🚀 40,000 ETH Exodus Daily: Ethereum’s Rocket Fuel for Shattering All-Time Highs

Ethereum's supply crunch just hit overdrive—whales are vacuuming 40,000 ETH off exchanges every 24 hours. This isn't accumulation; it's a full-scale liquidity siege.

The Burn Effect

Scarcity mechanics are kicking in hard. With staking yields still juicy and L2s eating base-layer gas fees, ETH's deflationary spiral just got a nitro boost.

Institutional FOMO

Spot ETF approvals last quarter opened the floodgates—now traditional finance is playing catch-up with crypto-native whales. Guess who's left holding empty bags? The usual hedgies who called it 'digital beanie babies' in 2022.

Price discovery mode activated. The only thing more volatile than ETH's chart right now? A Wall Street analyst trying to justify their outdated 'store of value' thesis.

In Brief

- ETH’s 30-day netflow hits -40K daily, signaling massive exchange outflows and bullish sentiment.

- Ethereum price nears ATH of $4,783.77 after a 60% surge in the past month.

- Spot ETH ETFs attract $1.5 billion in a single weekend, driving institutional adoption.

- Whale activity reaches a monthly high, reinforcing Ethereum’s strong market position.

About 1.2M ETH Pulled from Exchanges Amid Price Surge

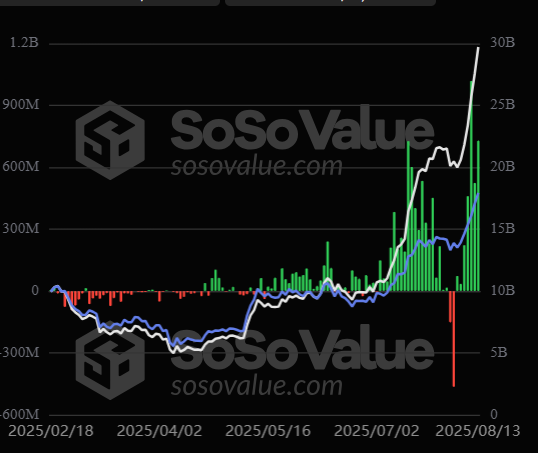

CryptoQuant contributor Burakkesmeci recently revealed that over 1.2 million Ether have left exchanges within the last 30 days. During this period, ethereum surged nearly 60%, breaking strongly above the $4,000 mark, trailing its ATH by just 3%. This northward push coincides with the increased institutional adoption witnessed by the asset.

Burakkesmeci asserted that Ether’s upward momentum could continue, pointing to key ETH price movements. The CryptoQuant contributor also drew attention to Ethereum’s All Exchanges Netflow metric, which measures the total Ether flow across all exchanges.

According to data, Ethereum’s 30-day Simple Moving Average (SMA30) has crashed into the negative zone. For clarity, the SMA30 refers to Ether’s average daily net flows, accessed across 30 days. With each passing day, the trend indicator is updated to the most recent 30-day timeframe, with old data points making way for new ones.

Massive Daily Outflows Push Ether Near Record High

On August 12, the ETH SMA30 was pegged at a negative figure of -40,000 ETH. Generally, such large outflows signal that holders are shifting their ETH stashes away from exchanges. Most times, these coins are moved to cold storage, likely in anticipation of future value appreciation.

Burakkesmeci also highlighted the growth in Ether spot ETFs as a potential driver in the Ethereum price. As spotted by SoSoValue, spot ETH ETFs posted capital inflows exceeding $1.5 billion during the weekend ending on August 12.

Starting May 16, Ethereum investment vehicles attracted over $8 billion, an almost three-month period of positive investment scores. The total net assets held by these investment vehicles are pegged at $27.6 billion, which is about 4.7% of Ether’s total market cap.

ETH Upswing Poised to Continue

Burakkesmeci maintained the upward trend could likely persist, assuming Ether’s SMA30 continues swimming in the negative zone. According to him, the uptrend will only stop when the trend moves into positive territory.

At the time of writing, Ethereum is exchanging hands at $4,700, fueled by recent institutional attention and whale movements.

ETHUSDT chart by TradingViewHere are other key on-chain Ether trends spotted by CoinCodex:

- Ether (ETH) price prediction sentiment is currently bullish.

- The coin is showing a Fear & Greed Index of 75, indicating greed.

- Ether is up 67% over the past year.

- Ethereum has outperformed 66% of the top 100 cryptocurrencies in the last year.

- The coin is trading above the 200-day simple moving average with 20 green days in the past month.

- Ethereum is trading near its cycle high of $4,783.77 and has high market liquidity.

Market expert Ali Martinez noted that whale activities have also touched a monthly high, reinforcing ETH’s position as a top market asset. With the ETH ETFs continuing to attract inflows and the US 401(k)s now allowed to incorporate digital assets, experts are predicting the asset to touch a new all-time high soon.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.