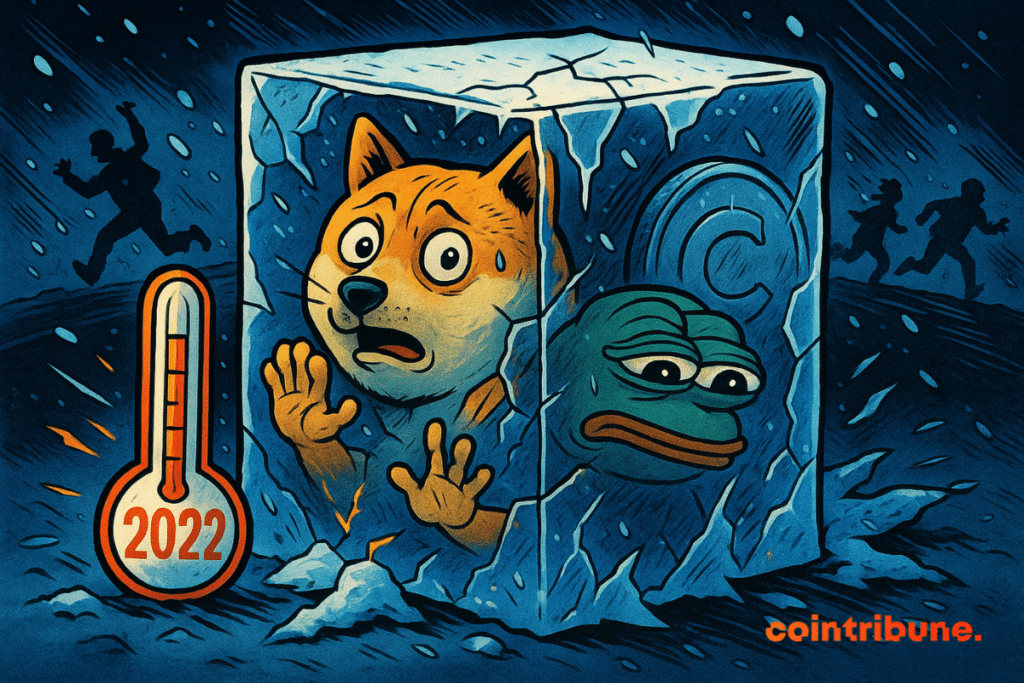

Crypto’s Wild Ride: Memecoins Plunge to Lowest Levels Since 2022

Memecoins hit a multi-year low—but is this the bottom, or just another chapter in crypto's volatile story?

The Joke's Over (For Now)

Forget the hype. The speculative frenzy that once sent dog-themed tokens and other internet-born cryptocurrencies soaring has crashed back to earth. The memecoin market just recorded its weakest collective valuation since the last crypto winter, a stark reminder that what goes up on social media buzz often comes down twice as hard.

Decoupling from the Pack

This isn't just a broad market dip. While major assets like Bitcoin and Ethereum show resilience, memecoins are bleeding out. Their collapse highlights a brutal market truth: narratives built on memes and community sentiment, without underlying utility, are the first to get liquidated when sentiment sours. It's a classic flight to quality—or at least, to assets with more than just a funny logo.

A Stress Test for Speculation

The plunge acts as a natural stress test, separating momentum traders from true believers. It also raises questions about the long-term viability of an asset class whose primary use case often seems to be funding viral tweet threads. One cynical finance veteran might call it the market's way of charging a 'stupidity tax'—a brutal but efficient mechanism for reallocating capital from the reckless to the resilient.

What's Next for the Degens?

History suggests this won't be the last memecoin cycle. New tokens will emerge from the ashes, promising even greater returns and community 'vibes.' But this crash serves as a crucial lesson in risk management. For the crypto ecosystem, a little less froth might actually be healthy, forcing a focus on building rather than just shilling.

The memecoin party isn't cancelled forever—it's just on a very uncomfortable, value-destroying hiatus. Whether this low marks a buying opportunity for the brave or a tombstone for a trend depends entirely on your appetite for risk and your faith in the power of the meme.

Read us on Google News

Read us on Google News

In brief

- Memecoins lose all dominance, falling to their lowest level in three years.

- No new theme takes over, signaling a global weakening of crypto speculation.

- Even popular tokens like DOGE and SHIB do not escape the coordinated sector drop.

- The overall crypto market liquidity contracts, which heavily penalizes highly volatile assets.

Memecoins no longer make anyone laugh: a fall without a safety net

In the crypto universe, the dominance of memecoins is an emotional thermometer to the point where they are considered a lucrative bubble. Yet, the mercury has collapsed: the memecoin market enters a true ice age, with dominance fallen to its lowest level in several years.

According to CryptoQuant, their share in the altcoin market dropped from 0.11 at the end of 2024 to only 0.04, a return to 2022 levels.

And the phenomenon is not niche: all sub-sectors are affected. Stars like DOGE, SHIB, or Pepe to cultural or political memes, no category resists. CoinGecko confirms: since the peak at the end of 2024, the decline is general and continuous.

More worrying still: no narrative rotation fills the void. This is unprecedented in the crypto market. Usually, one theme replaces another. Today? Nothing. Even retail speculation has deserted.

Ki Young Ju, CEO of CryptoQuant, summed up the situation in a blunt tweet: “memecoin markets are dead“.

“Dead? Just hibernating”: too quick a burial of memecoins?

But not everyone shares this morbid view. Under Ki Young Ju’s tweet, reactions strongly contrast. For some, this fall is a disguised buy signal.

A user replies:

Dead? Just hibernating. Bull market nap.

A way to remind that memecoins have the habit of disappearing only to come back better.

Others, like RunnerXBT, even interpret the situation as an opportunity and consider it one of the most bullish signals of the week. This counter-trend reading is based on the crypto market history: cycles repeat, and boring periods are often accumulation phases.

Memecoins, anchored in Internet culture, can be reborn from a simple buzz or an Elon Musk tweet. If the current dynamic is different, their rebound potential remains intact. Doubt settles in: should they really be buried?

The crypto market on standby, but not without heartbeat

While some ring the death knell, others watch for weak signals. And some numbers give hope. According to CoinGlass, the Open Interest (OI) of futures contracts on DOGE, SHIB, and PEPE is sharply up: +4%, +8%, and +3%. Proof that retail is slowly returning to the field.

Technical indicators confirm this stirring. Doge consolidates between $0.133 and $0.1568, a bullish breakout could propel it to $0.1810. The RSI slowly rises towards the neutral zone, MACD follows, sign of a gradual return of demand.

Same trend for SHIB and PEPE. Their curves move horizontally but supports hold. If the $0.00000900 threshold for SHIB is crossed, a new bullish phase could start. The crypto market thus seems suspended, awaiting a catalyst.

Key takeaways on the collapse of memecoins

- 0.04: current memecoin dominance level, equivalent to that of 2022 (CryptoQuant);

- +8%: SHIB Open Interest increase, signal of retail return (CoinGlass);

- 2024-2025: synchronized decline of all memecoin categories;

- $2.5 million: long liquidations on DOGE in 24h – more than shorts;

- Zero narrative relay: no sector substitution takes over.

It WOULD be unwise to dismiss memecoins with a wave of the hand. Last August, after a sudden crash, they showed they could be the first to restart the crypto machine. Their community and viral potential remain intact. This current silence may be just the calm before the storm.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.