Market Tremors: Why Bitcoin, Ethereum & XRP Are Plunging in Early 2026

The crypto market just hit a wall. After a promising start to the year, the digital asset space is awash in red. The big three—Bitcoin, Ethereum, and XRP—are leading the retreat, sparking a fresh wave of anxiety among investors.

The Liquidity Squeeze

It starts at the top. Major institutional players are pulling back, not diving in. The usual post-holiday capital inflows? Nowhere to be seen. Instead, we're seeing a classic risk-off rotation. Traders are fleeing speculative assets for safer harbors, leaving crypto exchanges feeling eerily quiet. The smart money isn't buying this dip—it's waiting on the sidelines, watching the leverage unwind.

Regulatory Headwinds Bite Back

Just when you thought the rulebook was getting clearer, global regulators are flipping the script. Ambiguous guidance from key jurisdictions is creating paralysis. Projects are shelving launches, and funds are delaying deployments, all frozen by compliance uncertainty. It's the old finance playbook: when in doubt, freeze everyone out until the lawyers cash their checks.

Technical Breakdowns and Broken Support

Charts don't lie. Critical support levels for major assets have shattered like glass. Each breach triggers automated sell-offs, creating a cascading effect that punishes every token in its path. The so-called 'healthy correction' is looking more like a structural failure. The bullish narratives that fueled the last rally have gone silent.

The Macro Shadow Looms Large

Never forget that crypto doesn't trade in a vacuum. Broader economic indicators are flashing warning signs. Interest rate expectations are shifting, geopolitical tensions are simmering, and traditional equity markets are jittery. Digital assets, for all their decentralization talk, still get tossed around in the storm of global macro sentiment. When Wall Street sneezes, crypto still catches a cold—a brutal reminder of its lingering correlation to traditional risk assets.

So, is this the end of the run? Hardly. It's a brutal reminder that this market moves in cycles of euphoria and despair. The fundamentals of blockchain adoption haven't changed, but the market's mood swings have. For now, the bulls are licking their wounds, watching the charts, and waiting for the fear to subside. The next move will separate the true believers from the fair-weather fans.

Why are Bitcoin, Ethereum, and XRP Prices going down at the same time? Every trader is currently looking for this answer, as the tokens dropped suddenly in the times when they were believed to maintain a bullish continuation. After a strong start to the year, the crypto market has turned defensive, with the BTC price slipping below recent highs and dragging major altcoins lower. Ethereum & XRP prices are also facing a notable pullback that raises concerns over the next price action.

The synchronised pullback has raised questions about whether this is simple profit-taking or a broader shift in market positioning.

What Just Happened Across the Crypto Market

The latest pullback was broad, fast, and coordinated across the crypto market. Within a short window, Bitcoin slipped below $91,000, dragging the ETH price and XRP prices below $3200 and $2.2, respectively. A clear shift is seen in the short-term market control, which has erased billions of dollars in value, reversing a meaningful portion of gains recorded earlier this week.

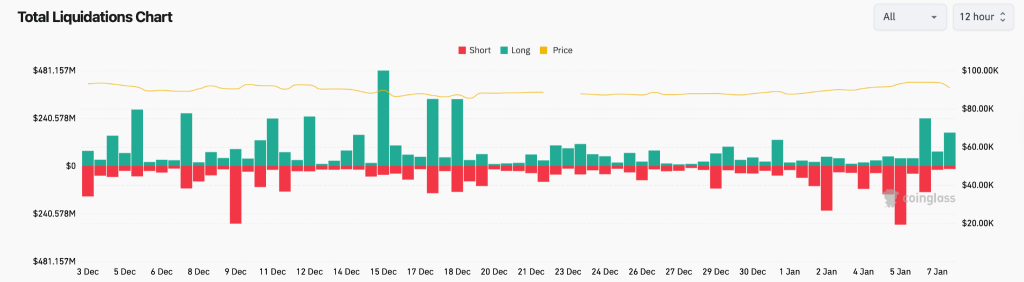

Derivative data confirms the intensity of the move. The Coinglass data shows the long liquidations being carried out over the past few days, which could have kept the bearish strength alive. Nearly $250 million in longs were liquidated after a $280 million long during the past trading day. Bitcoin and ethereum account for nearly $92 million in long liquidation each, and when multiple large-cap drops occur together, it typically signals systemic de-risking rather than asset-specific weakness.

Bitcoin Is Leading the Pullback

After the recent bullish action, the Bitcoin price is trying extremely hard to rise and secure the pivotal resistance around $95,000. However, the bearish influence continues to hover over the token as the price remains consolidated within a range. However, BTC, ETH & XRP prices all have displayed a strong bearish divergence that could point towards an upcoming bearish action.

The above chart is a comparison of the prices of BTC, ETH & XRP, showing a clear shift in the trend. As Bitcoin remains the market liquidity anchor, the recent rejection near the key resistance zone has set the tone for the entire market. Therefore, without Bitcoin reclaiming strength, sustained upside in major altcoins is extremely difficult.

What Traders Should Watch Next?

The synchronised pullback across Bitcoin, Ethereum, and XRP reflects a market-wide liquidity reset, not isolated weakness. With leverage flushed and momentum waning, the next move will depend on how the price behaves at key support zones, rather than short-term volatility. Traders should closely watch volume expansion, funding rate shifts, and open interest changes for confirmation. A stable base could signal consolidation, while renewed selling pressure WOULD increase the risk of a deeper corrective phase.