Solana ETFs Shatter Records: 10 Straight Days of Surging Inflows Defy Market Skeptics

Wall Street's latest crypto darling isn't slowing down—Solana ETFs just clocked a blistering 10-day inflow streak that's leaving traditional assets in the dust.

The unexpected rally

While Bitcoin ETFs still dominate headlines, Solana's institutional products are quietly vacuuming up capital like a hedge fund at a tax loophole conference. No flashy announcements, just relentless demand that's outpacing even the most bullish projections.

What's fueling the fire?

Traders are betting big on Solana's speed and scalability advantages—never mind that half these same investors couldn't explain a validator node if their bonus depended on it. The network's post-FTX resilience appears to have finally won over the suits who still think 'gas fees' refer to ExxonMobil.

The cynical take

Let's be real—this could just be the latest case of Wall Street chasing yield like a coked-up intern chasing approval. But for now, the numbers don't lie: Solana's ETF inflows are writing checks the rest of crypto's 'institutional adoption' narrative can't cash.

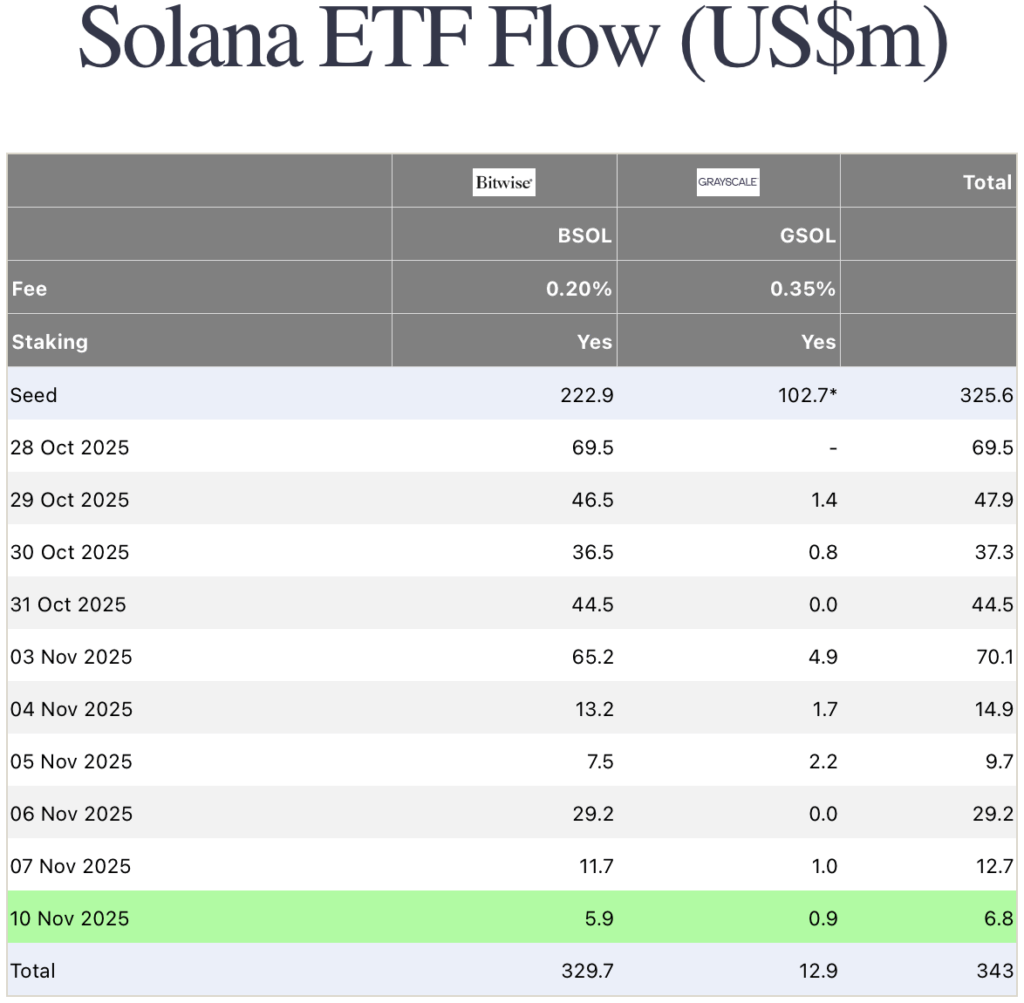

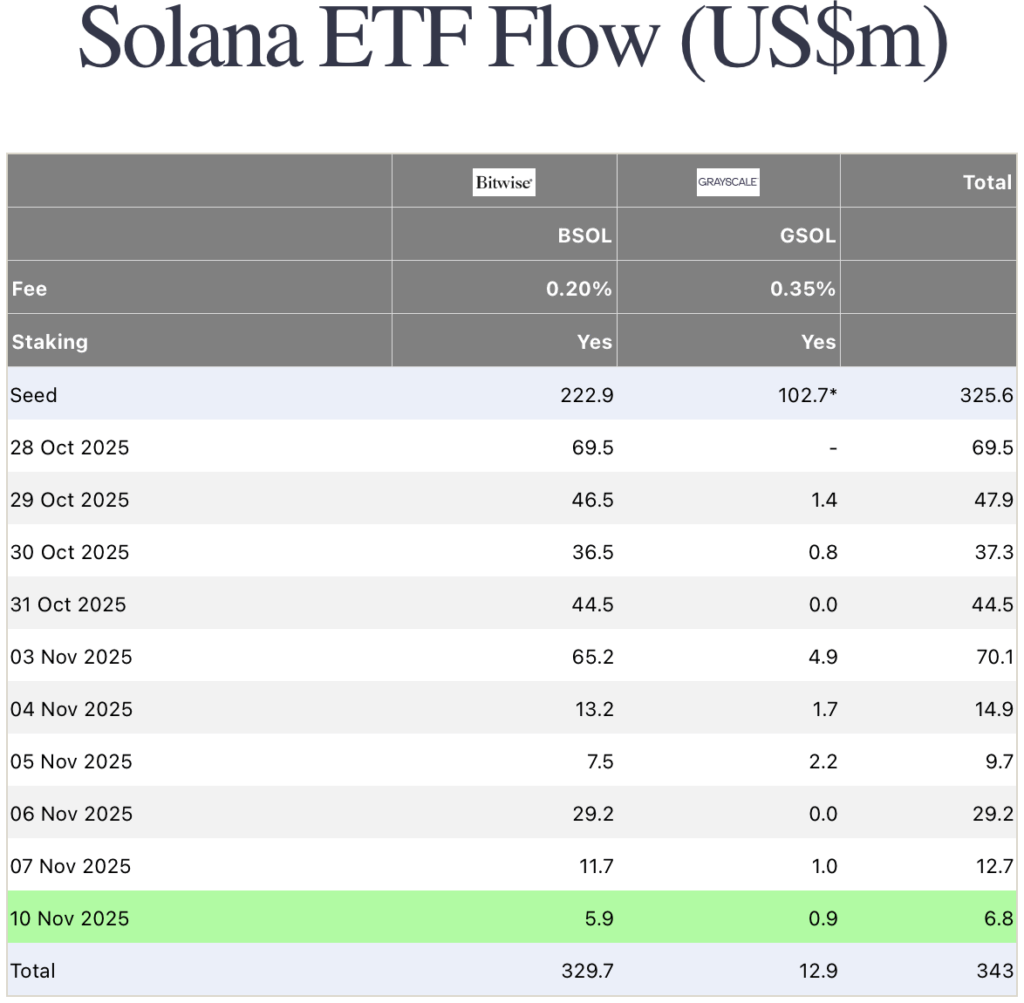

Although Monday’s inflows marked the lowest daily figure since debut, analysts see the trend as a sign of enduring appetite among institutional investors. Nick Ruck, director at LVRG Research, said the results have “significantly outperformed pre-launch expectations,” noting that many had underestimated Solana’s institutional potential due to regulatory and technical skepticism.

The funds even saw daily inflows above $70 million last Wednesday, prompting Bloomberg’s Eric Balchunas to describe the numbers as a “huge sign” of mainstream adoption.

READ MORE:

Ruck added that investors are increasingly treating Solana ETFs as a “high-beta complement” to Bitcoin and ethereum funds – accepting higher volatility in exchange for exposure to Solana’s expanding ecosystem. Sustained inflows, he said, could help tighten supply and provide lasting price support for SOL as altcoin markets mature.

As of Tuesday, Solana’s price dipped 1.85% to $164.24, while spot Bitcoin ETFs recorded $1.15 million in inflows, entirely from Bitwise. Ethereum ETFs saw no net movement, and Canary Capital’s Litecoin ETF added $2.11 million for the day.

![]()