Bitcoin Price at Risk of Deeper Reset? Whale Activity Signals Caution | 2025 Analysis

Bitcoin's bull run hits a wall of whale skepticism. Are the big players preparing to dump?

Whale wallets aren't accumulating—they're distributing. On-chain data shows a clear shift from 'HODL' to strategic profit-taking at key resistance levels. This isn't panic selling; it's calculated de-risking by investors who move markets.

The Institutional Chill

Grayscale outflows tell half the story. The real signal comes from OTC desk activity—large block trades are getting harder to place without moving the price. When whales struggle to exit quietly, retail often pays the loud price later.

Technical Breakdown

Key support levels that held through 2024's rally are now being tested with unusual volume. Each bounce grows weaker. The pattern suggests distribution, not accumulation—a classic sign that smart money is rotating out while narratives still sound bullish.

Narrative vs. Reality

ETF approvals created artificial demand spikes. Now that the paperwork novelty has worn off, underlying liquidity issues resurface. Turns out financialization doesn't magically create buyers—it just gives whales better exit ramps.

Bottom Line: Watch the wallets, not the headlines. When whales telegraph caution through on-chain movements, it's time to question the rally's durability. The 'greater fool' theory works until the biggest fools become the smartest sellers.

Hot Wallets Are the Main Destination for Large BTC Transfers

The analysis shows that around 65% of BTC across these groups was transferred to hot wallets, primarily exchanges. This was the most common destination.

Such transfers are usually seen as a preparatory step before selling. However, they do not imply immediate liquidation. Sales may happen later or may not happen at all. Even so, this type of activity often increases caution in the market and influences expectations.

The second most common category was internal transfers. These include bitcoin moved from one cold wallet to another or to unlabelled addresses. The purpose of these transactions is harder to interpret. In some cases, they may reflect rebalancing, changes in custody structure, or preparation for over-the-counter deals. In current market conditions, these movements can also amplify uncertainty, especially when large BTC volumes regularly move between addresses without a clear explanation.

November Marked the Peak in Large Outflows During Bitcoin Price Weakness

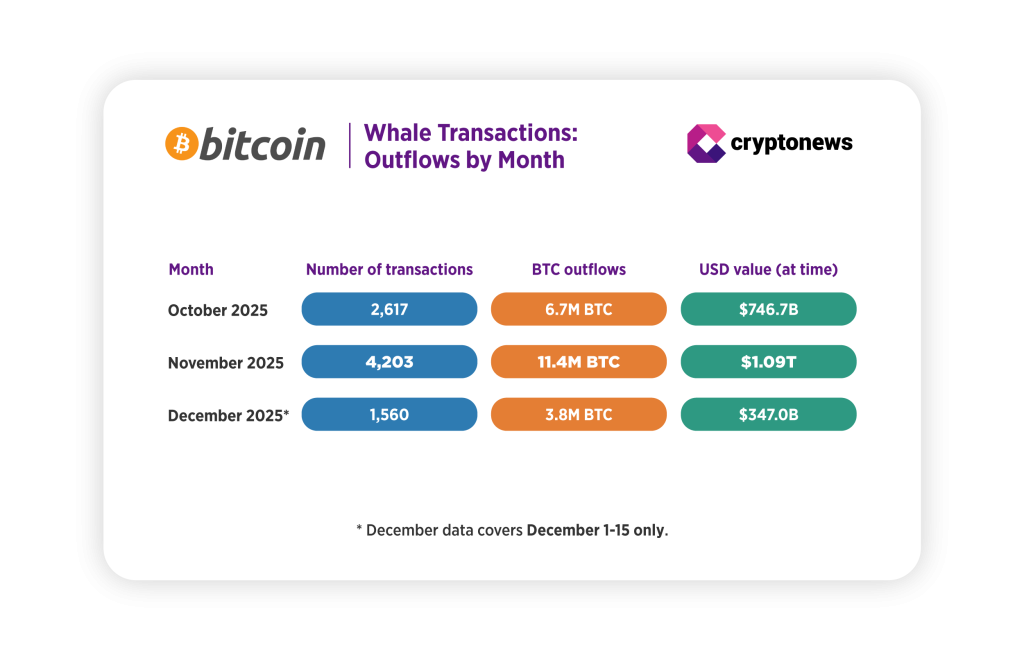

Across all three groups, Bitcoin whales as well as flows linked to BlackRock and Wintermute, activity peaked in November. This occurred after the October 10 sell-off and coincided with Bitcoin trading below $85,000, a period marked by elevated uncertainty.

The trend was most pronounced among Bitcoin whales. In November, their transaction volumes reached the highest levels both in the number of transfers and total BTC moved. Around 11.4 million BTC in outgoing transfers were recorded during the month. At prevailing prices, this represented more than $1 trillion in value. These figures were well above October levels and higher than activity seen in early December, when volumes began to decline.

Institutional flows showed a similar pattern. Bitcoin outflows linked to BlackRock also peaked in November. Estimates suggest around $1.3 billion worth of BTC was moved during the month, making it the most active period for this group in the analyzed timeframe.

Wintermute, one of the largest crypto market makers, also recorded its highest monthly volume of outgoing transfers during November. Given Wintermute’s role in providing liquidity, this increase likely reflects intensified trading activity and fund reallocation amid heightened volatility.

The fact that all three groups peaked at roughly the same time points to a broader redistribution of liquidity during a price correction rather than coordinated action by a single market participant.

Why Are They Doing This?

The rising share of BTC transfers to exchange wallets naturally raises questions. While these moves are often interpreted as preparation for selling, they do not automatically mean large players are ready to exit their positions.

During the correction, some market participants have suggested that falling prices could be used to test the resilience of major Bitcoin holders or even to trigger redistribution between them.

When bitcoin price comes under prolonged pressure, large and highly visible corporate holders like Strategy inevitably draw closer scrutiny. The company is among the largest corporate Bitcoin holders and is closely associated with a strong long-term BTC thesis. This raises a logical question: could price pressure be a way to test how resilient such positions really are, and what would happen if one of the largest public holders changed its stance?

According to experts, drawing direct conclusions is premature.,, says Cryptonews that it WOULD be an oversimplification to single out one company as a key driver of Bitcoin price movements:

It’s hard to single out a private entity as a reason why BTC is going up or down. BlackRock, for example, holds more Bitcoin than Strategy, not to mention various governments. Strategy is a very visible holder, but overall BTC ownership remains sufficiently distributed, meaning one private company should not be able to MOVE the market on its own.

Even so, the idea of a “stress test” for corporate holders is increasingly discussed in the context of current market dynamics.

Dobrovitsky argues the market is not there yet:

Not yet. There is still enough distribution in Bitcoin holdings for price moves to be fully indicative of pressure on a specific corporate holder. What we are seeing instead is a broader downturn across tech markets. Jobs are scarcer, venture capital funding has declined, and there are fewer sectors delivering outsized returns, both for retail and institutional investors.

From this perspective, Bitcoin price decline appears more like part of a wider cooling in risk assets than targeted pressure on specific players.

That said, Michael Saylor’s role remains an important part of the market narrative, even if it is not decisive. “Positive sentiment around Saylor and Strategy certainly helps Bitcoin,” Dobrovitsky adds. “But it shouldn’t be viewed as the be-all and end-all when it comes to BTC price dynamics.”

Conclusion

Depending on interpretation, this activity can be explained in different ways. On one hand, the rise in BTC transfers to exchanges and the increase in internal movements may reflect a broader market cooldown and standard risk reallocation during a price correction and weaker macro conditions. On the other hand, some participants believe falling prices may act as a stress test for the largest Bitcoin holders, including corporate players like Strategy, whose commitment to BTC has become part of the market narrative.

At the same time, on-chain data does not point to targeted pressure on any single participant. Both explanations remain within the realm of market expectations rather than confirmed scenarios.

Disclaimer: crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.