Bitcoin’s Historic Returns Obliterate S&P 500 Performance

Digital gold continues shining while traditional markets play catch-up

The Performance Gap That Keeps Widening

Bitcoin's track record of delivering astronomical returns has consistently left traditional equity markets trailing in its wake. The pioneering cryptocurrency's growth trajectory makes conventional stock market gains appear almost pedestrian by comparison.

Redefining Investment Expectations

While Wall Street analysts debate percentage points, Bitcoin's performance metrics have rewritten the rulebook on what constitutes meaningful returns in modern finance. The asset's volatility comes with rewards that traditional portfolios can only dream of matching.

The New Wealth Creation Paradigm

Investors watching from the sidelines have witnessed a fundamental shift in how wealth accumulates in the digital age. Bitcoin doesn't just outperform traditional assets—it operates in an entirely different league of financial returns.

Traditional finance keeps counting beans while Bitcoin builds empires—proving once again that sometimes the best investment strategy involves ignoring the conventional wisdom altogether.

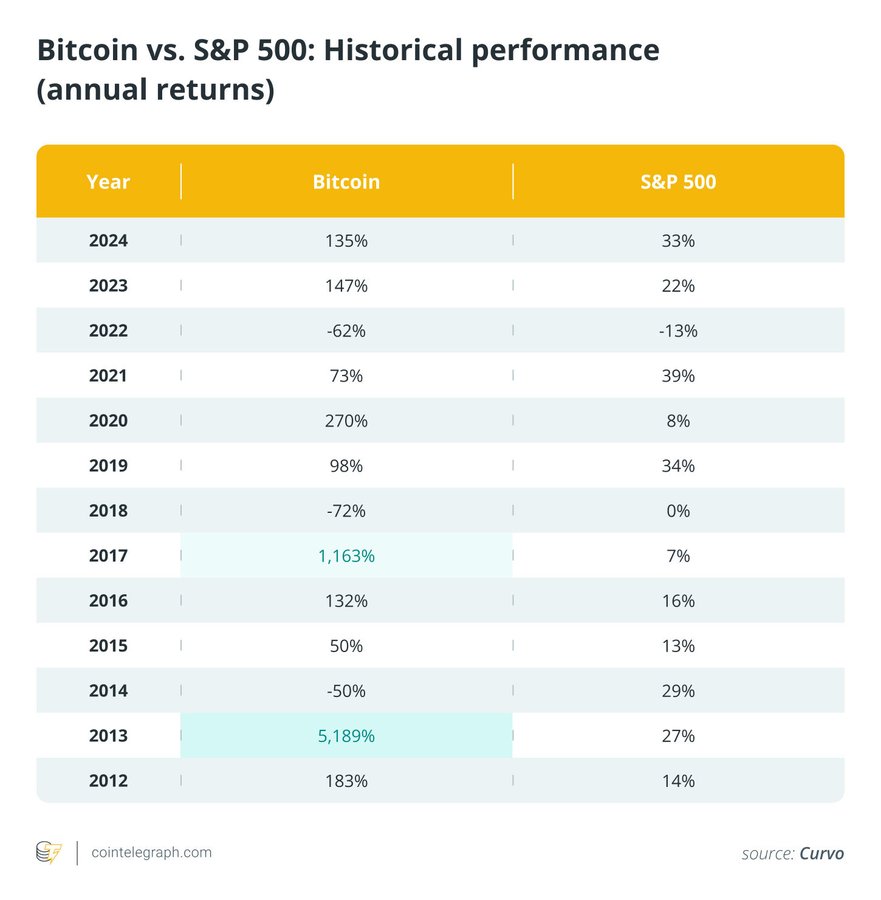

Even more recent cycles show this imbalance: Bitcoin jumped 147% in 2023 and 135% in 2024, while the S&P 500 posted 22% and 33%, respectively.

Yet volatility remains central to Bitcoin’s story. The asset has suffered sharp corrections, including a -72% drawdown in 2018 and a -62% slide in 2022, moments when the S&P 500 held steadier.

READ MORE:

Still, the long-term trajectory strongly favors Bitcoin, making it a standout in the debate over which assets can weather technological and macroeconomic disruptions, including the rise of artificial intelligence.

With institutional adoption accelerating through ETFs, corporate treasuries, and growing regulatory clarity, many analysts argue Bitcoin is solidifying itself as a long-term digital counterpart to gold, albeit with greater upside potential and sharper risks.

![]()