How Stablecoins Are Forcing the Fed to Rethink Monetary Policy in 2025

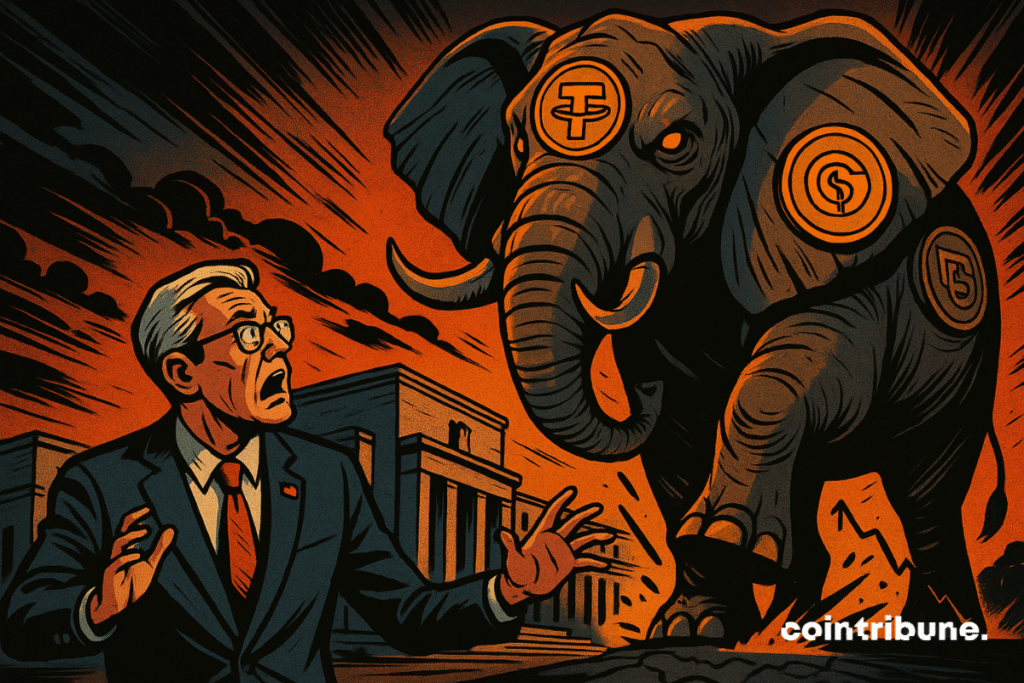

Stablecoins aren’t just surviving—they’re thriving. And now, they’re rattling the Fed’s cage.

Why? Because dollar-pegged crypto is quietly rewriting the rules of monetary policy. No permission needed.

The $150B Shadow Dollar System

Tether, USDC, and their ilk now move more daily volume than some small nations’ GDP. The Fed can’t ignore this parallel financial universe anymore—not when it’s eating their lunch.

Interest Rates? Stablecoins Don’t Care

While Powell agonizes over 25-basis-point tweaks, stablecoins bypass the whole debate. Need liquidity? Mint. Need yield? DeFi’s got 5% APY with zero Fed meetings.

The Coming Reckoning

Either the Fed adapts—or watches its monetary policy toolkit become as relevant as a fax machine. (Though let’s be real, Wall Street would still find a way to charge fees for sending one.)

Read us on Google News

Read us on Google News

In brief

- The Fed anticipates a decrease in the neutral rate due to dollar-backed crypto stablecoins.

- The crypto stablecoins market could reach $3 trillion by 2030.

- The GENIUS Act requires issuers to hold liquid dollar reserves for each stablecoin issued.

- Bank disintermediation could weaken the Fed’s traditional monetary transmission.

When Stablecoins Shake Up the Fed’s Tempo

Stephen Miran, Fed Governor, affirms: the rise of stablecoins could indeed influence U.S. monetary policy. According to him, the growing demand for these dollar-backed assets, potentially reaching $3 trillion within five years, is pushing down the neutral interest rate. He argues that, as a result, the equilibrium interest rate is lower in the presence of stablecoins than it WOULD be without them.

Stablecoins, far from being mere internal tools of the crypto universe, are becoming powerful vacuum cleaners for U.S. Treasury bonds. Miran argues that they offer savers in emerging markets unprecedented access to dollar-denominated assets, where traditional finance often struggles to take root. He points out that U.S. capital markets remain the deepest in the world, driving economic growth, funding innovation, and allocating capital efficiently. Stablecoins, he suggests, could play a leading role in this dynamic, enabling dollar holdings and payments both domestically and across borders.

What if this was just the beginning? Global adoption, encouraged by transnational financial bridges, could change the game.

Crypto vs. dollar: a silent influence war

With over 99% of stablecoins pegged to the dollar, the supremacy of the greenback asserts itself… via crypto. Yet behind this dynamic, pressure is exerted on the traditional banking system. Purchases of stablecoins drain funds that would otherwise feed bank deposits. The result: gradual financial disintermediation that could weaken the Fed’s decision transmission.

The GENIUS Act, praised by Miran for its clear framework, requires a 1:1 reserve backed by SAFE assets. But it is not enough to regulate everything. Many non-American issuers still escape these obligations. And with ever more efficient crypto platforms, the appeal of stablecoins is skyrocketing.

Stablecoins may become a multitrillion dollar elephant in the room for central bankers.

Source: Speech by Stephen Miran, 11/07/2025.A slow but DEEP shift, like a tide settling quietly.

A tide of dollars disrupting the global monetary order

An influx of dollar liquidity via stablecoins could heavily impact macroeconomic balances. The Fed, already facing a falling neutral interest rate, might be forced to revise its stance. Miran does not rule out an impact comparable to the “global saving glut” mentioned by Ben Bernanke.

In high inflation economies, these stable cryptos provide a refuge for households. But beware the downside: too much dollarization, and exchange rates lose their buffer role, increasing economic cycle volatility.

Key figures to remember:

- $3 trillion: high projection of the stablecoin market by 2030 (source: Fed);

- 99.6% of stablecoins are dollar-backed (source: DeFiLlama);

- Up to 40 basis points drop on rates (source: Azzimonti & Quadrini, 2024);

- Less than $7 trillion in Treasury bonds outstanding (source: Fed);

- The impact could reach 60% of the global saving glut (source: Miran speech, 2025).

A borderless crypto, an omnipresent dollar: here is an explosive mix for traditional economic models.

The Fed, despite some conciliatory speeches, remains cautious regarding the framework established by the GENIUS Act. An internal report even mentions “critical flaws” in this law considered too permissive for an asset with systemic implications. Decentralization disturbs, and the walls of traditional finance are wavering.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.