Multichain Liquidators Score Major Victory as New York Court Extends Freeze on Stolen USDC Assets

New York court slams brakes on stolen stablecoin movement—liquidators gain crucial advantage in cross-chain recovery race.

Legal Freeze Tightens Grip

The freeze extension blocks all transfer attempts across multiple blockchain networks. Liquidators now wield enhanced authority to track and recover assets across decentralized protocols—traditional finance's paper-based recovery systems look downright prehistoric by comparison.

Cross-Chain Pursuit Intensifies

Multichain tracking protocols activate across Ethereum, Polygon, and Solana networks. Digital forensics teams deploy sophisticated pattern recognition to trace stolen USDC movements—proving blockchain's transparency cuts both ways for would-be thieves.

Regulatory Winds Shift

The ruling establishes precedent for cross-jurisdictional digital asset recovery. Courts increasingly recognize blockchain evidence as admissible—finally treating crypto crime with the seriousness Wall Street reserves for insider trading investigations.

Another day, another demonstration that while crypto moves at light speed, the long arm of the law eventually catches up—usually right after the Lamborghini purchase but before the private island closing.

Inside the Multichain Case: How Liquidators Win by Freezing USDC

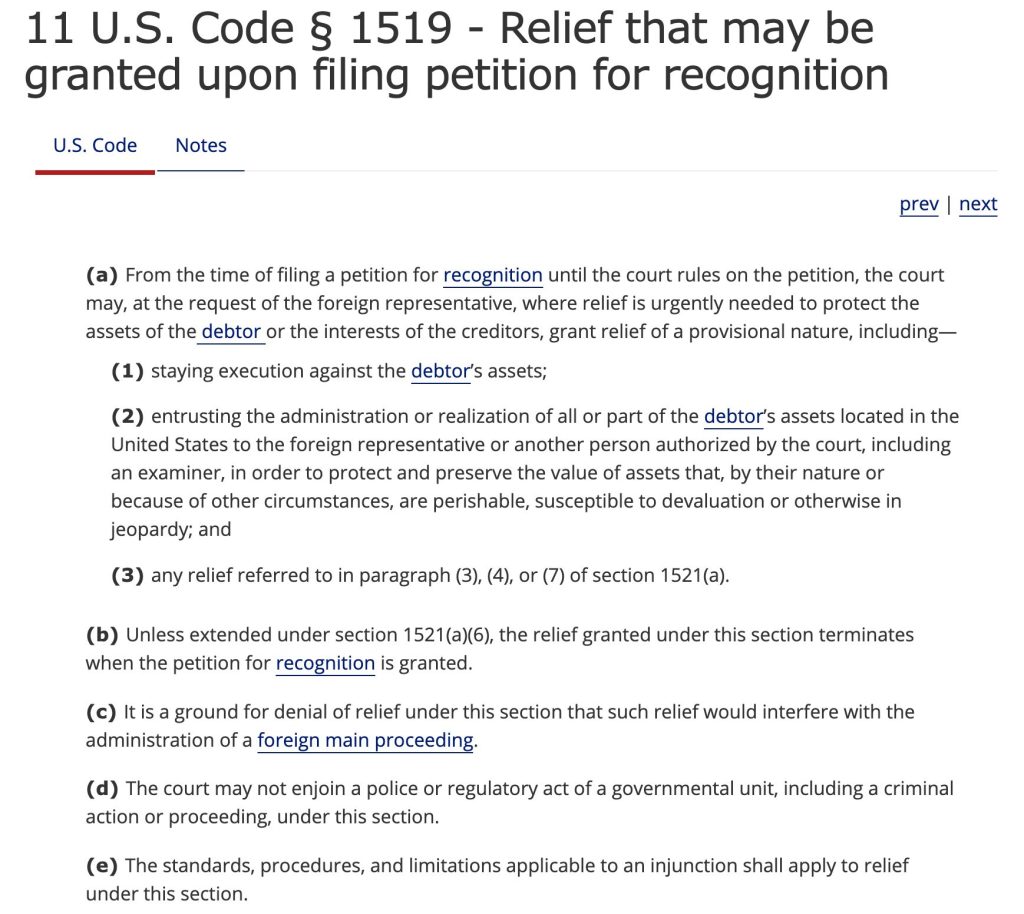

The order, issued under Section 1519 of the U.S. Bankruptcy Code, allows temporary relief before a foreign case receives formal recognition under Chapter 15, the framework that governs cooperation between U.S. courts and foreign insolvency proceedings.

Liquidators appointed in Singapore, from KPMG Services Pte. Ltd., filed for provisional relief on October 23, arguing that lifting Circle’s freeze could cause “immediate and irreparable harm” by allowing stolen assets to MOVE beyond recovery.

The request sought to preserve the funds until the U.S. court determines whether to recognize the Singapore case as a “foreign main proceeding,” a designation that WOULD allow the liquidators to pursue recovery efforts across jurisdictions.

Circle, which issues the U.S. dollar–pegged USDC stablecoin, typically enforces freezes by blacklisting addresses directly through the token’s smart contract, a feature that blocks any transfers involving those wallets.

The company first froze the three hacker-linked addresses in October 2023 at the direction of the U.S. Department of Justice (DOJ), which obtained a seizure warrant shortly after the exploit.

The DOJ later lifted the warrant after failing to identify the hackers, leaving Circle without a legal basis to keep the wallets locked. The latest order restores that authority.

![]()

![]() Multichain Breach Forces Circle to Freeze $63 Million in USDC#USD Coin issuer @circle has frozen $63 million belonging to three wallet addresses associated with the hack of the cross-chain bridge platform Multichain.#CryptoNews #USDChttps://t.co/HCQz1113j6

Multichain Breach Forces Circle to Freeze $63 Million in USDC#USD Coin issuer @circle has frozen $63 million belonging to three wallet addresses associated with the hack of the cross-chain bridge platform Multichain.#CryptoNews #USDChttps://t.co/HCQz1113j6

According to the court filing, the freeze is necessary to prevent competing claims over the same funds. A group of U.S. investors had filed a separate class action lawsuit against Circle in New York State court, seeking control of the stolen USDC.

That case has now been paused following the federal court’s ruling. Circle moved the matter to the Southern District of New York under the Class Action Fairness Act, which allows large, multi-jurisdictional class actions to be heard in federal court.

After the $125M Hack, Multichain Faces Its Final Chapter in Court

The Multichain collapse, one of the most high-profile failures in the decentralized finance sector, stemmed from an exploit discovered in July 2023.

Unidentified attackers drained over $125 million from Multichain’s bridge contracts on Fantom, Moonriver, and Dogechain, transferring funds to unknown addresses.

![]() Multichain Bridge Exploit: Trader’s $280K Becomes $1.9 M Windfall

Multichain Bridge Exploit: Trader’s $280K Becomes $1.9 M Windfall

A wallet address has transformed nearly 1.9 million #Fantom tokens, initially worth $280,000, into $1.9 million after the long-frozen Multichain Bridge momentarily opened.#CryptoNewshttps://t.co/rvcu4Q4FtI

Multichain, formerly known as Anyswap, operated as one of the largest cross-chain bridge protocols, allowing users to move assets across blockchains like Ethereum, BNB Chain, Avalanche, and Polygon.

The platform had a total value locked of about $9.2 billion in early 2022, according to data from DeFiLlama, before its troubles began in mid-2023.

Reports later surfaced that the company’s CEO, known as Zhaojun, had been detained in China, leaving the project in disarray.

Following the hack, affected projects, including the Fantom Foundation, launched legal actions in Singapore. In March 2024, the High Court of Singapore issued a default judgment in Fantom’s favor, finding that Multichain had breached contractual obligations.

![]() The High Court of Singapore has ruled in favor of the Fantom Foundation, ordering the Multichain Foundation to pay $2.1 million.#Singapore #Fantomhttps://t.co/N8phLTwyor

The High Court of Singapore has ruled in favor of the Fantom Foundation, ordering the Multichain Foundation to pay $2.1 million.#Singapore #Fantomhttps://t.co/N8phLTwyor

By May 2025, the same court approved a winding-up order against Multichain Foundation Ltd., appointing KPMG’s Bob Yap Cheng Ghee, Toh Ai Ling, and Tan Yen Chiaw as joint liquidators to oversee asset recovery and dissolution.

The frozen $63 million in USDC represents a portion of the total $210 million stolen from Multichain. The liquidators are seeking to recover these assets as part of the broader winding-up process.

In their U.S. filing, they described the New York court’s provisional relief as “an effective mechanism to implement Chapter 15’s policies of promoting cooperation between courts of the United States and foreign courts involved in cross-border restructuring cases.”