Crypto Industry Lost 1,000 Jobs to AI Since ChatGPT Launch - But Hiring Already Bouncing Back: A16z Report

AI automation slashed crypto workforce by thousands - then the sector pivoted hard.

The Great Rehiring Begins

While artificial intelligence wiped out 1,000 cryptocurrency positions following ChatGPT's market debut, hiring trends have already reversed course according to Andreessen Horowitz's latest analysis. The crypto job market proves more resilient than traditional finance sectors - which typically take quarters to recover from technological disruption.

Adapt or Die

Blockchain companies rapidly retooled operations, creating new AI-integrated roles that didn't exist eighteen months ago. The swift recovery demonstrates crypto's inherent advantage: decentralized organizations move faster than legacy financial institutions bogged down by committee decisions and regulatory drag.

Of course, Wall Street analysts will still claim this volatility proves crypto's instability - ignoring that their own quantitative trading desks have been quietly hiring the same displaced developers.

AI Lured Builders Away, But Crypto Recovered Hiring Momentum From Other Industries

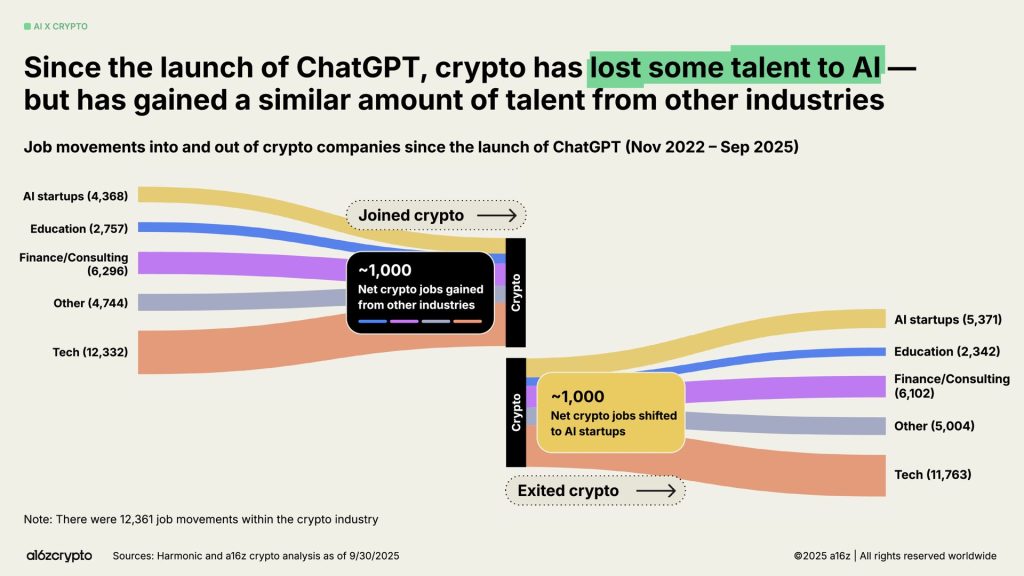

A16z said crypto gained about 1,000 net jobs from other industries even as AI pulled away a similar number of employees.

The largest inflows came from tech firms, which contributed over 12,000 professionals, followed by finance and consulting with around 6,000. Smaller inflows came from education and other sectors.

The shift shows the increasingly intertwined relationship between crypto and AI. Since ChatGPT’s debut, AI has drawn both capital and talent across the tech landscape. Many developers have pivoted to AI projects, while others have found new opportunities in crypto’s resurgent markets.

ChatGPT’s arrival in Nov. 2022 coincided with one of crypto’s darkest periods, marked by the collapse of FTX and a sharp contraction in venture funding. At the time, job losses, declining token prices, and regulatory uncertainty shook the industry’s confidence.

AI Consolidates Power While Crypto Continues To Champion Decentralization: A16z

Today, the landscape looks very different. The global crypto market capitalization has surpassed US$4 trillion, with Bitcoin reaching new record highs this year. The rebound comes amid a friendlier regulatory tone from the Trump administration, which has supported legislation for stablecoins and digital asset oversight. Institutional adoption is also deepening as firms such as JPMorgan, BlackRock, and Fidelity expand their crypto offerings.

A16z’s analysis shows that much of the new hiring in crypto now comes from professionals with finance and fintech backgrounds, reflecting the sector’s gradual convergence with traditional financial systems.

The firm noted that crypto’s talent pipeline is diversifying beyond developers, with growing demand for compliance, infrastructure, and product specialists.

At the same time, AI’s growth has raised questions about centralization and market concentration. The report said OpenAI and Anthropic control 88% of all revenue from AI-native companies, while Amazon, Microsoft, and Google hold 63% of the cloud infrastructure market. NVIDIA continues to dominate hardware with a 94% share of data center GPUs.

This concentration, A16z noted, contrasts sharply with the decentralized ethos of crypto.

Crypto Standards Are Evolving To Let AI Agents Transact And Access Data Without Intermediaries

Blockchains, the firm said, could serve as a counterweight to AI’s centralizing forces by powering open networks, verifiable compute, and transparent data systems.

Emerging crypto standards such as x402 aim to support autonomous AI agents, enabling them to perform microtransactions and access APIs without intermediaries — a market Gartner expects could reach $30 trillion by 2030.

Meanwhile, A16z identified stablecoins as one of the strongest signals of crypto’s maturity. The report found that stablecoins processed about $9 trillion in the past 12 months, an 87% jump from a year earlier. That figure represents more than half of Visa’s annual payments volume and more than five times PayPal’s.

The report said that although AI drew away some of crypto’s early talent, the industry’s rebound and growing presence among major institutions point to a clear return of confidence.