Coinbase Fuels Financial Expansion, Powers Major USDC Income Pilot in New York

Coinbase isn't just riding the crypto wave—it's building the financial infrastructure for the next one. The exchange giant is making a strategic push into the heart of traditional finance, backing a landmark pilot that could redefine how everyday Americans earn.

The New York Paycheck Play

Forget savings accounts with microscopic yields. A major pilot program in New York, powered by Coinbase's infrastructure, is putting a novel idea to the test: paying employee income in the stablecoin USDC. This isn't just about offering crypto as an option; it's about embedding a digital dollar directly into the payroll pipeline. The move targets a fundamental pain point—the erosion of purchasing power in stagnant bank accounts—and proposes a seamless, blockchain-native solution.

Building Bridges, Bypassing Bottlenecks

Coinbase's role goes beyond mere sponsorship. The company provides the critical regulatory and technological rails, ensuring the stablecoin payments are compliant and instantly settle. This positions Coinbase not as a speculative trading venue, but as a essential utility for a new financial system. It's a classic growth play: capture the flow of capital at its source, in this case, the bi-weekly paycheck, before it ever hits a legacy bank. (Take that, Wall Street middlemen clinging to ACH fees.)

The Bigger Bet on Utility

This pilot underscores a decisive shift. The focus is moving from trading volatility to demonstrating tangible utility. By facilitating USDC for income, Coinbase effectively on-ramps users into its ecosystem through their primary asset stream. It's a long-game strategy to foster daily use and trust in crypto assets, making them as mundane and essential as direct deposit. After all, what better adoption tool than your salary?

The initiative is a bold experiment in financial evolution. If it gains traction, it could pressure traditional institutions to offer competitive digital yield products or risk becoming obsolete warehouses for depreciating cash. It turns every participating employee into a passive advocate for crypto's practical benefits—one automated, high-yield paycheck at a time.

Read us on Google News

Read us on Google News

In brief

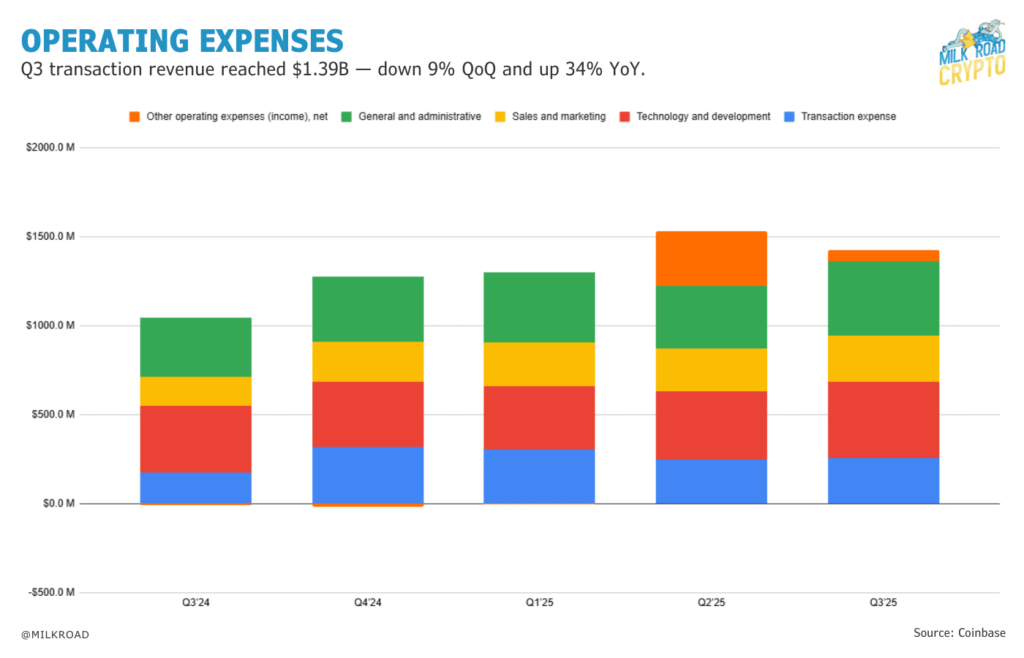

- Coinbase posts five quarters of revenue growth while keeping expenses below previous cycle levels across core cost categories.

- NYC income pilot delivers $12K in USDC directly to low-income residents through GiveDirectly with no bank intermediaries.

- The x402 protocol records a 10,780% monthly jump in transactions and sets new daily highs in activity and on-chain volume.

- Ark Invest strengthens its crypto exposure with a $10M Coinbase share purchase and added positions in BitMine and Circle.

Coinbase Strengthens Financial Position While Financing $12K USDC Pilot

Coinbase has now posted five consecutive quarters of revenue growth while keeping operating expenses below levels seen in the previous cycle. Rising sales and disciplined spending signal a firmer position than during the 2021 peak, when expenses surged across the industry.

Charts from Milk Road indicate that revenue is approaching late-2021 levels after rebounding sharply from the 2022–2023 slowdown.

Alongside its financial progress, Coinbase supported one of the largest crypto-based income pilots in the United States. Through a partnership with GiveDirectly, the program provides $12,000 in USDC to low-income New Yorkers.

Funding comes from a donation Coinbase made after closing its former GiveCrypto initiative. Administration, distribution, and participant support fall entirely under GiveDirectly’s oversight, keeping Coinbase in a funding-only role.

NYC Stablecoin Pilot Tests Direct Payments Without Banks

GiveDirectly enrolled roughly 160 residents across all five boroughs. Participants receive an initial $8,000 payment, followed by $800 per month for five months, totaling $12,000 in stablecoin.

Payments began in late 2024 and continue through 2025, reaching wallets directly without bank intermediaries. Eligibility, compliance, onboarding, and wallet setup are all managed by GiveDirectly.

Program details FORM a clear structure, outlined in the following key points:

- Support reaches low-income households across New York City’s five boroughs.

- Each participant receives $12,000 in USDC through a two-phase distribution.

- Transfers go straight to recipients’ digital wallets.

- GiveDirectly handles enrollment, screening, and payment logistics.

- Funding came from Coinbase’s earlier charitable allocation, following the end of GiveCrypto.

GiveDirectly describes the initiative as a targeted guaranteed-income test rather than a universal model. Even so, it ranks among the largest direct-to-wallet income pilots backed by a crypto company in the United States.

x402 Hits New Records as Coinbase Reports Stronger Quarterly Results

Financial performance at Coinbase has also shown greater steadiness. Operating costs remain low across technology and development, sales and marketing, and general and administrative categories. Transaction expense accounts for a smaller share of total costs than in prior cycles.

In the most recent quarter, Coinbase reported $1.39 billion in transaction revenue—down 9% from the previous quarter but up 34% year over year. Broader trends indicate rising revenue while expenses remain below earlier highs.

Activity on x402, Coinbase’s payment protocol, added another source of momentum. Between October 14 and 20, x402 recorded 499,000 transactions, an increase of 10,780% from the prior month. October 18 set a single-day record with 239,505 transactions and $332,000 in volume.

For context, Coinbase’s x402 brings the long-unused HTTP 402 “Payment Required” code into practical on-chain use for instant payments. Investor activity has remained steady as well, with Ark Invest purchasing 42,000 Coinbase shares worth $10 million.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.