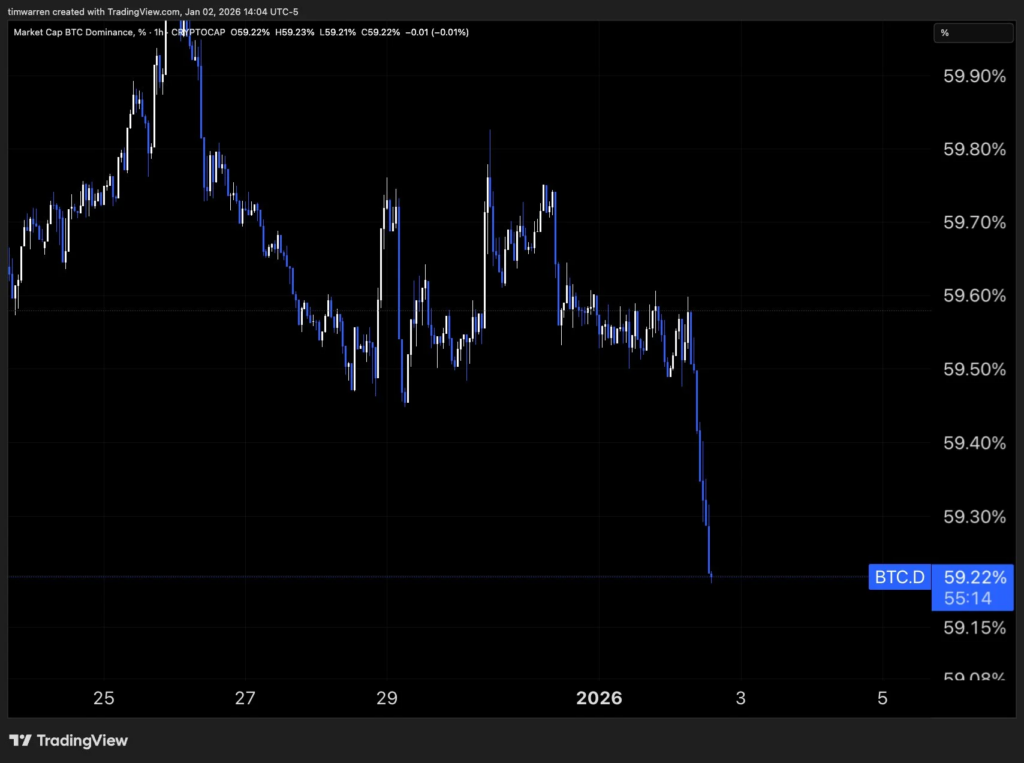

Altcoins Surge as Bitcoin Dominance Hovers Near 59% - The Rotation Is On

The king isn't dead, but the courtiers are getting restless. Bitcoin's grip on the total crypto market cap is slipping from its throne, dipping toward the 59% mark. That's the signal altcoin traders live for.

The Great Rotation Begins

When Bitcoin dominance retreats, capital doesn't just vanish—it rotates. We're seeing that play out in real-time. Money is flowing out of the flagship asset and hunting for higher beta plays elsewhere in the ecosystem. It's a classic risk-on move within a risk-on asset class.

Follow the Smart Money (Or the Desperate Yield)

This isn't just retail FOMO. Institutional portfolios, always hunting for uncorrelated returns, are rebalancing. The narrative has shifted from 'store of value' to 'utility and yield.' Protocols with clear use cases—DeFi blue-chips, AI-driven tokens, real-world asset platforms—are sucking up the liquidity. It's a bet on functionality over pure monetary dogma.

A Fragile Equilibrium

Don't pop the champagne just yet. This 59% level is a psychological battleground. A swift Bitcoin rally could reverse flows in a heartbeat, crushing altcoin leverage on the way up. The dominance chart is a seesaw, and we're at the tipping point. Traders are dancing on a knife's edge, balancing between catching the altseason wave and getting wrecked by a sudden BTC pump.

Remember, in crypto, the 'safe' trade is often the crowded one—and nothing makes traditional finance guys sweat more than watching degens in ape PFPs outperform their hedged portfolios. The altcoin rally is on, but it's fueled by equal parts innovation and impatience.

Read us on Google News

Read us on Google News

In brief

- Bitcoin trades near $89,644 but lags major altcoins as dominance weakens and overall market momentum shifts toward higher-risk assets.

- XRP and Dogecoin lead gains, with meme coins and mid-cap tokens rising as trading activity spreads beyond Bitcoin.

- Ethereum climbs above $3,100, holding key support levels after months of weakness and showing improved short-term price strength.

- Public firms increased ETH buying in Q3, briefly lifting the ETH/BTC ratio and adding pressure to Bitcoin’s market share.

Bitcoin Momentum Stalls as Altcoin Trading Activity Rises

Recent sessions indicate a gradual easing of Bitcoin’s dominance across the crypto market. After remaining near 60% for much of the year, that level is now close to slipping lower. Price stability has held, but relative performance continues to lag several large-cap tokens.

Bitcoin (BTC) is trading NEAR $89,644, up approximately 1.7% over the past 24 hours. Momentum remains subdued despite the advance. Market sentiment stays bearish, with the Fear and Greed Index at 29. BTC is also trading below its 200-day simple moving average and is down roughly 7% year over year.

By contrast, altcoins have posted broad gains across the market:

- XRP climbed 6% over the past 24 hours and is nearing the $2 mark.

- Dogecoin rose 10.51% to $0.139, leading meme coins in performance.

- Shiba Inu and other smaller tokens moved higher in tandem.

- Ethereum added 4.36% to trade around $3,114 following months of limited movement.

- Altcoin trading volumes rose further as Bitcoin dominance eased.

Public Companies Increase ETH Holdings, Lifting ETH/BTC Ratio

Ethereum, in particular, has begun to show renewed momentum after an extended period of underperformance. ETH has closed higher on 17 of the past 30 days, accounting for about 57% of the period. Price action is now holding above key support levels, supporting improved short-term trader sentiment.

Earlier in 2025, Bitcoin dominance remained at historically elevated levels. Later in the year, capital flows shifted toward altcoins as interest in Ethereum-focused treasury strategies grew. That move was followed by a pullback as attention around those firms intensified.

Several publicly listed companies accelerated ETH accumulation during the third quarter, outpacing bitcoin purchases. This activity temporarily increased the ETH/BTC ratio. While it remains uncertain whether these trends will develop into a sustained altcoin cycle, recent price action suggests traders are increasingly positioning beyond Bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.