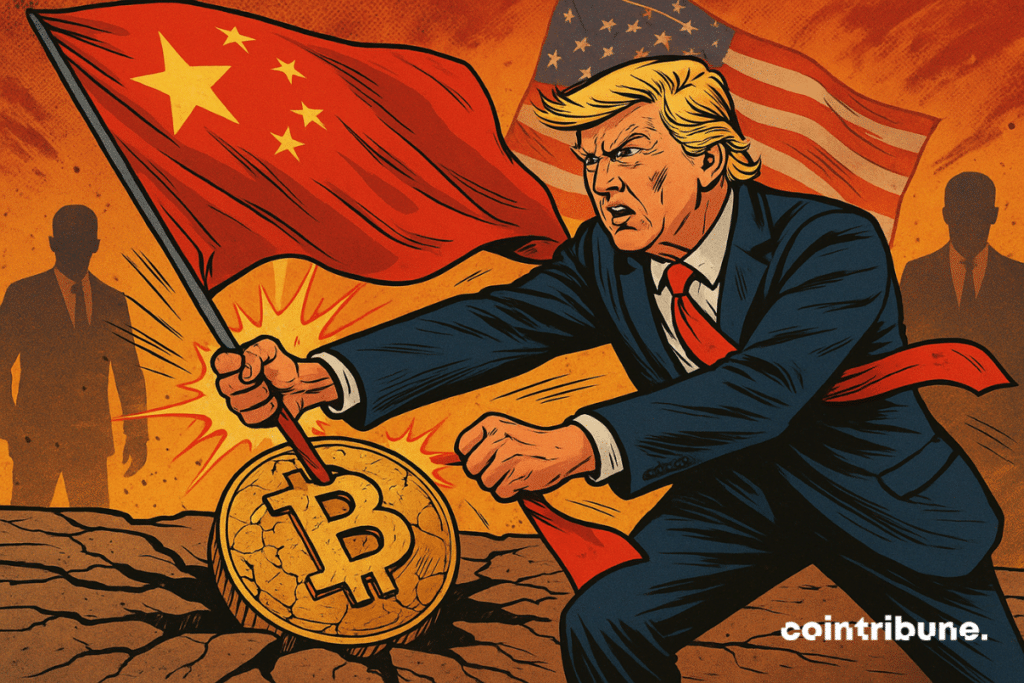

Trump’s Bitcoin Gambit: U.S. Fights Back Against China’s Crypto Domination Play

The crypto cold war heats up as Washington scrambles to counter Beijing's digital asset offensive. Two superpowers, one blockchain battleground - and your portfolio caught in the crossfire.

Geopolitical Tensions Go Digital

Forget trade wars - the new frontlines are being drawn in cryptographic code. As China accelerates its CBDC rollout and tightens grip on mining operations, the U.S. administration appears to be waking up to the strategic implications.

Dollar Dominance at Stake

With every yuan settled via digital wallets, the greenback's supremacy faces its greatest challenge since Bretton Woods. The Fed's 'wait-and-see' approach suddenly looks about as current as a paper checkbook.

Wall Street's Crypto Conundrum

Traditional finance giants now face their 'Nokia moment' - adapt to blockchain or watch from the sidelines as tech-savvy rivals eat their lunch. (Bonus jab: Don't worry - they'll still find a way to charge 2% management fees on your Bitcoin ETF.)

The clock's ticking. While politicians posture, the blockchain never sleeps - and neither do the markets.

Read us on Google News

Read us on Google News

In brief

- Trump promises an American response to China’s crypto offensive and the digital yuan.

- Washington wants to attract crypto players with clear rules and mandatory reserves.

- Hong Kong loosens regulatory grip, restarting China–US monetary rivalry.

- The president links crypto leadership and dollar sovereignty in his recent speeches.

Bitcoin as a banner, regulation as a lever: Washington rolls out its plan

President Trump, still in search of the Nobel Peace Prize, did not mince words in Miami at the America Business Forum. Before business leaders, he hammered: “We’re making the United States the bitcoin superpower, the crypto capital of the world, the undisputed leader in artificial intelligence“.

This message resonates as a turning point. Since January 2025, the Trump administration has signed executive orders to lift regulatory blocks and encourage the crypto industry. Among key measures: the GENIUS Act, passed in July, imposes mandatory reserves on stablecoin issuers, with monthly publication of their composition.

But it’s not just a matter of legal framework. For Trump, crypto also supports the dollar while strengthening America’s position in innovation. He states:

And it takes a lot of the pressure off the dollar. It does a lot of good things, but we’re into it.

The message is clear: crypto is a tool of monetary power as much as a technological lever.

China: ban crypto while drawing inspiration from it

Officially, China remains hostile to cryptos. Since 2021, Beijing has banned bitcoin transactions and mining. Yet, this apparent caution hides a more subtle strategy. TRUMP has expressed concern:

China … China wants to do it. They’re starting it, but they want to do it. Other countries want to do it. If we don’t do it properly — it’s a big industry.

China is betting on its own digital currency, the digital yuan, and on centralized FLOW control. But from Hong Kong, the door is ajar. This special administrative region has relaxed some restrictions, allowing registered platforms to offer more services around digital assets.

Meanwhile, China extends its influence via the deployment of the digital yuan and the systematic refusal of any private crypto competition. Behind the scenes, Beijing advances its pawns. By denouncing this tactic, Trump repositions the United States as a bastion of free crypto against centralized state models.

Crypto vote, a new electorate to conquer

This pro-crypto shift was not only about geopolitical stakes. It was also aimed at an electorate. Before the elections, Trump explained that his campaign supported digital assets from the start, and that Biden joined late after realizing his loss of ground among crypto voters.

The crypto industry is no longer a niche issue. It matters in public opinion. It embodies a new promise: gains, social mobility, financial independence. For Trump, this dynamic can make America a new economic engine.

The future presented blends AI, blockchain, tokenization, and energy sovereignty through local mining. This vision appeals to both investors and small holders. It gives an image of modernity and reconquest, at a time when China is trying to dictate its own digital roadmap.

Dates, figures, realities: what to remember

- July 2025: passage of the GENIUS Act on stablecoins;

- Estimated 200,000 BTC in the hands of the U.S. government;

- 70% of the bitcoin global hashrate was Chinese before 2021;

- The digital yuan is in the national deployment phase.

If Trump continues in this direction, he will face a harsh reality. China retains a grip on rare earths, essential to manufacturing AI chips. This strategic imbalance could weaken the dollar according to some analysts.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.