XRP ETFs Bleed Out: $40 Million Flees in Single-Day Rout

Investors hit the eject button on XRP exchange-traded funds in a dramatic one-day selloff.

The Great Unwind

A tidal wave of redemptions washed over the sector, with funds tracking the digital asset hemorrhaging a cool $40 million in assets under management. That's not a trickle—it's a floodgate swinging open.

Sentiment Sours

The mass exodus signals a sharp pivot in institutional and retail sentiment. When ETFs, designed as easy-access vehicles, start leaking this badly, it points to deeper concerns—regulatory overhang, competitive pressure, or just good old-fashioned profit-taking after a run-up. It's the market's version of a vote of no confidence.

Broader Implications

This isn't just an XRP story. Such concentrated outflows act as a canary in the crypto-coal mine, testing the resilience of digital asset investment products during volatility. It separates the hype from the hold. Remember, in traditional finance, they'd call this 'portfolio rebalancing.' In crypto, we call it Tuesday.

The move leaves a stark question hanging: is this a healthy correction or the first crack in the dam? One day's panic doesn't make a trend, but it sure gets everyone's attention. For the true believers, it's a buying opportunity. For the skeptics, it's validation—another reminder that in the quest for decentralized finance, the most traditional force of all, fear, still reigns supreme.

Read us on Google News

Read us on Google News

In brief

- XRP ETFs recorded their first day of net outflows since their launch, with $40.8 million withdrawn on January 7, 2026.

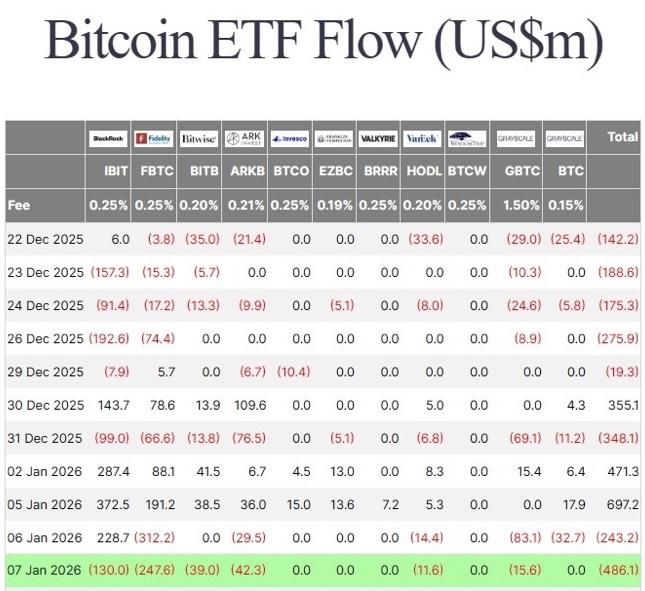

- Bitcoin and Ethereum also experienced massive outflows the same day ($486M and $98M respectively).

- These movements raise questions about the maturity of crypto ETFs: short-term trading tools or long-term investment assets?

Crypto: XRP ETFs record $40.8 million outflows on January 7, 2026

Since their launch in November 2025, XRP ETFs had consecutive 36 days of net inflows, accumulating over $1.3 billion in assets under management. This performance, unprecedented for an asset like XRP, made an impact and strengthened institutional investors’ confidence. Yet, on January 7, 2026, the trend reversed: $40.8 million left these funds, a first since their creation.

This sudden outflow raises questions: is it a simple profit-taking after a 25% rise of XRP at the start of the year, or a strategic rebalancing at the beginning of the fiscal year? One thing is certain, this first net outflow marks a symbolic turning point for XRP ETFs, previously viewed as a stable haven in the volatile crypto universe.

XRP, Bitcoin, Ethereum: What ETF flows reveal about institutional strategies in 2026

Crypto ETF flows in January 2026 show a clear trend. Indeed, after record inflows early in the month ($471 million for Bitcoin on January 2, $174 million for Ethereum), the net outflows on January 7 surprised by their magnitude. Bitcoin ETFs, for example, lost $486 million in one day, while those dedicated to ethereum gave up $98 million. A synchronization with XRP ETF outflows reveals a coordinated approach by institutional investors.

Analysts note that these flows may reflect simple profit-taking after a 2025 marked by strong asset appreciation. However, some also see it as a sign of market maturity, where crypto ETFs are starting to be treated like traditional assets, subject to the same reallocation logic. This situation could make 2026 the most bullish year ever, according to Brad Garlinghouse.

2026: Crypto ETFs between institutional adoption and volatility risks

The flows observed in January 2026 raise a fundamental question: are crypto ETFs becoming short-term trading tools, or are they part of a long-term investment logic? Institutions seem to be using these products more and more for arbitrage or hedging strategies, like traditional ETFs. Yet, their volatility remains much higher, as shown by the sudden outflows on January 7.

For retail investors, these movements raise challenges. On one hand, ETFs offer simplified exposure to cryptos. On the other hand, their sensitivity to institutional flows can amplify market corrections. In 2026, the arrival of new ETFs, like those dedicated to Bittensor, could reshuffle the cards. But one question remains: will these instruments create new speculative bubbles?

XRP, Bitcoin, and Ethereum ETFs crossed a threshold in 2026, with flows reflecting both their growing adoption and sensitivity to market fluctuations. While these net outflows may cause concern, they also show that cryptos are gradually integrating into traditional financial market logics. The question remains whether this institutionalization will enhance their stability… or their volatility.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.