$2 Billion Floods Crypto Derivatives Markets as Bitcoin and Ethereum Lead Charge

Institutional capital is making a definitive move. A massive $2 billion surge into crypto derivatives signals a major shift in market structure, with Bitcoin and Ethereum commanding the lion's share of the action.

The Big Money Play

Forget the spot market noise. The real story is unfolding in the complex world of futures and options. That two-billion-dollar wave isn't retail FOMO—it's sophisticated capital positioning for what comes next. These flows create leverage, amplify trends, and often foreshadow major price movements. When this much money piles into derivatives, it's not a bet on today; it's a wager on tomorrow's volatility.

BTC & ETH: The Undisputed Engines

Bitcoin and Ethereum aren't just participating; they're driving the bus. Their established liquidity and deep markets make them the only viable playground for institutional-sized orders. This concentration reinforces their dominance—capital begets more capital. While altcoins may flash higher percentages, the sheer volume here proves where the smart money builds its core positions. It's a classic case of the rich getting richer, even in decentralized finance.

What the Flows Really Mean

This isn't just bullish sentiment. It's a structural upgrade. Major inflows into derivatives deepen markets, improve price discovery, and—love it or hate it—tie crypto closer to traditional finance mechanics. It brings both stability from larger players and the hair-trigger risk of cascading liquidations. The market is maturing, adopting the very tools that Wall Street uses to both hedge and speculate. Sometimes progress looks a lot like the system you aimed to disrupt.

The tape tells the tale. While pundits debate narratives, capital has voted with a $2 billion check. The derivatives market is now a core battleground, and the giants are drawing the lines. Just remember, in finance, every sophisticated hedging strategy is someone else's outright gamble.

Read us on Google News

Read us on Google News

In brief

- Open interest rose $2.8B in December, with Bitcoin and Ethereum futures contributing a significant portion.

- Bitcoin futures positions grew from $22B to $23B, while Ethereum futures climbed from $13B to $15B.

Bitcoin and Ethereum Futures See Notable Gains

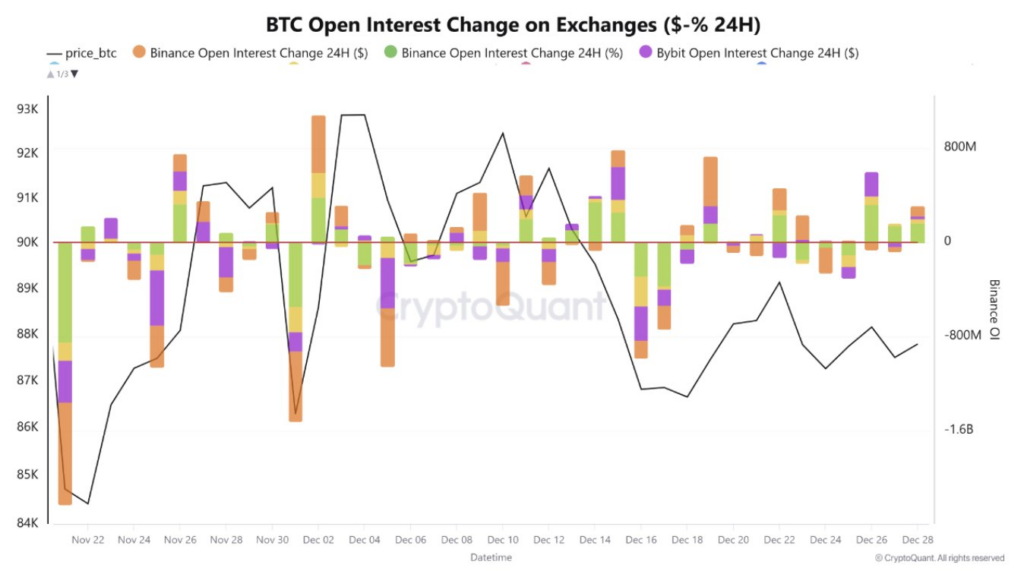

A contributor at on-chain analytics platform CryptoQuant reported that Bitcoin futures positions grew from $22 billion to $23 billion, increasing by $1 billion, while Ethereum futures rose from $13 billion to $15 billion, gaining around $1.4 billion. These changes occurred as Bitcoin’s price hovered near $88,000 and the Crypto Fear and Greed Index remained at 27, reflecting ongoing market caution. Since then, the index has dropped further to 23, a level classified as extreme fear, highlighting the gap between growing derivatives exposure and negative market sentiment.

Over the past week, roughly $450 million in new Leveraged positions were added, reflecting strong engagement in the derivatives market. This surge in activity occurred even as Bitcoin briefly climbed back to $90,000 yesterday before dropping about $4,000 within six hours, which triggered roughly $100 million in liquidated long positions. Despite this short-term volatility, total Bitcoin positions still rose about 2% week-on-week, suggesting that traders used the pullback as an opportunity to open new positions rather than exit the market.

Here are some other key factors from December that show how traders responded despite market caution:

- Centralized exchanges such as Binance, Bybit, and OKX steadily added positions throughout December, with Gate.io showing the largest accumulation, reflecting continued market engagement.

- Rather than cutting back, exchanges either held or increased their exposure, a move that differs from the usual pattern where leverage declines during market bottoms.

- This sustained growth in open interest, even as fear levels reached extremes, suggests traders remained cautiously optimistic, taking on risk while the broader market sentiment stayed negative.

Investor Outflows Signal Lingering Sentiment Pressure

While derivatives show conviction, broader investment products highlight ongoing caution. CoinShares’ weekly report indicates Bitcoin outflows of $443 million in the past week, while digital asset products overall recorded withdrawals of $446 million. Since the October 10 price drop, cumulative outflows total around $3.2 billion, signaling that investor sentiment has yet to fully recover.

As the year closes, Bitcoin is down 6.51% year-to-date. For the past two weeks, the cryptocurrency has traded in a tight range between $86,700 and $89,900, with small candlesticks pointing to low volatility. To finish the year in positive territory, Bitcoin needs a 6.8% rally from its current $87,240 level. This requires breaking above immediate resistance at $88,000 and pushing past the upper Bollinger Band near $91,000, signaling stronger bullish momentum.

The RSI, around 43, must climb above 50 to confirm upward pressure, supported by consistent buying. Maintaining support near $85,000 is also crucial to avoid further downside. A steady rally with rising momentum and solid support is essential for bitcoin to close the year in the green.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.