Bitcoin’s Human Rights Revolution: Fighting Discrimination in the Digital Age

Forget gold—Bitcoin's becoming the ultimate human rights tool. While traditional finance builds walls, crypto tears them down.

The Unbanked Finally Get a Seat at the Table

No passport? No problem. Bitcoin wallets don't ask for your ethnicity, religion, or political affiliation. A smartphone and internet connection are the only tickets needed. It bypasses the gatekeepers who've historically denied services based on prejudice.

Censorship Resistance as a Feature, Not a Bug

When governments freeze assets or block donations to dissident groups, Bitcoin keeps the lights on. Transactions can't be stopped by a central authority. Funds move peer-to-peer, cutting out the middleman who might be compelled to discriminate.

The Financial Sovereignty Shift

It puts economic power back into individual hands. Your wealth isn't held by an institution that can arbitrarily decide you're too risky. The network is neutral—it doesn't care if you're a billionaire or a refugee.

Not a Magic Bullet, But a Powerful Lever

Sure, Bitcoin's volatility would give any traditional wealth manager a heart attack—imagine trying to hedge human dignity against Fed policy announcements. And internet access remains a hurdle. But as a tool for economic inclusion and protest against systemic financial discrimination? It's proving harder to shut down than a Wall Street bonus culture.

The real disruption isn't just technological—it's social. Bitcoin offers what legacy systems often withhold: pure, permissionless participation.

Read us on Google News

Summary

1.

In brief

2.

Invisible discrimination: when money erases existence

3.

Bitcoin, the wealth exile cannot erase

4.

Bank discrimination: being human is not enough

5.

bitcoin facing bank discrimination: removing the right to refuse

6.

Temporal discrimination by inflation: when time becomes an enemy

7.

Bitcoin facing temporal discrimination: last refuge of the future

8.

Political discrimination and authoritarianism: when owning becomes a crime

9.

Bitcoin facing political discrimination: the right to own when owning is criminalized

10.

The crushing cycle, from crisis to violence, then to crisis: why this debate becomes urgent

11.

Monetary discrimination and mass exodus: when urgency becomes structural

12.

Geographical discrimination: urgency when solidarity becomes a privilege

13.

The economy of constraint: urgency when time kills

14.

The great democratic retreat: urgency of legal discrimination

15.

Bitcoin, an imperfect but universal solution against discrimination

16.

Bitcoin as an emerging human right: the last lifeline

Read us on Google News

Summary

1.

In brief

2.

Invisible discrimination: when money erases existence

3.

Bitcoin, the wealth exile cannot erase

4.

Bank discrimination: being human is not enough

5.

bitcoin facing bank discrimination: removing the right to refuse

6.

Temporal discrimination by inflation: when time becomes an enemy

7.

Bitcoin facing temporal discrimination: last refuge of the future

8.

Political discrimination and authoritarianism: when owning becomes a crime

9.

Bitcoin facing political discrimination: the right to own when owning is criminalized

10.

The crushing cycle, from crisis to violence, then to crisis: why this debate becomes urgent

11.

Monetary discrimination and mass exodus: when urgency becomes structural

12.

Geographical discrimination: urgency when solidarity becomes a privilege

13.

The economy of constraint: urgency when time kills

14.

The great democratic retreat: urgency of legal discrimination

15.

Bitcoin, an imperfect but universal solution against discrimination

16.

Bitcoin as an emerging human right: the last lifeline

In brief

- The largest global economic discrimination is not moral. It is monetary, silent, and systemic.

- Losing access to money often means losing all economic existence.

- Extreme inflation acts as a confiscation of time, imposed without democratic consent.

- Authoritarian regimes always start by controlling or censoring money.

- Bitcoin does not solve human crises. It prevents total economic erasure.

- Bitcoin is not an ideology. It is a minimal infrastructure against systemic discrimination.

Invisible discrimination: when money erases existence

He flees at night, with a bag too light for a whole life. At the border, his papers are worth nothing anymore. His money neither. Blocked accounts, refused cards, confiscated or lost cash: in a few hours, he becomes a stranger to all systems. That day, he loses not only his country of origin. He loses his right to exist economically.

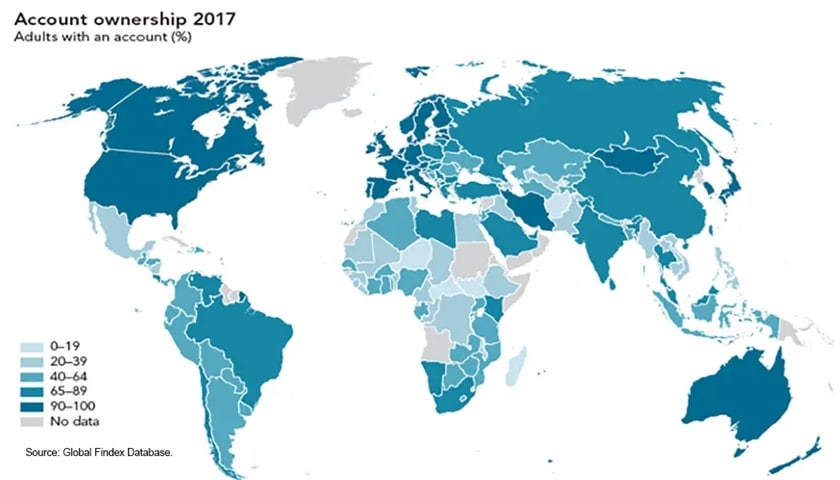

Today, billions of human beings suffer from economic discrimination without any law proclaiming it., and manifests even in the real uses of Bitcoin observed today, far from any abstraction. Being born without papers, without a bank account, in a poor jurisdiction, or under an authoritarian regime is enough. Exclusion is automatic. Silent. Global.

He loses his legal identity, his access to money, his economic continuity. Without documents, he no longer exists for banks. Without an account, he no longer exists for the global economy..

Bitcoin, the wealth exile cannot erase

Bitcoin introduces a radical break. Wealth is no longer attached to a state, an account, or permission. It becomes storable, portable, transferable.. What is impossible in the traditional system becomes conceivable. Bitcoin will never solve the tragedy of refugees. It does not remove war, exile, or loss. But it prevents it from becoming a total economic disappearance. It allows crossing a border with memory as the last bank account. With wealth in one’s mind.. An economy no longer needing to be hidden. Only remembered.

Bank discrimination: being human is not enough

The refugee discovers exclusion at the border. But billions of others are born excluded. Roya Mahboob, an Afghan-born entrepreneur and philanthropist, simply wanted to pay women for their work in Afghanistan. Not enrich them, but remunerate.. Not due to poverty. Due to legal prohibition. In Afghanistan, being a woman is enough to close access to the financial system. Roya then takes another path: empowering these tens of thousands of young women by training them in digital and financial literacy, in Afghanistan and beyond. Teaching them to understand, use, and preserve value through online courses or in clandestine education centers. Discreet, unofficial places invisible to institutions. Learning has become an act of silent resistance.

When a system forbids a woman from owning a bank account, discrimination is neither technical nor economic. It is political, social, civilizational. Roya then discovers a brutal truth:. The banking system does not exclude them by mistake. It excludes by design. This exclusion is not marginal. Among them, hundreds of millions of women. Bank exclusion is not only related to income, but also and especially to identity, gender, social status. Without documents, without male authorization, access is denied.. It does not punish behavior. It denies economic existence. As with refugees, the system demands proof before recognizing the human. Those who cannot prove are simply erased.

Bitcoin facing bank discrimination: removing the right to refuse

Faced with this exclusion, Bitcoin does not appear as a financial innovation. It appears as an escape. Roya Mahboob began paying these women in bitcoins out of necessity. They have no bank accounts, but they have phones. Money no longer passes through fathers, husbands, or intermediaries. It arrives directly. Without constraints, without permission, without negotiation..

. A way to pay without asking for permission. A way to circumvent an unfair law without violence. Bitcoin does not select its users, and requires no identity, status, or authorization. It does not “give” access to the system. It removes the right to refuse access. This difference is fundamental.. It treats every individual as a legitimate economic entity. No more, no less. It is an infrastructure of financial autonomy, not humanitarian aid. When the state becomes the oppressor, this neutrality ceases to be abstract. It becomes essential.

Temporal discrimination by inflation: when time becomes an enemy

He works. He gets paid. Then he starts again. But every month, his salary is worth less. This Venezuelan is neither an activist nor a dissident. He is ordinary. His savings melt quietly. Not due to personal error. Due to a distant political decision. In February 2019, inflation exceeded 344,000%. One of the most violent in modern history. Prices rise. Numbers change. No one votes. No one warns.. A slow, invisible, cumulative violence. It does not destroy everyone’s wealth..

In countries with extreme inflation, choices do not exist. No access to global markets, no stocks, no diversification, no hedging assets. Money must remain local, fragile, exposed. In Venezuela, Lebanon, Zimbabwe, Argentina, Malawi, Nigeria, Turkey, time becomes an enemy. Saving is no longer a virtue, it is a fault.. Inflation acts like a non-voted tax. It always penalizes the same ones: those without networks, without assets, without escape..

Inflation from 1980 to 2028Bitcoin facing temporal discrimination: last refuge of the future

When the Lebanese pound lost 90% of its value on February 1, 2023, no one was consulted. When currency was devalued by 44% overnight in Malawi, no one was protected. These decisions never go through public debate. They are imposed and strike unilaterally. Savings are dissolved by decree. Time is confiscated without consent.. A parallel system, open to all, without permission, status, or privilege. For the first time,. Not guaranteed, certainly. But not confiscable.

Bitcoin does not eliminate inflation. It offers an escape where there was none. In stable countries, where inflation exists but is contained, it is one option among others for diversification. Elsewhere, it is a historic novelty.. Today, an alternative exists. It is not yet fully mature. It is volatile short-term. But it is accessible. Bitcoin does not promise security. It promises the possibility of no longer suffering passively. In a world of imposed inflation, this possibility becomes a right.

Political discrimination and authoritarianism: when owning becomes a crime

Yeonmi Park was born without the right to own. In North Korea, she owned nothing: no account, no savings, not even the right to leave. Deposits could be blocked overnight. And holding cash became dangerous.. Confronted with this silent violence, there is often only one way out: exodus. Yeonmi fled as a child. First to survive. Then to try to help those left behind. Finally, to save or support North Korean refugees exiled and exploited in China..

Like Yeonmi, nearly 300,000 North Koreans fled to China, mostly women. Many were reduced to modern slavery, often sexual. Their children, born from forced unions, are stateless. Without identity, they have neither access to education nor legal existence. In a country marked by the one-child policy, these children are recognized nowhere. Without legal existence, no bank account is possible. For these refugees and their descendants, financial exclusion is total.

. Freezing an account is enough to silence a voice. Excluding an NGO is enough to suffocate it. Collective sanctions punish entire populations. Opponents, journalists, pastors, academics become economically nonexistent. In Hong Kong, accounts are frozen without judicial decision, following a national security law imposed by Beijing. In Nicaragua, institutions are deprived of resources. In Iran, financial access becomes conditional on obedience, following the “law on family protection by promoting the culture of hijab and chastity.” The bank becomes an instrument of conformity..

Bitcoin facing political discrimination: the right to own when owning is criminalized

Faced with this reality, Bitcoin does not appear as an alternative currency. It appears as a minimal right. The right to own, to transfer, to leave without being stripped.. For Yeonmi Park, sending money once meant risking total confiscation. For years, she used extremely costly clandestine channels. 40% commission for a Chinese intermediary, 40% for a North Korean intermediary. 80% lost, even before helping. Bags of cash thrown at the North Korean border, corruption, theft, constant fear. Sometimes, the money never arrived.

Today, another path exists. More direct. More fragile too.. Bitcoin does not overturn dictatorships. It does not protect against repression and political discrimination. But it becomes a last resort, a nonviolent border against economic erasure.. It does not judge, does not censor, grants no privilege. It prevents one essential thing: that power decides who has the right to exist economically..

The crushing cycle, from crisis to violence, then to crisis: why this debate becomes urgent

None of this is accidental.. Inflation, debt, shortages weaken societies, install fear, legitimize control. Power responds through norms, finance, surveillance. Money becomes conditional. Dissent becomes risky. Conformity becomes an economic requirement. When money is captured, freedom is too. Before withdrawing civil rights, economic access is removed.

Authoritarianism does not always arise by force. It settles by management. By rules, ceilings, permissions.. People do not flee a country. They flee the impossibility to live, save, transmit. Exodus is not a historical anomaly. It is the logical consequence of an economic system that has become excluding by design.

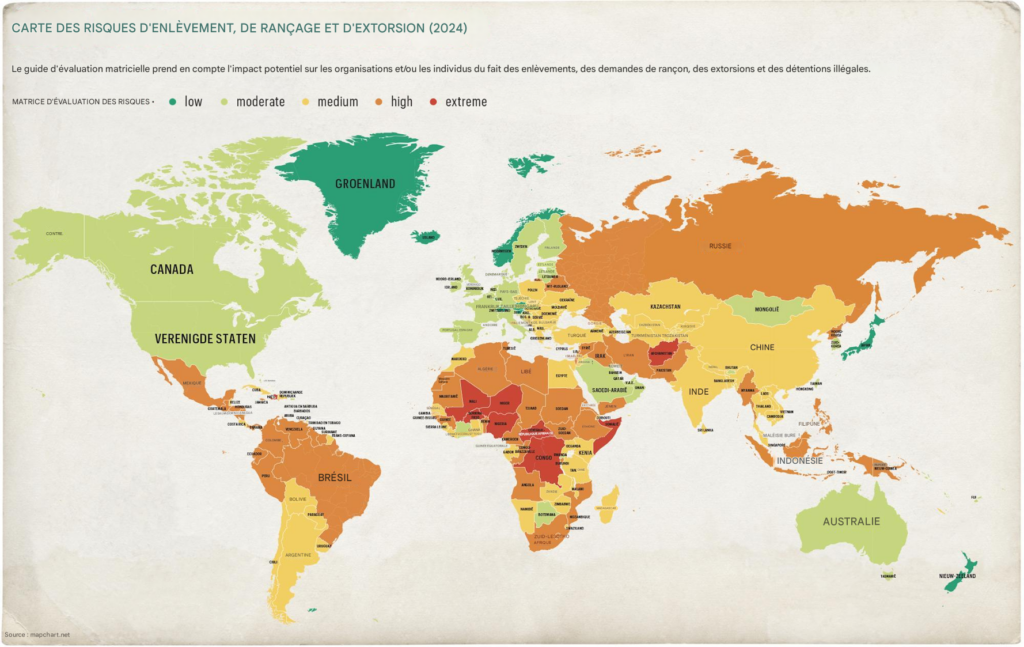

Mass exodus in turn engenders systemic insecurity. Migration routes, gray zones, absent states. Where law recedes, violence organizes.. Kidnappings, ransoms, human trafficking become economic models. When money no longer circulates, violence takes over. Modern slavery is not an accident. It is an industry born from institutional void..

What we experience is thus not a succession of independent crises. It is a self-sustained global loop:. This system does not collapse. It works. The more the world fragments, the more permission-based monetary systems discriminate. This debate is not theoretical. It is structural. Bitcoin is not the solution to the unjust world.. What follows is not a hypothesis. It is what we already observe.

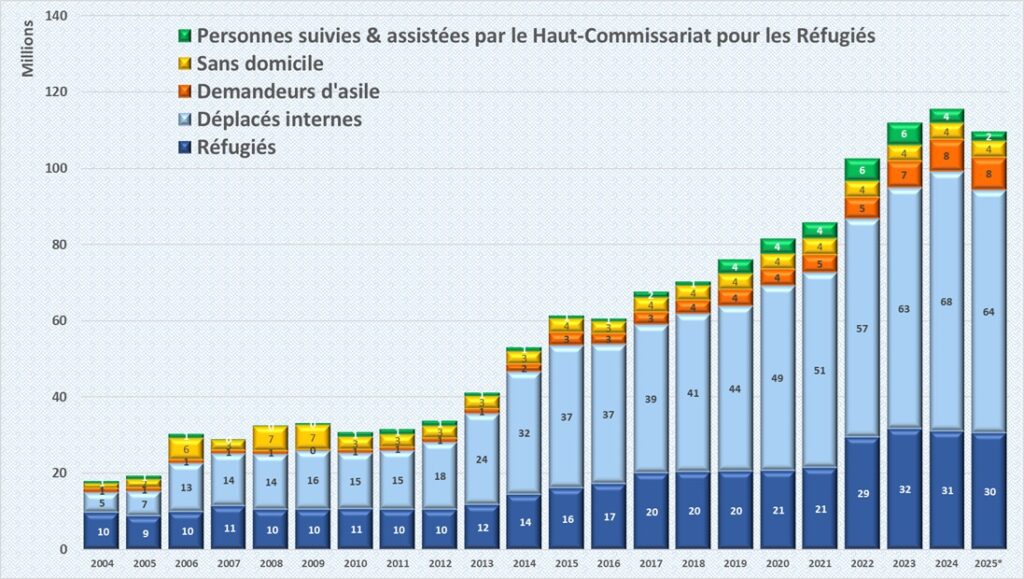

Monetary discrimination and mass exodus: when urgency becomes structural

What was a marginal tragedy has become a mass phenomenon.. Millions yesterday. More than one hundred million today. The curve no longer progresses, it runs away. Every conflict adds to the previous ones, every economic crisis creates new exiles. Every authoritarian regime produces its own wave of escapes. Forced mobility is no longer an exception. It becomes structural. And with it, economic exclusion. Because the global monetary system does not evolve. It remains national, administrative, conditional, rigid. The more refugees there are, the more monetary discrimination spreads..

When tens of millions of people cross borders, money does not follow. It is blocked, lost, dissolved. Each new wave amplifies the same mechanism. Loss of identity. Loss of bank access. Thus a loss of economic continuity. What was bearable on a small scale becomes destructive on a large scale.. It is not a one-time failure. It is a structural incompatibility. As exodus accelerates, injustice and discrimination become normalized. Bitcoin loosens a constraint and introduces mobility where the system imposes immobility.. It becomes a minimal condition for economic continuity.

Geographical discrimination: urgency when solidarity becomes a privilege

He works far from his own, often invisible, sometimes tolerated, rarely protected. Every month, he sends most of his salary to his family left behind. This mundane gesture supports households, villages, sometimes entire economies.. Queues. Forms. Suspicions. Repeated humiliations. Commissions rising up to 25%. In 2024, $900 billion of remittances generated $60 billion in commissions. Days of waiting for a vital transfer. Sometimes, a refusal without explanation.. Born on the wrong side of the border, supporting one’s own becomes a privilege. The system treats solidarity as a risk. It penalizes those without a strong passport or international bank.

. Hundreds of millions of migrants finance the survival of their loved ones. The traditional system takes commissions, slows down, filters. It turns a family duty into an administrative ordeal. Bitcoin does not fix this system. It bypasses it, without permission, without geographical censorship, without political delay. In emergencies — such as donation calls for Ukraine — it becomes a lifeline.. Imperfect. Sometimes volatile. But neutral. Bitcoin does not promise social justice. It eliminates a precise abuse: the right to hinder solidarity..

The economy of constraint: urgency when time kills

They fled a regime, but violence catches up on exile routes. Refugees are kidnapped, sold, held to pressure their families. Meron Estefanos, an Eritrean journalist exiled in Sweden, collected their voices. Refugees kidnapped in Sudan, sold in Sinai. Ransoms demanded under time constraint. $30,000, sometimes $70,000. One hour to pay. States are absent, banks become unusable, NGOs powerless. Western Union imposes ceilings, delays, controls up to 25% commissions. Money exists, but does not arrive on time. Here, discrimination is total: no account, no state, no recourse..

Faced with this urgency, Meron did not choose ideology. She chose what worked. Bitcoin reduced delays, removed ceilings, bypassed intermediaries. Lives have been saved. Tens of thousands.. It operates in morally broken zones. But when everything collapses, morally neutral tools become vital. Bitcoin does not fight kidnappings. It does not replace justice or peace.. In the economy of constraint, every minute counts. Here, Bitcoin is not a promise. It is a last resort.

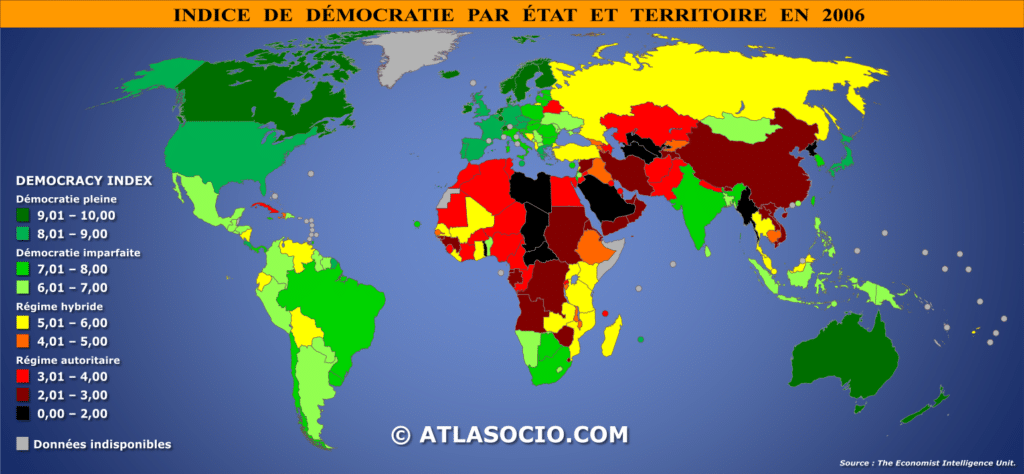

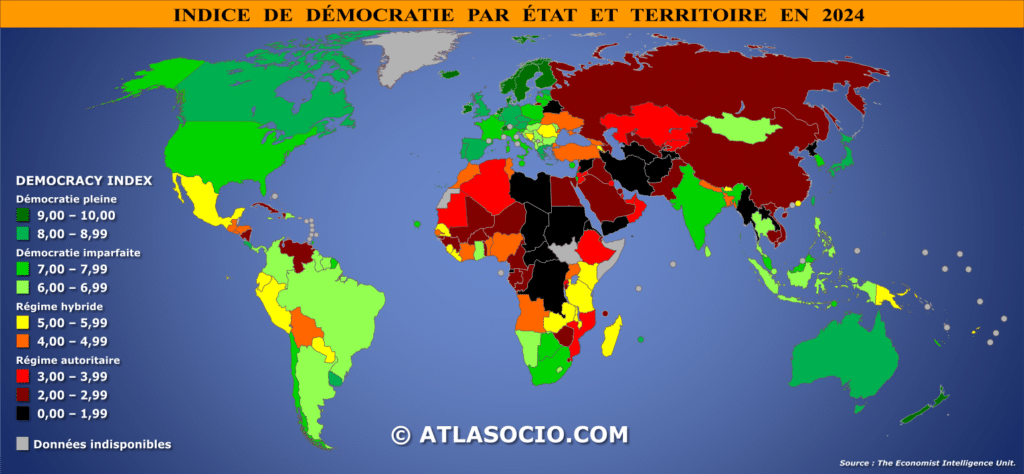

The great democratic retreat: urgency of legal discrimination

What do these human stories reveal, poignant, often inspiring, sometimes unbearable?. Rarely by force. Often by procedure, norm, finance. Only 8% of humanity lives today under full democracy. Elected states become intrusive: silent inflation, financial surveillance, traceable, censorable, programmable money. Discrimination no longer targets entire peoples, but behaviors. A gift, an opinion, a protest is enough. The traditional system no longer protects against legal abuse. It automates it. When money becomes a political lever, democracy becomes conditional. It is not dystopia. It is already an infrastructure in place.

In 2013, in Cyprus, the state threatened to tax bank deposits to save banks. Citizens fled to Bitcoin by instinct of economic survival. In Canada, during the Freedom Convoy, protesters’ and donors’ accounts were frozen. Without trial, by simple administrative decision. Edward Snowden and Julian Assange paid for transparency with exile, financial asphyxiation, and civil erasure. The system did not malfunction. It worked exactly as planned. Bitcoin does not create freedom. It guarantees nothing. It limits arbitrariness, and prevents money from becoming a leash..

Bitcoin, an imperfect but universal solution against discrimination

It is often said that Bitcoin is useless, superfluous. That the dollar suffices, especially to protect against local inflation. That stablecoins make this dollar more accessible. But the dollar depends on a bank and a state. It obeys sanctions, the extraterritoriality of American law, monetary policy, and devaluation. Stablecoins depend on an issuer; they are programmable, freezable, revocable..

In Lebanon or Venezuela, these permissions disappear without judgment: blocked accounts, arbitrary ceilings, forced conversions. The traditional system does not discriminate by ideology but by conformity. Without account, without recognized identity, without bank access, the dollar becomes inaccessible. Without documents, stablecoins become vulnerable. Bitcoin requires no authorization, no identity, no intermediary. It promises no stability nor equality of outcomes or wealth. It guarantees one thing only: equality of access..

Yes, Bitcoin is volatile. It is the cost of freedom short-term. Yes, its adoption is uneven. Technology is demanding. Education is necessary. It is the price to pay to truly own your digital property. Because any other alternative requires an intermediary, a permission… which can become exclusion tools. Bitcoin does not remove risk or injustice. It prevents total exclusion. It is not only a currency, an investment, or a technology, but a protocol that removes arbitrary exclusion criteria. No other system offers such universality without permission. Neither the dollar, nor stablecoins, nor banks.. A perfect system that excludes is more dangerous than an imperfect system that does not.

Bitcoin as an emerging human right: the last lifeline

This text is not about Bitcoin. It is about what happens when a human can no longer pay, receive, leave, survive. Discrimination always begins the same way. An account closes, a payment fails, a border turns money into a fault. No one becomes a refugee by choice. No one becomes undocumented by ideology. One becomes so when the system stops recognizing your existence. At that exact moment, money ceases to be abstract. It becomes a lifeline. Or a line of death. Bitcoin is not the promise of a better world. It is proof that a worse world is already here, as shown by the reasons why Bitcoin deeply disrupts authoritarian regimes. When everything disappears – papers, rights, protections – sometimes only one thing remains: the capacity not to be erased. Bitcoin is not a comfortable solution. It is what remains when nothing else remains.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.