2025: The Year Crypto Derivatives Go Institutional as CME Overtakes Binance

The old guard just took the keys. The Chicago Mercantile Exchange (CME) has officially surpassed Binance in crypto derivatives volume, marking a seismic shift from retail playground to institutional proving ground.

Regulation Wins the Day

Forget memecoins and leverage-hungry day traders. The real money—pension funds, asset managers, sovereign wealth—demands regulatory clarity. They got it. A wave of global frameworks finally provided the guardrails Wall Street needed to dive in. CME, with its century of trust and ironclad compliance, became the default on-ramp.

Trust Trumps Everything

Institutions don't gamble on unproven tech or opaque balance sheets. They buy certainty. CME offers just that: a regulated, audited, and familiar environment. The move signals that crypto's value is no longer just in decentralization, but in its ability to integrate with—and ultimately transform—the legacy system it once mocked. A neat trick, if you can pull it off.

The New Playing Field

This isn't just a volume milestone; it's a change in the game's very nature. The products that matter now are institutional-grade: longer-dated options, complex structured products, and physically-settled futures that hedge real-world treasury exposure. The volatility is being packaged, priced, and sold to the most risk-averse entities on the planet. The ultimate irony? Crypto's wildest asset class is becoming just another line item in a pension fund's quarterly report.

The era of cowboy capitalism is over. Welcome to the era of the suit.

Institutional Capital Reshapes Market Leadership

One of the most important shifts in 2025 was the consolidation of institutional influence across derivatives venues. The end of year report states that demand for hedging, basis trading and risk-managed exposure has migrated toward regulated exchange-traded products, notes CoinGlass.

This has strengthened the role of the Chicago-based futures market with CME Group securing its leadership in Bitcoin futures after overtaking Binance in open interest in 2024.

By 2025 the CME also narrowed the gap with Binance in ethereum derivatives showing growing institutional participation beyond Bitcoin. At the same time leading crypto-native exchanges such as OKX, Bybit, and Bitget retaining a substantial market share.

Merry Christmas!![]()

CoinGlass 2025 Crypto Derivatives Market Annual Reporthttps://t.co/WJ6wUNU8Hc

Rising Complexity and Systemic Risk

CoinGlass notes that extreme market events in 2025 also stress-tested margin frameworks, liquidation mechanisms and cross-platform risk transmission pathways at an unprecedented scale.

Importantly these shocks no longer remained confined to individual assets or exchanges showing the growing interconnectedness of the derivatives ecosystem.

Fragility has prompted renewed scrutiny of risk controls, particularly given the concentration of open interest and user assets among a small number of dominant platforms.

Macro Liquidity and High-Beta Behavior

From a macro perspective CoinGlass says Bitcoin continued to behave less like an inflation hedge and more like a high-beta risk asset. During the 2024–2025 easing cycle BTC surged from roughly $40,000 to $126,000, largely reflecting Leveraged exposure to global liquidity expansion rather than independent value discovery.

When liquidity expectations shifted in late 2025, the pullback reinforced Bitcoin’s sensitivity to central bank policy and geopolitical uncertainty.

These dynamics created fertile ground for derivatives trading, as volatility linked to U.S.–China trade tensions shifting Federal Reserve policy, and Japan’s monetary normalization generated sustained opportunities for hedging and speculative strategies.

On-Chain Derivatives and the Regulatory Backdrop

Another defining theme of 2025 was the transition of decentralized derivatives from experimentation to genuine market competition.

High-performance application chains and intent-centric architectures enabled on-chain platforms to rival centralized exchanges in specific niches, particularly censorship-resistant trading and composable strategies.

Regulation evolved in parallel. The United States moved toward legislative clarity as the European Union reinforced consumer protection under MiCA and MiFID while jurisdictions such as Hong Kong, Singapore and the UAE positioned themselves as compliant hubs.

Together these developments point toward gradual convergence under the principle of “same activity, same risk, same regulation.”

A New Phase for Crypto Derivatives

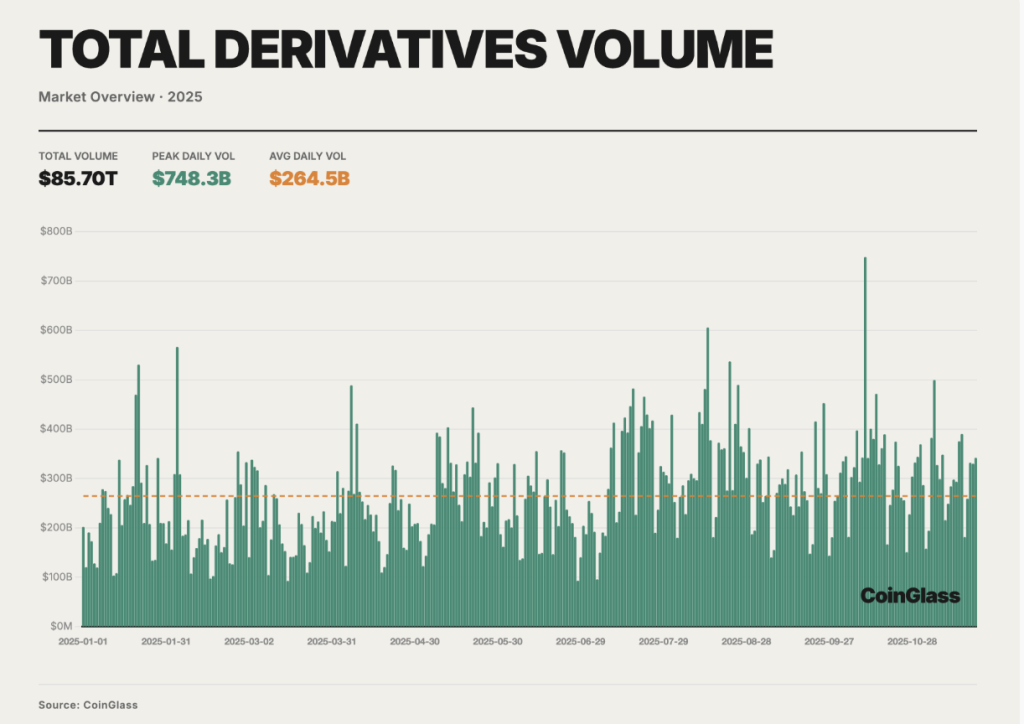

Taken together, 2025 marked the point at which crypto derivatives became a central pillar of global digital finance rather than a peripheral speculative market.

Institutional dominance, regulatory integration and on-chain innovation are now reshaping how risk is priced, transferred and managed—setting the stage for an even more complex derivatives landscape ahead, reports CoinGlass.