BlackRock’s BUIDL Shatters Records: $100M Dividend Payout Propels Valuation Past $2B Milestone

Forget whispers—this is a roar from Wall Street's new digital frontier. BlackRock's tokenized treasury fund, BUIDL, just flexed serious financial muscle, distributing a colossal $100 million in dividends to its investors. The move isn't just a payout; it's a power play that has officially catapulted the fund's total valuation over the $2 billion mark.

The Mechanics of a Mega-Payout

So, how does a digital asset spin off nine figures in yield? By doing what traditional finance often struggles with: executing with ruthless efficiency. The dividends were generated from the underlying short-term U.S. Treasury holdings and repurchase agreements, then seamlessly distributed on-chain. No waiting for checks to clear, no intermediary delays—just programmable, transparent capital flow directly to token holders. It's a masterclass in cutting out the middleman.

Why the $2B Valuation is a Game-Changer

Crossing the $2 billion threshold isn't just another vanity metric. It's a loud, undeniable signal of institutional conviction. This scale of capital demonstrates that tokenized real-world assets (RWAs) are moving beyond pilot projects and niche experiments. They're becoming a legitimate, scalable pillar of the modern portfolio. When the world's largest asset manager builds a digital fund this big, the market pays attention—and capital follows.

The Ripple Effect Across Finance

This milestone sends shockwaves far beyond BUIDL's own ledger. It validates the entire thesis of blockchain efficiency for traditional finance. Expect competitors to scramble, regulators to scrutinize closer, and a fresh wave of institutional capital to start probing the on-ramps. The race to digitize everything from bonds to real estate just hit hyperdrive. After all, nothing motivates old-guard bankers like the sight of a competitor making money in a way they don't fully understand—yet.

BUIDL's $100 million dividend isn't just a reward for investors; it's a provocation to an entire industry. It proves that the fusion of TradFi reliability with DeFi's agility can work at a billion-dollar scale. The fund's journey past a $2 billion valuation marks a point of no return. The future of asset management is being built, token by token, and it's leaving dusty old settlement systems—and their hefty fees—firmly in the past.

Read us on Google News

Read us on Google News

In Brief

- BlackRock’s BUIDL fund has paid out around 100 million dollars in dividends ever since its debut in March 2024.

- The fund’s total valuation has now surpassed 2 billion dollars, placing it among the largest tokenized cash products available in the market.

BUIDL’s Growth and Institutional Impact

Securitize, serving as BUIDL’s transfer agent and administrator, reported that the fund is now the first tokenized Treasury product to reach $100 million in cumulative dividends. BUIDL channels capital into near-term U.S. government securities, repo deals, and other cash-like holdings. Its valuation has now surpassed $2 billion, placing it among the largest blockchain-based cash products in operation

While initially launched on Ethereum, BUIDL has grown to operate across several blockchain networks as interest in on-chain dollar-yield products has strengthened. Its debut on solana on March 25 coincided with the tokenized treasury market surpassing $5 billion in total assets. The fund operates under a regulated money market framework, issuing shares as blockchain tokens, with ownership and dividend distribution recorded directly on-chain.

Consequently, the milestone in dividends demonstrates that blockchain finance can function at a professional, large-scale level. Institutions holding BUIDL shares benefit from returns produced by the underlying assets, with distributions executed directly on the blockchain, removing intermediaries and streamlining operations.

BUIDL’s Increasing Influence in the Crypto Ecosystem

Beyond generating passive income, BUIDL tokens are increasingly integrated into the broader crypto ecosystem;

- They serve as backing for stablecoins, including Ethena’s USDtb, supporting their on-chain operations.

- The tokens are used as collateral across a variety of trading and financing arrangements, supporting liquidity and market activity.

- BUIDL’s role in the market was further strengthened in November when Securitize and Binance confirmed the tokens could be used as off-exchange collateral for trading on Binance.

This development reflects a wider trend of institutions adopting tokenized money market funds to gain regulated exposure to dollar-denominated yield. In 2025, the segment has grown rapidly, though authorities have highlighted potential challenges. These concerns include the finality of transactions, managing liquidity, and how tokenized securities could perform during periods of market volatility.

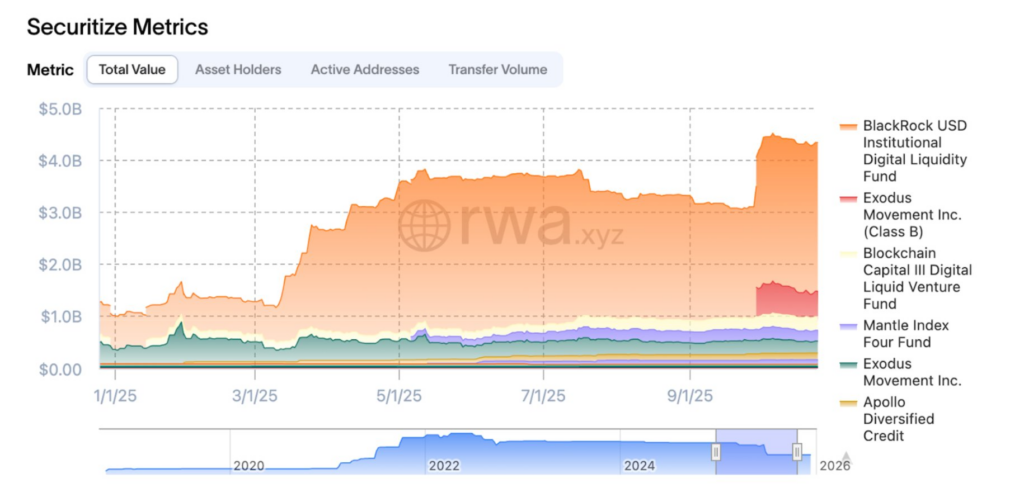

At the same time, the broader tokenized real-world asset market—excluding stablecoins—has expanded significantly, rising from roughly $5.5 billion at the end of 2024 to $18.2 billion by December 2025. In its 2025 review, Securitize reported that it had outpaced the overall tokenization market. The company’s total tokenized assets increased from $1 billion to $3.4 billion, while tokenized Treasuries climbed from $653 million to $2.4 billion. Net inflows over the same period surpassed $3 billion, setting a new record in the tokenization industry.

Regulatory Scrutiny and Risk Considerations

Despite rapid growth and adoption, tokenized money market funds are now receiving closer attention from experts and regulators. The Bank for International Settlements issued a warning in November that such products could present risks similar to, or even exceeding, those seen in traditional money market funds.

Key areas of concern include liquidity risk, operational challenges, and compliance issues related to anti-money laundering and counter-terrorism financing—risks often associated with stablecoins and other blockchain-based instruments.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.