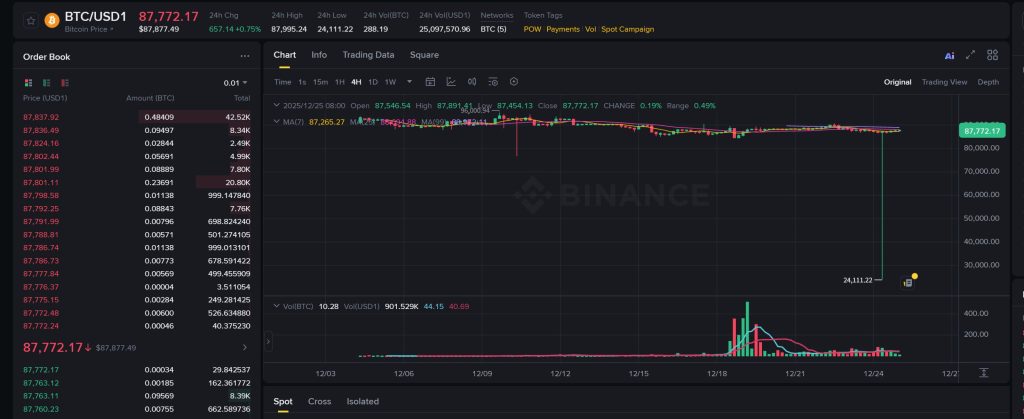

Bitcoin Plunges to $24K in Flash Crash on Binance USD1 Pair – What’s Next?

Bitcoin just took a nosedive. A sudden, violent flash crash on Binance's USD1 trading pair sent the king of crypto tumbling toward the $24,000 mark. It's a stark reminder that in digital asset markets, stability is often just an illusion.

The Anatomy of a Flash Crash

These events aren't your typical slow bleed. They're algorithmic, high-velocity sell-offs that can wipe out millions in liquidity in seconds. The trigger? Could be a large sell order, a cascade of liquidations, or just pure market sentiment flipping on a dime. On a major pair like USD1, the shockwaves are felt across the entire ecosystem.

Why This Matters Beyond the Chart

A sharp move to $24K isn't just a number. It tests leverage, breaks support levels that traders religiously watch, and shakes the confidence of newcomers who thought crypto winter was over. For the pros, it's a liquidity event—a chance to buy the dip if your nerves are steel. For everyone else, it's a heart-stopping reminder of the asset's volatility.

Navigating the Aftermath

Markets don't crash in a vacuum. Watch for follow-through selling, check stablecoin dominance for signs of flight to safety, and monitor funding rates. Sometimes the bounce is vicious, too—dead cat or new rally? Only the tape tells the truth. Just remember, in crypto, the 'efficient market hypothesis' often takes a coffee break when you need it most.

Final Thought: A cynical take? Wall Street spends billions on risk models, yet a decentralized asset on a 24/7 market can still humble the smartest money in the room. Maybe that's the point.

Source: Binance

Source: Binance

This type of “flash wicks” occurs when liquidity thins and order books lose depth. The BTC/USDT trading pair has remained stable after resuming.

Bitcoin Flash Wicks and Quick Reversal

During non-peak trading hours, when market makers often pull back, large buy/sell orders could sweep through multiple empty levels. This scenario creates a dramatic spike that looks like a market breakout.

Further, the instant reversal of the wick shows that no broader market MOVE supported the spike.

“Many spot investors find themselves in a similar position to where they were before the flash crash,” Nic Puckrin, crypto analyst and co-founder of The Coin Bureau, told Cryptonews.

“This is certainly an argument against excessive leverage in a market with fluctuating liquidity in such an uncertain geopolitical climate.”

Additionally, temporary pricing issues can also trigger such dislocations. These price fluctuations are often created by faulty quotes or reactions from trading bots.

Experts often emphasize that real rallies require sustained buying pressure and rising volume. In this case, trading volume remained low, and the price quickly returned to its previous level.

BTC Price Remains Bearish – What is the Next Directional Move?

Bitcoin rose 0.89% to $87,693.65 over the past 24 hours, outpacing the broader crypto market (+0.83%). The crypto is down sharply from its October peakabove $126,000. The largest digital asset is trading at $87,773 at press time, per CoinMarketCap data.

According to analysts, Bitcoin is currently consolidating within a descending “triangle pattern,” trading below the 21MA, which serves as a resistance barrier. A definitive breakout or breakdown would confirm the next directional move.