US Government Research Paper Validates Ripple’s Technology — A Game-Changer for Cross-Border Payments

Forget the regulatory noise—a US government research paper just handed Ripple's tech a massive credibility boost. The findings cut through the political chatter, spotlighting the underlying architecture that could reshape global finance.

The Nuts and Bolts of Validation

Researchers didn't just skim the whitepaper—they tore into the protocol's mechanics. The paper highlights how Ripple's consensus model bypasses traditional bottlenecks, slashing settlement times from days to seconds. It's a technical deep-dive that reads like a blueprint for modernizing legacy systems, all while sidestepping the energy-guzzling proof-of-work model that bogs down other networks.

Why This Matters Beyond the Courtroom

While lawyers battle over securities definitions, this validation shifts the conversation. Institutions aren't just watching the legal drama—they're studying the tech's real-world utility. The research underscores Ripple's potential to handle massive transaction volumes without crumbling, a feature that makes Wall Street's aging infrastructure look downright prehistoric.

The Finance Sector's Cynical Take

Let's be real—banking loves efficiency, but only when it protects their margins. Ripple's tech threatens a juicy revenue stream: those fat fees on international transfers. No wonder adoption feels like pulling teeth; you're asking an industry to cannibalize its own profit center. The tech works, but the incentive to deploy it? That's a whole other battle.

The Bottom Line

Government validation doesn't guarantee mainstream adoption overnight, but it does provide institutional cover. It's a signal that serious players can start building on this without fearing regulatory backlash. The paper essentially says: 'The technology is sound—now figure out the business model.' For crypto practitioners, that's a bullish signal worth watching, even if the traditional finance world drags its heels every step of the way.

A little-known U.S. government research paper from 2018–2019 is now gaining community attention, as it sees Ripple (XRP) as a trusted ledger for its role in a regulated financial environment.

The paper was written for government and aerospace use, not for crypto trading or speculation, making its findings especially important for Ripple XRP’s future.

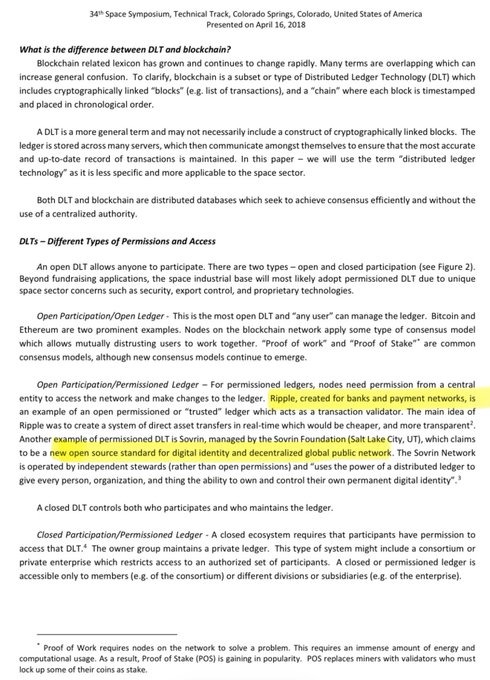

US Research Paper Separates Blockchain From DLT

According to the research presented at US Space Symposiums, governments do not focus only on “blockchain.” Instead, they care more about Distributed Ledger Technology (DLT) as a whole.

The report explains that while blockchain works well for open and public networks, governments and regulated institutions often need something different.

The paper highlights that DLT can exist without public mining, open access, or anonymous users. This makes it suitable for governments, which require systems with clear rules, identity checks, control, and compliance with existing laws.

Ripple Named for Trusted and Regulated Systems

When the paper discusses permissioned and trusted ledgers, it directly points to Ripple’s architecture as a working example.

Unlike Bitcoin and Ethereum, which are mentioned as open and permissionless systems, Ripple is designed for banks, payment companies, and institutions that need built-in trust and control.

The research shows that Ripple can help with things like managing identities, sharing data safely, settling payments, and handling licenses or certifications. These are practical, real-world needs for governments and big organizations that cannot risk system failures or legal problems.

Ripple Real World Usage

Ripple’s payment network is now used by hundreds of financial institutions across more than 90 countries for faster and cheaper global transfers.

Institutions that use Ripple’s tech for cross-border payments include major banks like Santander, Standard Chartered, SBI Holdings in Japan, PNC Bank, and CIBC (Canada). These organizations leverage Ripple solutions to speed up international payment settlement and cut costs compared with traditional systems.

Other global players like American Express and regional fintech firms such as Tranglo and BeeTech integrate XRP-enabled infrastructure to help MOVE money quickly between different countries.

XRP Fits Long-Term Adoption, Not Hype

Meanwhile, Ripple XRP’s strength is not in short-term HYPE but in long-term use. Governments and institutions move slowly, but once they choose technology, they stick with it for years.

This research suggests XRP is designed for that world. While many projects focus on trends, Ripple and XRP continue to appear in serious, regulated systems that most people never notice.