BTC Reverses 3.5% Pump Ahead of CPI — Will Inflation Data Ignite Crypto’s Next Rally?

Bitcoin's sudden reversal wipes out gains as markets brace for inflation data—the crypto world holds its breath.

The Pre-CPI Jitters

That 3.5% pump evaporated faster than a meme coin's promises. Bitcoin's price action turned bearish just hours before critical inflation numbers hit the wire. Traders are positioning for volatility, with options markets showing heightened anxiety around today's Consumer Price Index release.

Crypto's Inflation Hedge Narrative Tested

Remember when everyone called Bitcoin 'digital gold'? Today's CPI data will either validate that thesis or send it back to the drawing board. The correlation between traditional markets and crypto remains tighter than Wall Street's grip on bailout funds—proving once again that when traditional finance sneezes, crypto catches a cold.

The 3.5% reversal signals more than just technical resistance—it reveals institutional hesitation ahead of macroeconomic fireworks. Market makers are pulling liquidity, while retail traders scramble for direction. The irony? Most crypto 'investors' can't even explain how CPI calculations work, yet they're betting their portfolios on them.

Will today's numbers trigger the comeback crypto desperately needs? Or will it be another case of 'buy the rumor, sell the news'? One thing's certain: in crypto, the only inflation that's guaranteed is the number of self-proclaimed experts on Twitter.

Historical Pattern Shows Inflation Data Could Trigger a Crypto Comeback

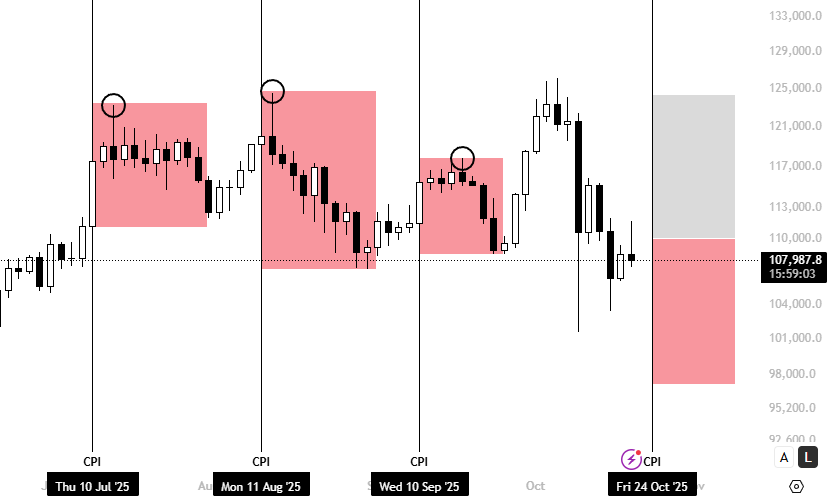

Bitcoin’s recent price action mirrors a recurring pattern.

The last three CPI releases have all coincided with local tops, each following a burst of bullish sentiment.

This has fueled skepticism that another rally ahead of the data could face swift rejection.

However, the setup looks different this time.is entering the CPI week already down over 3.5% in the past seven days, which could make it more sensitive to Fed rate cut relief rallies if inflation surprises to the downside.

examined theand found that each sparked short-term rallies in digital assets.

After the September 2024 cut, Bitcoin rose 6.6% in a week to around $64,300, signaling investors’ welcome of the Fed’s policy pivot.

The November 2024 cut triggered a much stronger move, with BTC up 16% in a week and 32% over the month.

By December 2024, the momentum cooled as bitcoin briefly topped $108,000 before retreating below $100,000.

These reactions suggest that monetary easing still carries strong upside implications for crypto markets, a trend that could reemerge if inflation data softens and the Fed maintains dovish guidance.

Gold’s -8% Drop Could Fuel Bitcoin Rotation

With Gold marking a potential top and risk sentiment subdued, traders are now watching for signs of liquidity rotation back into crypto.

The precious metal extended two-day losses to -8%, erasing over $2.5 trillion in market cap, on track for its largest two-day drop since 2013.

We just witnessed history:

Yesterday, gold prices fell -5.7%, marking the largest 1-day drop since April 2013.

This is a ~4.5 sigma move.

In other words, such a large MOVE only happens in 1 out of 240,000 days in a "normal" world.

What does it mean? Let us explain. pic.twitter.com/7OtAgsPili

Bitcoin bull market fractals show that gold topped in October 2020, and Bitcoin exploded right after.

According to asset manager Bitwise, only 3-4% capital rotation from gold to Bitcoin could push BTC to over $240,000 from current levels.

NVT Golden Cross Says Bull Market Not Over

While many crypto bears are calling for the top and the end of the bull run, the Bitcoin NVT Golden Cross indicator, which measures whether Bitcoin is overvalued or undervalued relative to on-chain network activity, shows that the top is not yet in.

Similarly, since the massive liquidation event on October 10, the crypto market has experienced a real shockwave.

Data from CryptoQuant shows that since January 2025, daily BTC spot volumes on Binance ranged between $3 billion and $5 billion.

However, since October 10, volumes have surged, now up between $5 billion and $10 billion per day.

Spot Market Resurgence After the October 10 Event, Traders Return to Fundamentals

“Historically, market cycles have shown that phases of spot accumulation often precede structural recoveries.” – By @Darkfost_Coc pic.twitter.com/LXe0bamkPa

This acceleration shows a renewed interest in spot trading that could lay the groundwork for a more sustainable bullish recovery.

Technical Analysis: Bitcoin Support Holds at $108K-$112K Zone

On the technical front, Bitcoin’s 3-hour chart shows that the asset has since entered a correction phase, breaking below the 0.5 Fibonacci level and currently testing support NEAR the 0.25 level around $112,000.

The recent price action shows increased volatility with sharp moves in both directions, indicating indecision in the market.

The projected trajectory suggests Bitcoin is trying to find support in the $110,000-$112,000 zone before potentially rebounding toward $117,000.

If Bitcoin can hold above $108,000 and FORM a base, the path of least resistance appears to target the $117,000 level first, with potential to retest the previous highs near $126,000 if bullish momentum returns.

However, a breakdown below $106,000 WOULD invalidate this bullish scenario and could trigger further downside pressure.