Crypto Apps Outearn Their Blockchains: The Shifting Power Dynamics of Web3

Move over, miners—app developers are now raking in bigger stacks than the chains they're built on.

Layer-2s and dApps eat the base layer's lunch

The numbers don't lie: Frontend interfaces are vacuuming up fees that used to flow to validators. Whether it's DeFi yield optimizers or NFT marketplaces, the value capture has flipped—just like Wall Street always finding new ways to skim cream.

Smart contracts get rich while blockchains play infrastructure

Ethereum might settle the transactions, but it's the apps that users actually touch—and pay for. The irony? Most chains still price gas in their native token while apps count profits in stablecoins.

Closing thought: Maybe Satoshi should've built a better UI instead of worrying about Byzantine generals.

Crypto Apps Went From $0 to $724M Faster Than Blockchains

PumpFun, for instance, collected $724 million in fees over the past year, more than the solana blockchain itself.

Hyperliquid brought in $667 million.

Meanwhile, Solana, one of the most valuable major L1s hosting most revenue-generating consumer apps, recorded $2.8 billion in annual revenue and $632 million in fees.

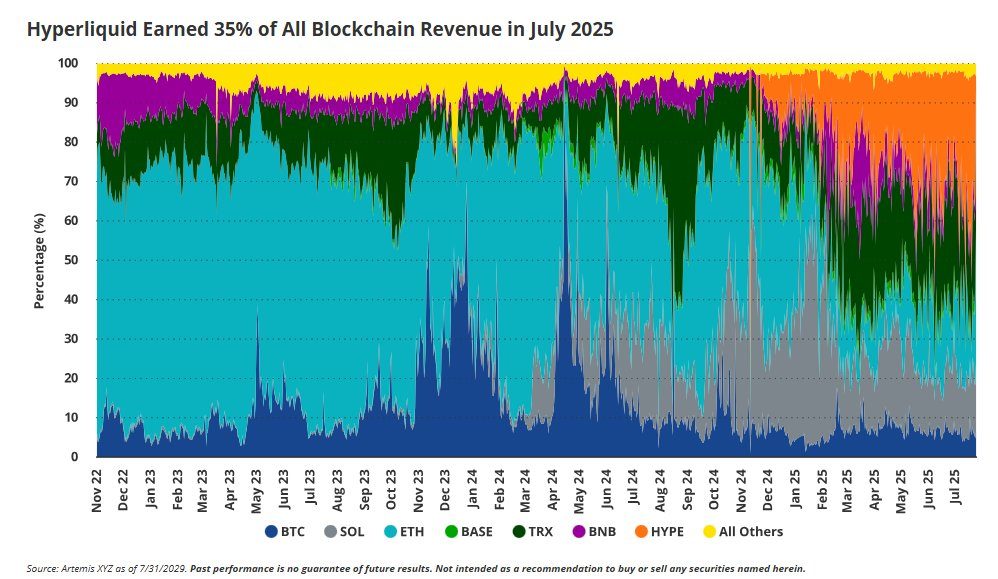

Hyperliquid alone captured 35% of all blockchain revenue in July, despite launching just one year ago.

Delphi Capital’s research also highlights how the stablecoin boom has created enormous value, making stablecoin issuers among the most profitable companies globally.

Tether, the issuer of USDT, is projected to earn $15 billion in profit this year with a 99% profit margin, collecting roughly $23 million daily in fees.

This makes it the most profitable company in the world per employee, surpassing tech and banking giants like Apple, Meta, Goldman Sachs, and Nvidia.

Blockchain Value Capture Problem And Revenue Velocity

Crypto revenue velocity has accelerated as the ecosystem evolved from protocols to applications that scale trading, attention, and market volatility monetization.

During the DeFi Protocol Era, crypto companies generated revenue quickly.

Early protocols like Maker and Aave hit $100 million in cumulative revenue within a few years of monetizing.

The DeFi Terminal Era saw trading terminals accelerate revenue generation by offering convenience and better discovery for traders.

Then came DeFi Attention Scalers, apps like Pump, Axiom, Hyperliquid, and now Aster, which monetized attention more efficiently through rapid product iteration.

These platforms expanded across spot, perps, leverage, yield, new market contracts, discovery tools, and social features.

The goal for most crypto apps now is to provide the best product for trading attention and market volatility.

The old protocol framework assumed chains WOULD capture value proportional to the activity built on them.

Ethereum-based protocols like Uniswap and Aave struggled to capture the value they created for their host chain. But the actual economics are flowing elsewhere.

This L1 premium could continue eroding until chains internalize more value moving through their ecosystems.

Vitalik’s Solution: “DeFi Can Be Ethereum’s Google Search”

Ethereum co-founder Vitalik Buterin raised this same issue in September, noting that one of the persistent tensions within the ethereum community has been balancing applications that generate enough revenue to economically sustain the ecosystem.

Whether by supporting ETH’s value or funding individual projects, against applications that fulfill the underlying goals that originally drew people to Ethereum.

In a blog post titled “Buterin compared low-risk DeFi to Google Search, calling it a potential revenue anchor that could fund Ethereum’s broader ecosystem, much like ad revenue from Search supports Google’s other ventures.

The model, he argues, would allow Ethereum to maintain economic strength while preserving its cultural values through non-financial apps.

![]() Ethereum co-founder @VitalikButerin believes the network’s long-term sustainability may depend on an unlikely hero — low-risk DeFi protocols.#Ethereum #Buterinhttps://t.co/zte7GmHoaw

Ethereum co-founder @VitalikButerin believes the network’s long-term sustainability may depend on an unlikely hero — low-risk DeFi protocols.#Ethereum #Buterinhttps://t.co/zte7GmHoaw

“The revenue generator does not have to be the most revolutionary or exciting application of Ethereum,” Buterin wrote.

“But it does need to be something that is at least not actively unethical or embarrassing.”

Buterin pointed to Aave’s stablecoin lending rates as a concrete example where blue-chip stablecoins like USDT and USDC generate yield around 5%, while higher-risk assets offer over 10%.

These returns, he suggests, could provide a reliable base LAYER of income without compromising the ecosystem’s principles.