Grayscale Shakes Up Crypto: Files SEC Application for Groundbreaking Bittensor ETF

Wall Street's crypto heavyweight just placed a massive bet on AI-driven blockchain.

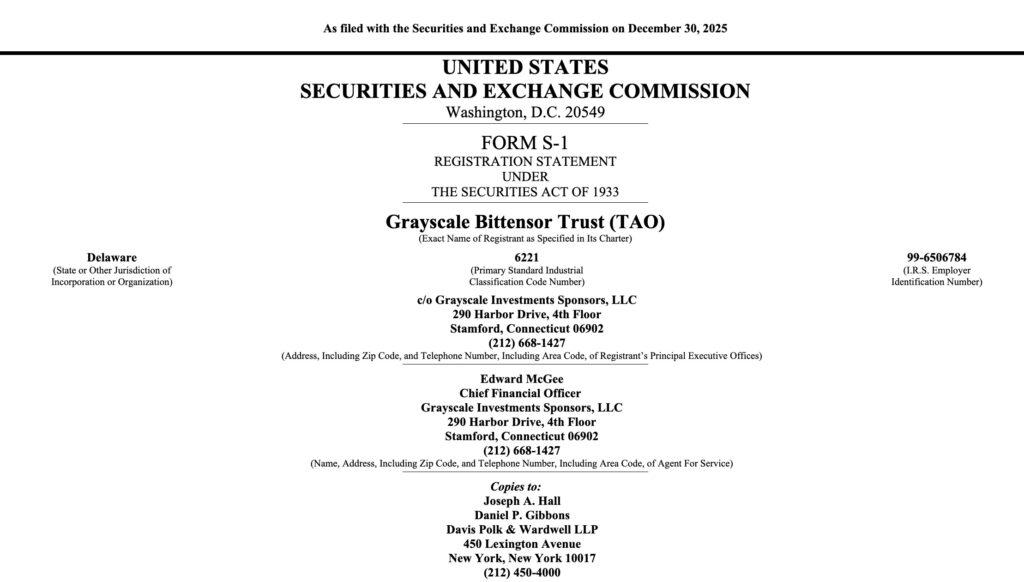

Grayscale Investments, the firm behind the landmark Bitcoin ETF conversion, has formally submitted paperwork to the Securities and Exchange Commission for a spot exchange-traded fund tracking Bittensor (TAO). The move signals a major institutional push to bridge artificial intelligence and decentralized finance through a traditional investment vehicle.

Why This Filing Matters

It's not just another crypto ETF application. Bittensor operates a decentralized network where machine learning models compete and collaborate—imagine a global, incentivized brain for AI. Grayscale's filing attempts to package this complex, bleeding-edge protocol into a neat ticker for brokerage accounts. It’s a direct conduit for mainstream capital to flow into AI-powered crypto, bypassing the technical hurdles of direct token ownership.

The Regulatory Gauntlet

The SEC now holds the cards. Approval is far from guaranteed, given the agency's historically cautious stance on non-Bitcoin crypto products. Analysts expect scrutiny over Bittensor's novel mechanics and how Grayscale plans to custody and validate the underlying TAO tokens. The process could take months, if not years—a waiting game where Wall Street's patience is tested against regulatory skepticism.

A New Frontier or a Speculative Bubble?

This filing accelerates the narrative that the next bull run will be fueled by AI-crypto convergence. If approved, the ETF would provide unprecedented exposure to a token whose value is tied to the usage and performance of a decentralized AI marketplace. Critics, however, see it as another case of financial engineering trying to slap a familiar wrapper on a highly volatile and experimental asset—because what's finance without repackaging risk and calling it innovation?

The ball is in the SEC's court. A green light could open the floodgates for a new category of thematic crypto ETFs. A rejection would reinforce the high walls between DeFi and traditional finance. Either way, Grayscale just forced the conversation.

Read us on Google News

Read us on Google News

In Brief

- Grayscale filed an S-1 form with the SEC for an ETF linked to the TAO token of Bittensor.

- This product targets a listing on the NYSE Arca under the ticker GTAO, marking a first for decentralized AI.

- SEC approval of Grayscale’s Bittensor ETF could propel TAO and democratize institutional investment.

Grayscale files an S-1 form for a Bittensor ETF, a first in the United States

Grayscale has officially filed an S-1 form with the SEC to launch an ETF based on the TAO token of Bittensor, under the ticker GTAO on the NYSE Arca. This move follows the success of the Grayscale Bittensor Trust in OTC and the first Bittensor halving on December 14, 2025, reducing the daily token issuance from 7,200 to 3,600.

This filing is part of a broader strategy to democratize access to institutional crypto assets. Grayscale is betting on decentralized AI as a growth lever for the coming years, aligning its products with regulators’ expectations. With a market capitalization of 2.3 billion dollars, TAO positions itself as a key player in the AI-linked cryptocurrency ecosystem.

Decentralized AI opens to institutional investors, a revolution if the SEC approves the Bittensor ETF

SEC approval of the Bittensor ETF WOULD mark a turning point for decentralized AI! It would then offer institutional investors regulated and secure access to TAO. This product would allow holding tokens directly, without initial staking, unless conditions evolve. Such approval could accelerate decentralized AI adoption in institutional portfolios by aligning traditional investors’ interests with those of technology innovators.

By comparison, Europe has already passed this milestone with the Bittensor ETF listed on the SIX Swiss Exchange under the ticker STAO by Deutsche Digital Assets. Building on this momentum, Grayscale could position the United States as a major player in this emerging sector. The risks and opportunities for the markets are immense, with unprecedented diversification potential for investors.

Crypto: Bittensor (TAO) at the dawn of its moment of glory?

30 minutes after Grayscale’s announcement of filing for a Bittensor ETP with the SEC, the TAO price immediately reacted, rising from 219 dollars to 222 dollars in 30 minutes! Reflecting the enthusiasm of crypto investors. If the SEC approves Grayscale’s Bittensor ETF, TAO could see a MOVE towards 800 dollars. Especially since the token reached a peak of 767 dollars in 2024 before stabilizing around 220 dollars at the end of 2025.

Consequently, experts anticipate increased liquidity and better visibility for Bittensor, driven by growing institutional demand. This would strengthen its position in the decentralized AI ecosystem. Could TAO become the next “blue chip” in this sector, similar to Bitcoin for cryptos? Market reactions and sector stakeholder expectations will be crucial in the coming months.

Grayscale’s filing for a Bittensor ETF marks a key milestone for decentralized AI and crypto. If the SEC approves this product, institutional investors will finally have access to an innovative and disruptive asset. The question remains whether TAO can confirm its potential. And you, would you be ready to invest in decentralized AI?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.