Wall Street’s Bitcoin ETF Frenzy Signals Bullish Revival - $2B Floods In

Institutional money stampedes back into crypto as ETF inflows hit 2025 highs.

Market pulse: The Bitcoin ETF pipeline just exploded with $2.3B weekly inflows - the strongest since the 2024 halving rally. BlackRock and Fidelity dominate 73% of fresh capital.

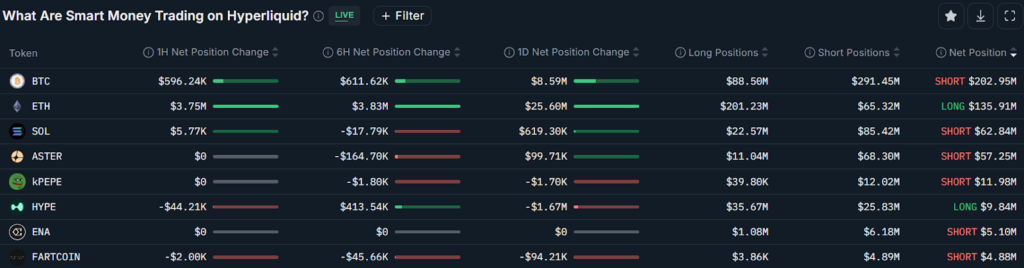

Why it matters: Traders are betting big on SEC approval of options trading for spot Bitcoin ETFs by Q1 2026. The 'smart money' knows what retail still doubts - regulated crypto products are here to stay (and profit).

Bonus jab: Meanwhile, gold ETFs bled $800M last week. Boomer portfolios won't rebalance themselves.

Bitcoin ETFs had suffered persistent outflows since the early-October sell-off, with daily redemptions peaking NEAR $700 million at one point. The new inflows, however, suggest that the worst of the “de-risking phase” may be over.

Meanwhile, ethereum ETFs recorded $107 million in outflows on Tuesday, while Solana products extended their winning streak with another $8 million in positive inflows, underscoring a selective but growing return of risk appetite among digital asset investors.

![]()