Crypto Market Sentiment Shifts to Neutral – Here’s the Bullish Path Forward

Crypto's feverish rally hits the pause button—but don’t mistake calm for capitulation. Neutral sentiment? Just the market catching its breath before the next leg up.

Why the cool-off? Traders locking profits, macro jitters, or just classic crypto volatility doing its thing. Either way, sideways action builds stronger foundations than parabolic spikes.

The bullish case remains intact: Institutional inflows keep climbing, Layer 2 adoption hits new highs, and Bitcoin’s scarcity math hasn’t changed. Remember—neutral is the springboard, not the endpoint.

Watch for catalysts: ETF approvals, Fed pivots, or that one obscure blockchain metric analysts will inevitably overhype. (Bonus cynicism: Wall Street still can’t decide if crypto’s a ‘hedge’ or a ‘risk asset’—so they’ll trade both sides.)

Bottom line? This isn’t 2018. The infrastructure’s built, the players are institutional, and the dips? They’re getting bought. Time to stack, not panic.

1. CMC Fear & Greed stability

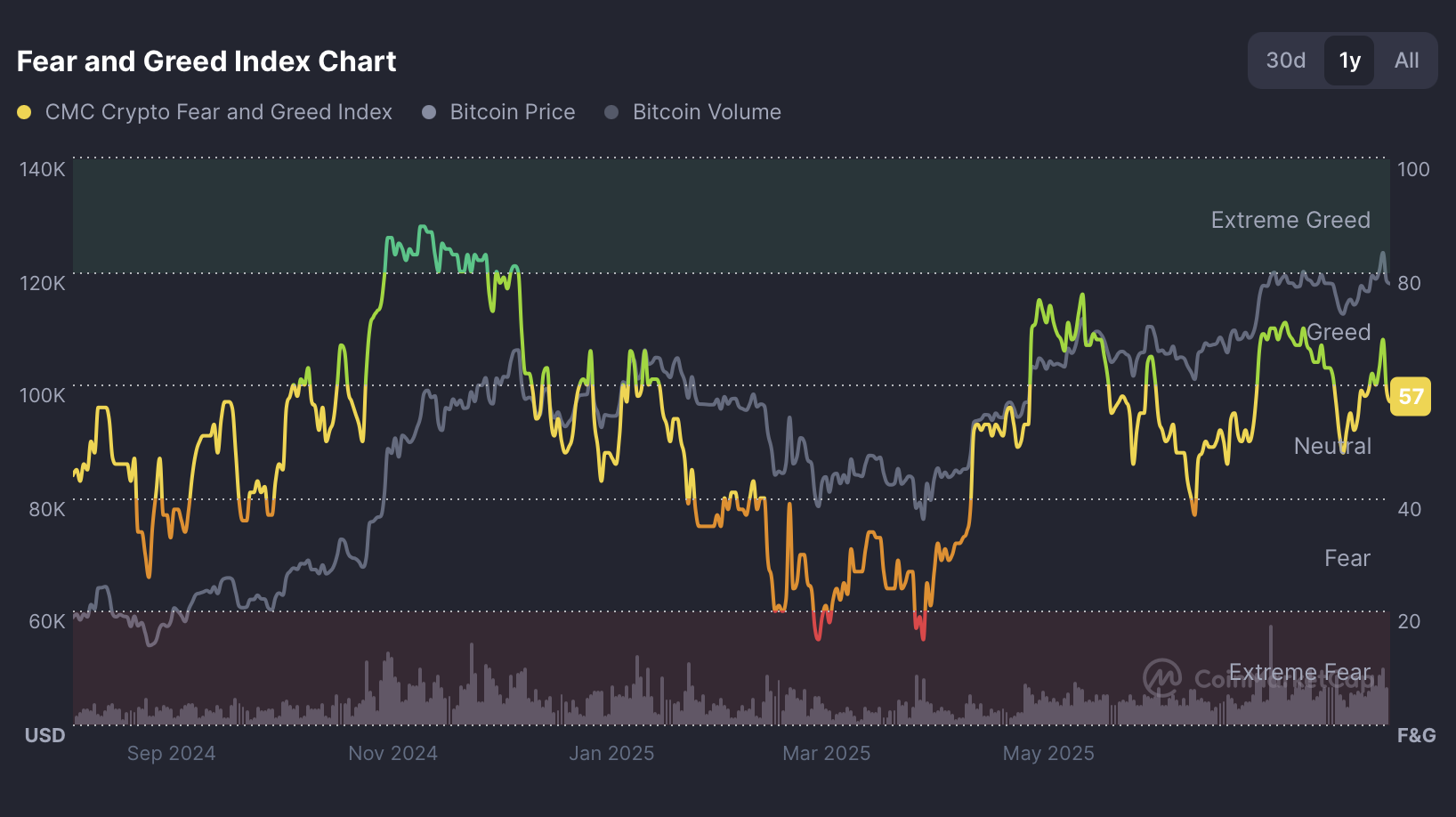

The Fear & Greed Index sits at 57 (Neutral), down 16% from July’s peak. This cooling reflects fading speculation despite Bitcoin’s resilience. Over the last week, the index held steady between 57–58, suggesting traders are waiting for a stronger catalyst after August’s 6.6% rise in total market cap. Neutral readings historically align with sideways price action before decisive moves.

2. Institutional access bullish impact

Institutional flows remain a bright spot. The Fed’s decision to scrap its crypto banking scrutiny program removes a longstanding barrier to traditional finance participation. Meanwhile, Ethereum ETFs recorded $2.31 billion in weekly inflows, underlining growing demand. However, Bitcoin dominance climbed to 59.03%, signaling capital rotation into BTC as risk appetite toward smaller-cap altcoins cools. Together, these moves suggest institutional confidence in crypto’s long-term trajectory even as retail speculation eases.

3. Technical consolidation signals

The total crypto market cap continues to trade above its 30-day EMA at $3.85T, preserving the bullish structure. Still, resistance looms at the $4.04T Fibonacci level (23.6%), with the RSI(14) at 68.17, near overbought conditions. Daily spot volumes dropped sharply by 59% to $446B, underscoring hesitation. Analysts are now watching for a MACD histogram reversal (currently +$5.6B) to confirm whether the next trend points higher or signals a retracement.

READ MORE:

What this means for crypto

For now, the market sits in a neutral zone of balance – institutional support and ETF inflows provide a floor, but fading retail activity and technical resistance cap upside. If bulls can break through the $4T barrier with volume, the next leg higher could carry Bitcoin and Ethereum toward fresh highs. If not, neutral sentiment could harden into consolidation or even a correction. Either way, the coming weeks are likely to set the tone for the remainder of 2025’s crypto cycle.

![]()