Shiba Inu Battles Surging Long-Liquidations: Can SHIB Price Stage a Recovery?

Another day, another dog-themed coin in the crosshairs. The meme token darling is getting mauled by leveraged bets gone wrong, sparking fresh panic across retail portfolios.

The Liquidation Cascade

Forced selling is ripping through the market. Traders who bet big on a quick moon-shot are getting their positions automatically closed—feeding a vicious cycle of downward pressure. It's the classic crypto leverage trap: amplifying gains on the way up, and obliterating capital on the way down.

Technical Wreckage

Key support levels have evaporated like morning fog. The chart paints a picture of relentless selling, with each minor bounce getting sold into aggressively. The order book looks thin, meaning even modest sell orders can trigger disproportionate moves.

The Path to Recovery

Reversing this trend requires more than just hopium. It needs a massive shift in market structure—sustained buying to absorb the overhead supply, a reduction in open interest to clear out weak hands, and frankly, a new narrative to distract from the current bloodletting. Community rallies and exchange listings might provide a temporary sugar rush, but they're no substitute for organic demand.

The Bottom Line

While the faithful cling to the 'hold' mantra, the market's mechanics are brutally efficient at punishing over-leverage. Every surge in long-liquidations isn't just a data point; it's a transfer of wealth from the overconfident to the patient. The recovery question hinges on whether the remaining holders have the stomach—and the capital—to wait out the storm, or if this is just another lesson in the high cost of chasing memes with margin. After all, in crypto finance, the only thing that spreads faster than a bullish rumor is the contagion of a margin call.

The crypto market is on a bearish trend over the last 24 hours and Bitcoin led the rally by declining toward $90K. As a result, several altcoins and meme coins lost their early-January gains and are now retesting weekly support lines. Shiba Inu, a notable meme coin, lost buyers’ support as long liquidation surged in recent hours. Currently, traders are wondering whether SHIB price could make a comeback amid falling on-chain metrics.

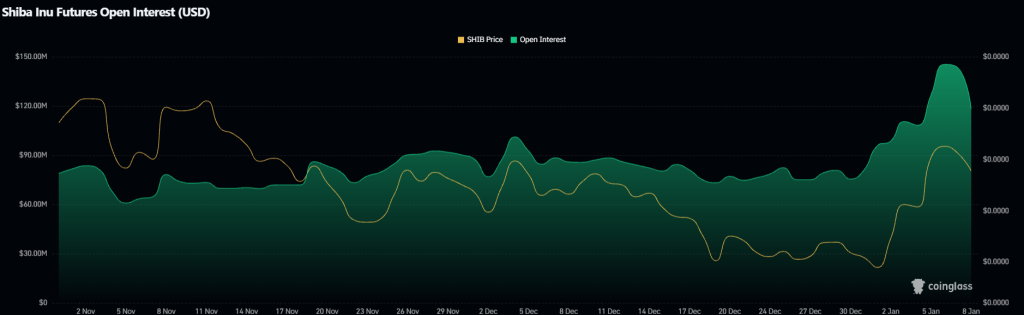

Shiba Inu’s Open Interest Crashes

Crypto prices fell further, with most altcoins trading lower. The recovery rally seen at the start of January has slowed, even though the market conditions remain positive as expectations grow that the Federal Reserve may cut interest rates.

Shiba Inu was also affected by the downtrend, as its price and other key indicators declined along with the wider market. Data from Coinglass shows that SHIB price faced liquidations worth $352K in the last 24 hours, of which buyers closed nearly $302K worth of positions.

Shiba Inu’s bearish trend might intensify as several metrics have turned negative recently. The SHIB burn metric shows a collapse on the daily time frame. The data source revealed that over the past 24 hours, the SHIB burn rate went down by 23.8%. Additionally, the demand for SHIB among whales is declining.

Also read: Binance Founder Seeks to Dispel Speculation Over Memoir Plans

Santiment reveals that SHIB sits at the bottom in terms of whale transaction growth as the meme coin recorded only a 110% increase in whale transfers worth more than $100,000.

Additionally, the open interest of shiba inu is also declining. Coinglass reveals that SHIB’s OI dropped from the peak of $145 million to a recent low of $118 million. This suggests that volatility is declining as a smaller number of traders are now taking positions in SHIB.

At the start of 2026, open interest surged by about 20% just before Shiba Inu climbed roughly 35%. Now that open interest is falling, traders are watching closely to see where Shiba Inu’s price goes next.

What’s Next for SHIB Price?

Shiba Inu is seeing selling pressure after losing the support level at $0.00000888, but the pullback could find support NEAR its moving averages around $0.0000085. As of writing, SHIB price trades at $0.00000872, declining over 2% in the last 24 hours.

Currently, buyers are showing support as SHIB price made a minor jump from its recent low. Buyers are now aiming for a hold above the EMA trend lines to sustain the recovery rally. If the price holds above the EMA-20 trend line, it WOULD suggest buyers are stepping in on dips, which could open the door for a move above $0.00001 and potentially push SHIB toward $0.0000112.

However, if SHIB faces resistance and drops below the moving averages, it would signal continued selling. In that case, the price could slide to around $0.0000085 and possibly down to $0.0000077.