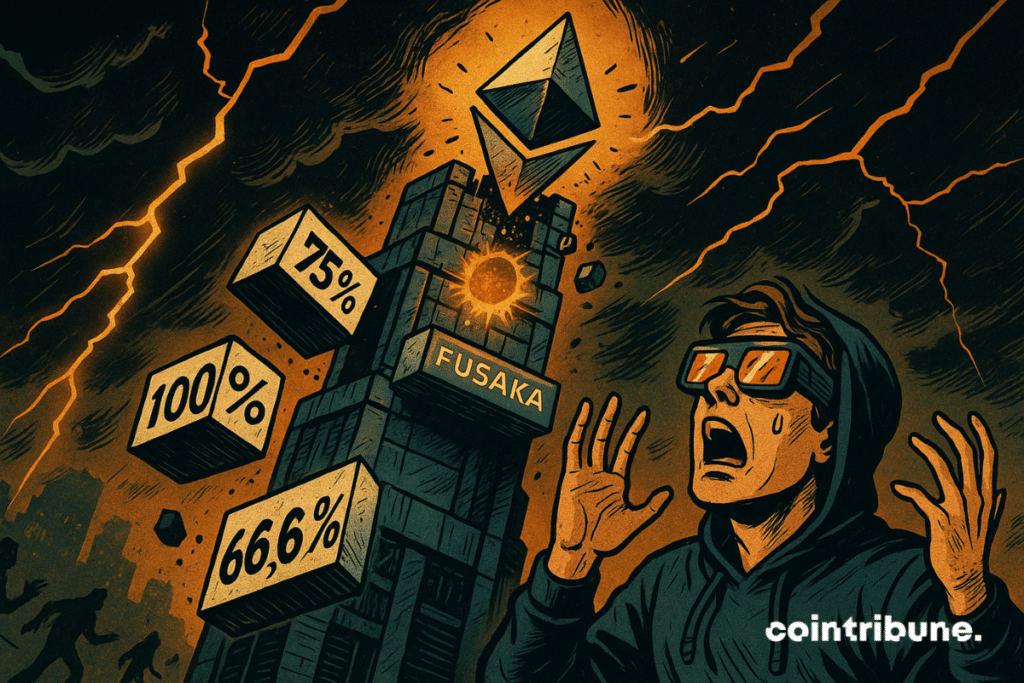

Ethereum Bleeds 25% of Validators Post-Fusaka: Network Teeters on Edge of Critical Failure

A quarter of Ethereum's validators vanished overnight. The Fusaka event didn't just shake the network—it carved a chasm straight through its security backbone.

The Great Unstaking

Imagine a bank where 25% of its vault guards simply clocked out. That's the scale of the exodus. Validators—the nodes that stake ETH to secure transactions and create blocks—pulled their stakes en masse. The queue to exit stretched for days, a digital run on the blockchain.

Pressure Points Exposed

Network latency spiked. Block finalization, usually a rhythmic certainty, stuttered. The remaining validators scrambled under the increased load, a stark stress test no roadmap ever planned for. It exposed a fragile dependency: enough coordinated exits could theoretically grind the chain to a halt.

The Incentive Engine Sputters

The core economic model faced its moment of truth. Slashing penalties for leaving? Apparently, a price many were willing to pay. The promised rewards for staking couldn't hold against the sudden, overwhelming urge to flee. It was a brutal lesson in liquidity preference—turns out, 'exit liquidity' applies to validators too.

Finance's old guard will likely smirk, muttering about 'digital gold' and 'uncorrelated assets' between sips of overpriced coffee. Yet, here's the twist: this wasn't a price crash. This was a structural tremor. Ethereum didn't just lose value; it lost a critical mass of its operators. The network survives, but its margin of safety just got a lot thinner. The next test might not be so forgiving.

Read us on Google News

Read us on Google News

In brief

- A bug in the Prysm client caused Ethereum validator participation to drop by 25% after Fusaka.

- The crypto network came close to losing finality, revealing a dangerous dependency on few consensus clients.

Prysm bug: Ethereum on the verge of losing its finality

Shortly after the activation of Fusaka, acaused the production of obsolete states. Result: nearly 25% of validator nodes went offline.

Ethereum then fell below the critical 75% voting participation threshold, dangerously approaching the supermajority threshold at 66.6%. This is essential to maintain the crypto network finality.

The emergency fix, based on the –disable-last-epoch-targets flag, quickly restored synchronization. Validation thus. However, this instability raises serious questions about ethereum network robustness, especially in case of a bug in a dominant consensus client.

The massive staking on Prysm proved to be. If the bug had affected Lighthouse (which controls over 50% of validators), Ethereum would likely have lost its finality. This scenario would have caused :

- blocked withdrawals ;

- frozen rollups ;

- a potential chain reorganization.

Diversity of Ethereum clients remains insufficient

The bug not only highlights a technical flaw. It also exposes a structural weakness:. Despite repeated warnings since 2021, Prysm still holds a major share of validators. The data shows a peak at 22.71% before the incident. After the crisis, this share dropped to 18%.

Ethereum today relies on a fragile balance. This refers to a crypto ecosystem too centralized around a few consensus clients. This weakens. Developers understand this: it is necessary to encourage adoption of alternative clients (such as Lodestar, Nimbus, or Teku) to prevent a single technical bug from compromising the entire chain.

In any case, the latest alerts on Ethereum show that technical decentralization can no longer remain a pipe dream. Faced with increasing risks, the community must strengthen its resilience to guarantee the security of all actors in the crypto ecosystem.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.