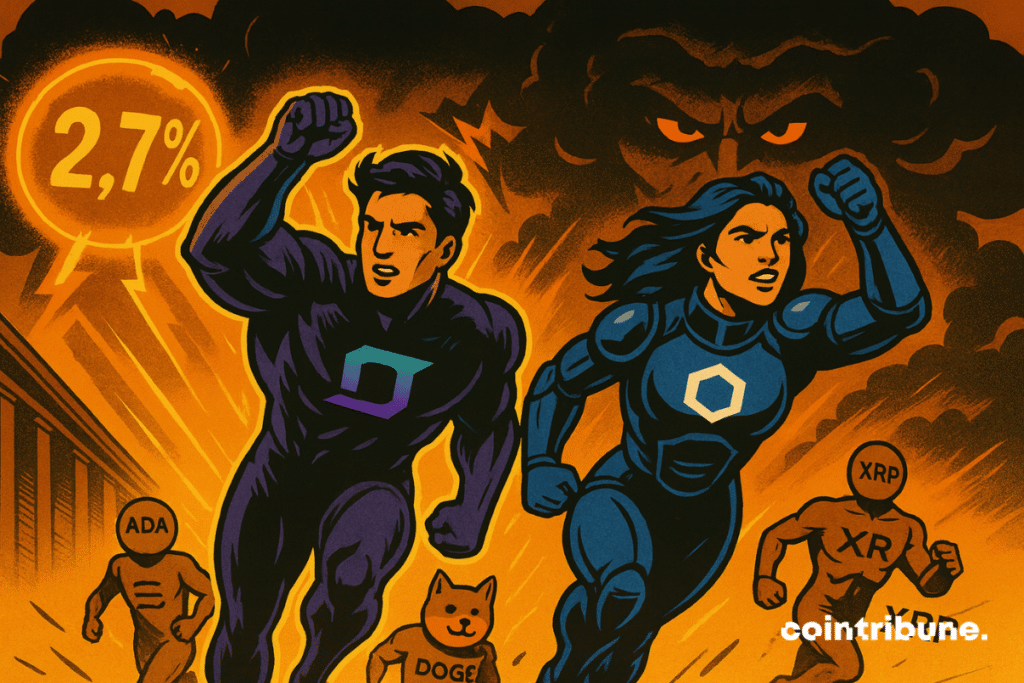

CPI Plunge Ignites Crypto Rally: Solana & Chainlink Lead the Charge

Inflation cools—crypto heats up. As the Consumer Price Index takes a dive, digital assets are stealing the spotlight with a risk-on surge. Solana and Chainlink emerge as frontrunners in this macro-driven momentum play.

The CPI Effect: Crypto's Traditional Market Counterpunch

When fiat economies sneeze, decentralized networks catch a bid. Traders are pivoting from inflationary hedges to blockchain assets with actual utility—for once.

Solana's Scalability Shines

The 'Ethereum killer' is living up to its nickname, processing transactions at speeds that make legacy finance look like dial-up. No wonder institutions are quietly accumulating SOL between martini lunches.

Chainlink's Oracle Gambit Pays Off

Decentralized data feeds are finally having their moment. LINK's real-world integration proves smart contracts aren’t just theoretical—even if Wall Street still doesn’t understand them.

As the Fed’s monetary policy flounders, crypto markets are doing what they do best: capitalizing on traditional finance’s failures. Will this rally have legs? In a world where money printers go brrr—bet on the chains that actually build.

In Brief

- The post-CPI crypto rally is driven by institutional flows and hopes for interest rate cuts.

- The rise of leverage and open interest increases the risk of liquidations on altcoins.

Post-CPI rally: key figures and institutional driver

The inflation surprise fuels the probability of a Fed rate cut as early as September. This stimulates crypto demand. Altcoins follow:

- ADA at $0.85;

- DOGE at $0.23;

- SUI at $3.91;

- XRP at $3.25.

Above all, the market narrative is evolving. It mainly refers to institutional flows driving crypto assets beyond simple retail momentum. This structural change could extend the rally, especially if macroeconomic data confirm the Fed accommodative scenario.

It remains to be seen if the historicalwill repeat as professional appetite dominates. Meanwhile, the crypto asset prices respond strongly to macro signals and Fed announcements.

SOLUSD chart by TradingViewLeverage, open interest and reversal risk

Some crypto analysts point to an aggregated open interest risingin one month on derivatives. This shows not only appetite but also market fragility.

In a reflexive crypto environment, the increase fuels euphoria until the first shock. A simple rally exhaustion or a macro surprise can thus trigger.

For altcoins, more sensitive to leverage, risk discipline becomes key:

- position sizes;

- stops;

- warnings on open interest and spreads…

Indeed, as long as the CPI trajectory and Fed messaging remain favorable, institutional flows support can.

In any case, the post-CPI crypto momentum is real. However, the rise in leverage requires strict risk management. A macro catalyst can reverse the crypto dynamic in a few hours.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.