Bitcoin Price Drops, Yet Long-Term Holders Aren’t Selling—Here’s Why They’re Holding Strong

Bitcoin dips—but the OGs aren't budging. While short-term traders panic-sell, the veterans are stacking more sats. Here's what the smart money knows that the herd doesn't.

The Diamond-Hand Playbook

Forget the daily charts. Long-term holders operate on a different timeline—one measured in halving cycles, not hourly candles. They've seen this movie before: a price drop triggers weak hands to fold, creating prime accumulation zones. It's a classic shakeout, and they're not falling for it.

Institutional Inflows Don't Lie

While retail investors check prices every five minutes, BlackRock and Fidelity keep buying. Spot Bitcoin ETFs just recorded another week of net inflows—because pension funds don't trade based on Twitter sentiment. The big players are building positions for the next decade, not the next dip.

The Real Metric That Matters

Exchange reserves tell the real story. Bitcoin keeps moving from hot wallets to cold storage—a bullish signal that gets ignored amid price noise. When coins leave exchanges, they're not coming back for quick trades. They're going into digital vaults for the long haul.

Macro Tailwinds Trump Micro Panic

Global debt crises, currency devaluation, and institutional adoption create fundamental momentum that overshadows temporary price movements. Smart investors position for macro trends, not micro-volatility—something traditional finance still struggles to grasp as it chases quarterly earnings.

So while day traders hyperventilate over 5% swings, the veterans quietly accumulate. They remember 2018's 80% crash—and the 20x returns that followed. Today's 'dip' is tomorrow's discount, and they're shopping accordingly. After all, Wall Street still thinks Bitcoin's a speculative asset while quietly adding it to balance sheets—the ultimate finance hypocrisy.

Bitcoin’s price has slipped from recent highs, breaking below key short-term levels and triggering renewed fears of a deeper correction. However, beneath the surface, on-chain data tells a very different story.

Despite the pullback, long-term bitcoin holders are not selling aggressively. Key on-chain indicators show that older coins remain largely inactive, suggesting the recent downside move is being driven by short-term traders and leverage resets rather than structural distribution.

This divergence between the BTC price weakness and holder behavior is critical. It points to a market that is cooling off and rebalancing—not one that is topping out.

What the On-Chain Data Is Saying

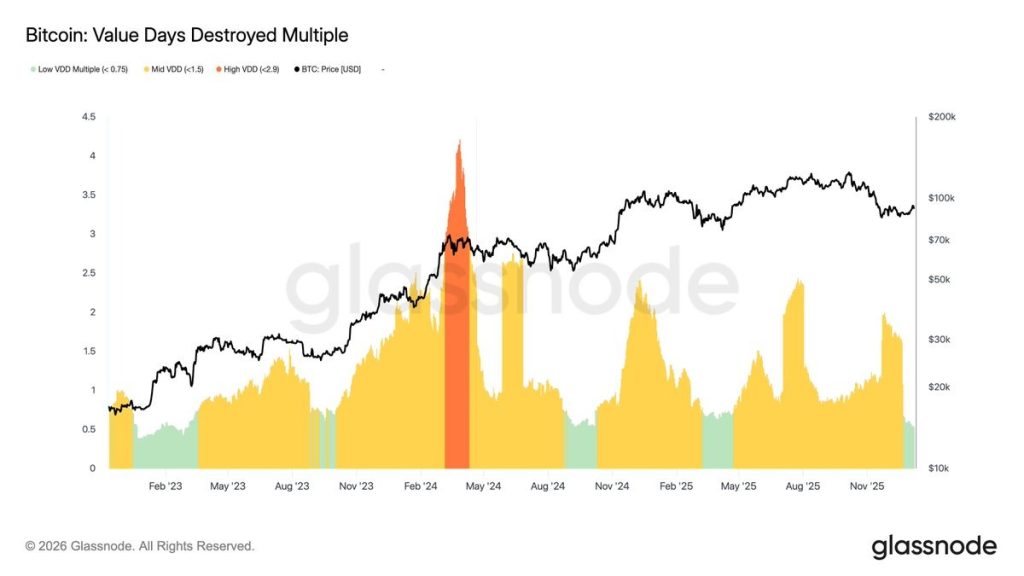

The Value Days Destroyed (VDD) Multiple tracks when older, long-held BTC is being spent. Historically, major market tops are accompanied by sharp red spikes, signaling long-term holders distributing into strength. Right now, that signal is missing.

Recent readings from Glassnode remain in the low-to-mid VDD range, indicating that:

- Long-term holders are not aggressively selling

- Most BTC being moved belongs to short-term participants

- Selling pressure is tactical, not structural

This behavior typically aligns with consolidation or trend continuation, not final tops.

Bitcoin Long-Term Holders Remain Optimistic

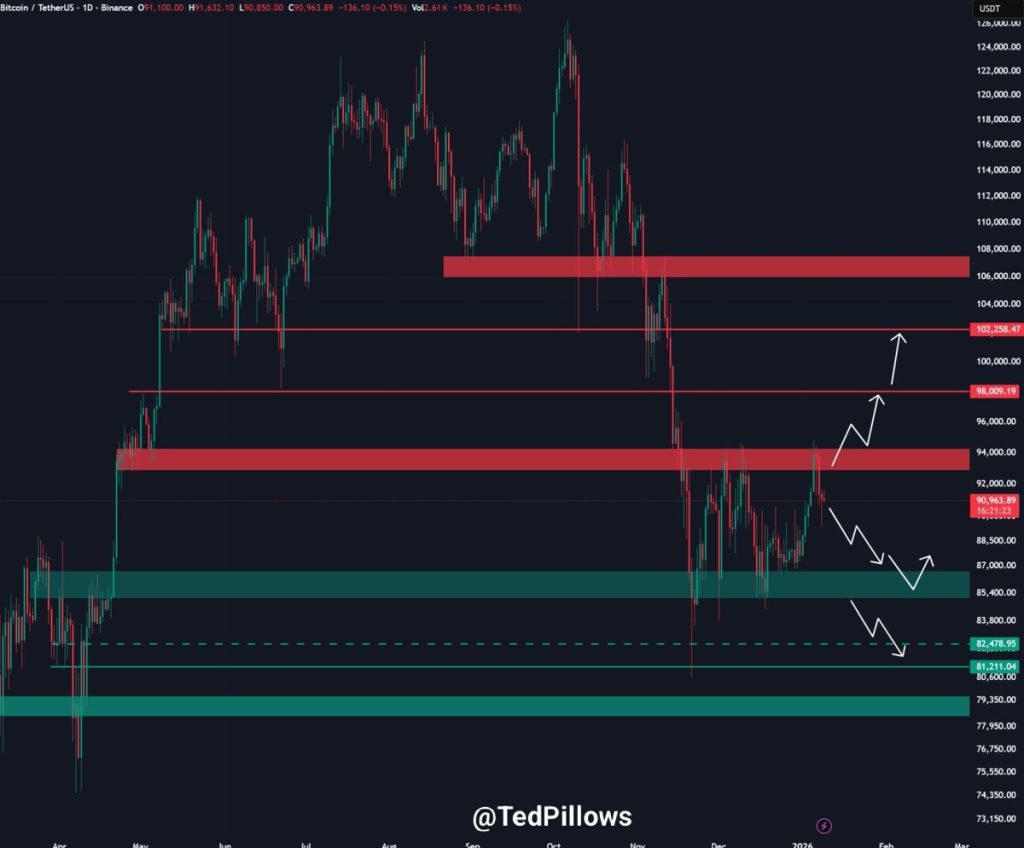

The price chart shows Bitcoin rejecting higher supply zones around the $105k–$110k region, followed by a breakdown below mid-range support near $102k–$98k. This triggered a sharp move lower, but importantly, the price has not entered freefall. Instead, BTC is reacting around the established demand zones. Volatility is high, but a structure is forming, and hence the moves could resemble liquidity sweeps but not panic sweeps.

The combined charts point towards three main outcomes. Firstly, no mass distribution from long-term holders. Secondly, distribution is occurring at higher levels, followed by a controlled reset and thirdly, short-term traders are driving volatility, not smart money exits. This is typical of mid-cycle corrections, where leverage and late longs are flushed while long-term conviction remains intact.

What’s Next for the BTC Price Rally?

Bitcoin price is facing notable upward pressure but continues to trade within a demand zone. If the price reclaims the range between $98,000 and $102,000, it could signal absorption and open the door for continuation. An invalidation could drag the price close to $82,000, which could weaken the broader bullish thesis. Besides, holding within the current demand zone between $88,000 and $92,000 could keep the structure constructive.

Despite the sharp pullback, on-chain data does not support a cycle-top narrative. Long-term holders remain calm, while price action reflects a market resetting excess, not unwinding conviction. For now, the BTC price appears to be digesting gains, not ending the trend. Direction will be decided not by fear, but by how price reacts at key levels in the days ahead.