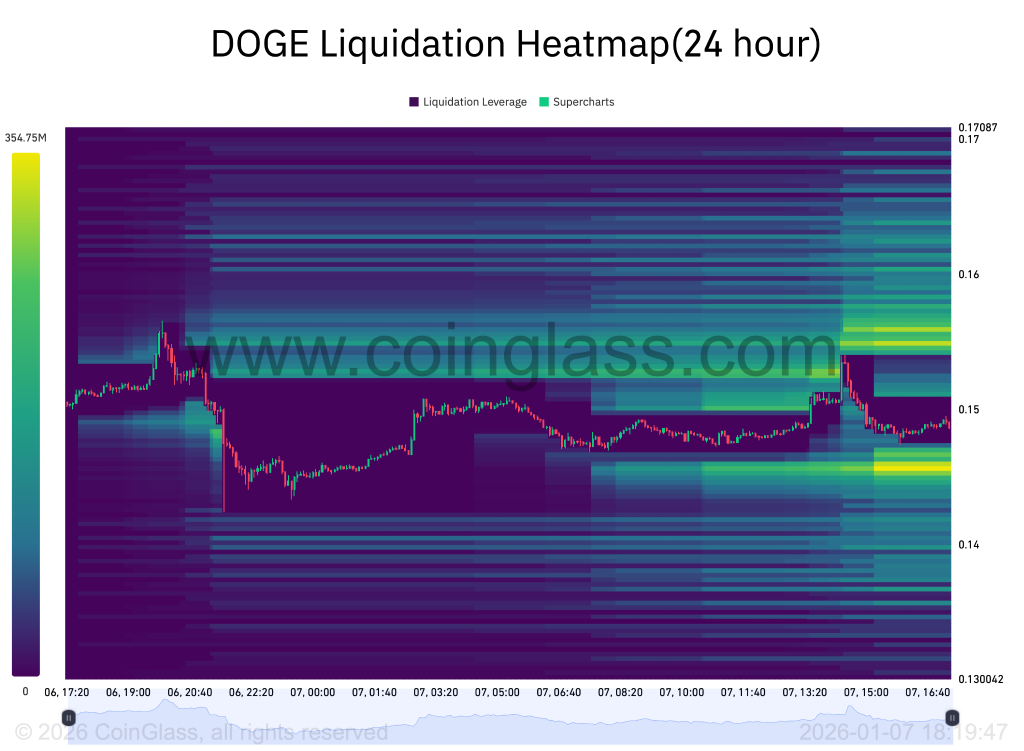

From a trading perspective, this heatmap highlights key liquidity pockets that can act as short-term price magnets. The concentration of liquidations above $0.155–$0.160 suggests upside continuation could accelerate if DOGE pushes into this zone, as short positions are forced to cover.

Conversely, liquidity stacked NEAR $0.145–$0.142 marks a downside risk area where late long positions could be flushed on weakness. Traders should watch for breaks into these zones with rising volume, as such moves often trigger fast. Moreover, the momentum-driven expansions rather than slow, controlled price action.

What’s Next for the DOGE Price?

Dogecoin has entered a consolidation phase after staging a strong recovery and breaking its multi-year bearish structure. The weekly chart shows DOGE holding above the 200-week MA near $0.137, a level that often defines long-term trend direction. While the broader memecoin sector remains strong, DOGE is currently digesting gains after its recent rally. This pause appears corrective rather than distributive, as price continues to respect higher-timeframe support levels.

From a technical standpoint, DOGE is trading within a descending channel, signaling a controlled pullback following a breakout. The rising trendline from mid-2024 continues to act as dynamic support around $0.14, while overhead resistance remains capped near the $0.17–$0.18 zone. Holding above support keeps the bullish structure intact, whereas a breakout above the channel could open the path toward higher resistance levels in the coming weeks.

Will Dogecoin Price Reach $1 in 2026?

Dogecoin price reaching $1 in 2026 is possible, but not a base-case scenario. Although DOGE has broken out of its long-term downtrend, it must first overcome critical supply near $0.30 and $0.40 with expanding volume to sustain higher targets. Given the present structure and momentum, a move to $1 in 2026 is not the most probable scenario; it WOULD require extraordinary upside catalysts and broad market strength. Traders should treat $1 as a high-probability continuation only if DOGE clears major prisms with conviction.