U.S. Grants Five Crypto Companies Unprecedented Banking Status in Landmark Regulatory Shift

Washington just handed crypto its biggest institutional win yet—five digital asset firms now operate with full federal banking charters.

### The Regulatory Dam Breaks

Forget state-by-state money transmitter licenses. This move grants a select group of five companies the authority to custody assets, process payments, and issue stablecoins on a national scale. It bypasses the traditional banking gatekeepers entirely, creating a parallel financial system with federal approval.

### What a Federal Charter Actually Means

The implications are seismic. These five firms can now offer services previously reserved for legacy banks, but with blockchain's efficiency. Think instant settlements, 24/7 operations, and programmable money—all wrapped in a regulatory shield that screams legitimacy to Wall Street. It cuts through the compliance fog that has stifled growth for years.

### The New Power Players

While the official roster remains under wraps, the qualification bar was sky-high. The chosen five likely represent a mix of established custody giants, leading exchange infrastructure, and compliant stablecoin issuers. They didn't just meet the old rules; they defined the new ones.

### A Jolt to Traditional Finance

Watch for tremors across traditional banking. Why park cash in a savings account yielding pennies when a federally-chartered crypto bank offers a programmable dollar? The move exposes the sluggishness of legacy finance—after all, it only took a decade of lobbying and a market crash or two for regulators to catch up. The real irony? The 'wild west' of crypto just built a more modern fort, complete with a government-issued flag.

This isn't an experiment anymore. It's a new financial reality, approved, stamped, and delivered. The race to rebuild finance just got its official starting gun.

Read us on Google News

Read us on Google News

In Brief

- The U.S. bank regulator (OCC) conditionally approved the banking charter applications of five major crypto companies.

- BitGo, Fidelity Digital Assets, and Paxos are converting their existing trust companies into national banks.

- Circle and Ripple are obtaining new charters to become federal trust banks.

- These approvals will allow custody of digital assets and, in some cases, the issuance of stablecoins.

Paxos, Circle and Ripple Join the Circle of Trust Banks

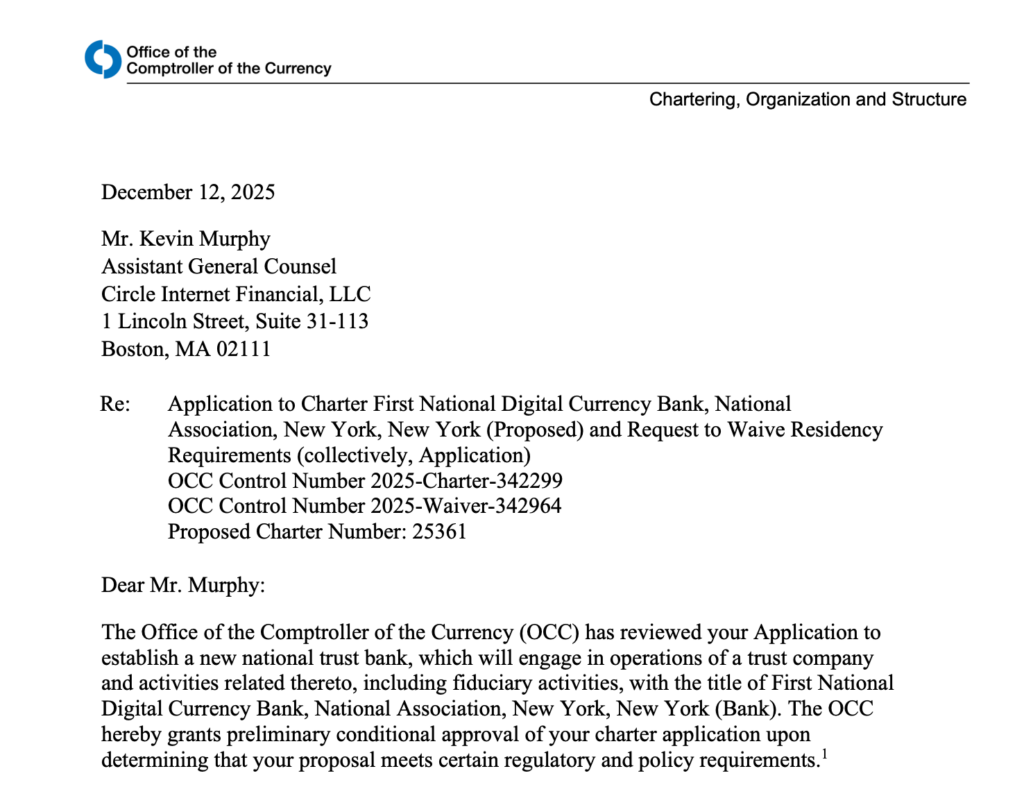

The Office of the Comptroller of the Currency (OCC) released on Friday a series of approvals marking a turning point. BitGo, Fidelity Digital Assets, and Paxos received authorization to convert their state trust companies into national banks. Circle and Ripple are starting directly with a new federal banking charter.

This decision radically transforms the status of these crypto players who previously operated in a more ambiguous regulatory zone.

For BitGo, Fidelity Digital Assets, and Paxos, this is a promotion. These three companies already operate state trust companies. Their new federal charter gives them enhanced legitimacy and direct supervision by the OCC. Circle and Ripple, however, start from scratch with entirely new applications.

The arrival of new players in the federal banking sector is a good thing for consumers, the banking sector, and the economy, said Jonathan Gould, Comptroller of the Currency. His message is clear: financial innovation deserves its place in the traditional banking ecosystem.

These approvals are not just administrative formalities. They will allow companies to offer digital asset custody services under strict federal supervision.

Paxos confirmed that its regulated platform will enable companies “to issue, custody, exchange, and settle digital assets with clarity and confidence.” The company notably retains the right to issue stablecoins, cryptocurrencies pegged to the dollar.

Divergent Strategies to Conquer Wall Street

The ambitions of the five companies go beyond obtaining a banking charter. BitGo is actively preparing for its IPO. The Securities and Exchange Commission (SEC) is currently reviewing its filing submitted in September.

The company aims for a listing on the New York Stock Exchange and claims about 90 billion dollars in assets under management. A valuation that reflects the sector’s growing maturity.

Circle has already passed this milestone. The USDC stablecoin issuer went public last May on the NYSE. This dual role – trust bank and publicly traded company – could become a model for other sector players.

In contrast, Ripple takes a different stance. Monica Long, the company’s president, ruled out any IPO idea in November. Paxos also has not communicated intentions in this direction.

One detail draws attention in the approval letters: Ripple will not be able to issue its RLUSD stablecoin under this banking charter. This restriction contrasts with the rights granted to Paxos and raises questions about the different regulatory approaches applied depending on the companies.

The movement far exceeds these five pioneers. Coinbase, the largest American exchange platform, filed its own application in October. The company however specifies that it has “no intention of becoming a bank” in the traditional sense. This nuance illustrates the varied strategies of crypto players in response to regulation.

The OCC is thus opening the doors to a new chapter for the crypto industry. By integrating these companies into the federal banking system, the regulator acknowledges the lasting place of digital assets in modern finance. It remains to be seen whether this regulatory trust will accelerate the long-awaited institutional adoption.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.