Bitcoin’s $94K Rally Hinges on One Missing Ingredient: Real Volume, Warns QCP

Bitcoin's price chart whispers of a breakout, but the market's pulse tells a different story.

The Missing Fuel

Analysts at QCP Capital see a path for Bitcoin to surge past the $94,000 mark—a target that would shatter previous records. The blueprint is there, etched in bullish technical patterns and optimistic derivatives data. Yet the firm issues a stark caveat: this rocket needs real volume to ignite. Current trading activity, they argue, lacks the conviction and capital inflow necessary to sustain a genuine, historic rally. It's all potential energy with no kinetic follow-through.

Ghosts in the Trading Machine

The discrepancy highlights a modern market paradox. Algorithmic trading and low-fee arbitrage can create the illusion of activity—noise that looks like signal on a superficial chart. QCP's analysis cuts through that fog, demanding evidence of organic, high-conviction buying from major institutions and long-term holders. Without it, any move toward $94k risks being a fleeting pump, the kind that leaves retail traders holding the bag while the whales quietly exit.

So, will Bitcoin make its run? The architecture for a mega-rally is drafted, but the builders—the real money—haven't shown up to the site. It's another reminder that in crypto, the most important number isn't always on the price ticker; sometimes, it's the one measuring who's actually willing to put their capital where their Twitter hype is.

Gamma Risk Builds Above $94K as Dealers Flip Short

Post-expiry positioning has shifted meaningfully following Friday’s record options expiry.

BTC perpetual funding on Deribit surged from near-flat levels to above 30%, signaling dealers who were previously long gamma ahead of expiry are now positioned short gamma to the upside.

“As prices rise, these participants are required to buy spot BTC or near-dated Call options to hedge, creating a feedback loop,” QCP said in its note.

The firm observed this dynamic when bitcoin briefly breached $90,000, triggering aggressive buying in perpetuals and the BTC-2JAN26-94K call.

QCP emphasized that a sustained move above $94,000 could amplify this gamma-driven squeeze in the coming sessions.

However, downside hedging has eased after the large December 85K put was not rolled, pointing to reduced near-term demand for protection despite ongoing spot ETF outflows and persistent selling pressure during US hours.

The 86K level has remained resilient throughout recent weakness, providing technical support even as institutional outflows continued.

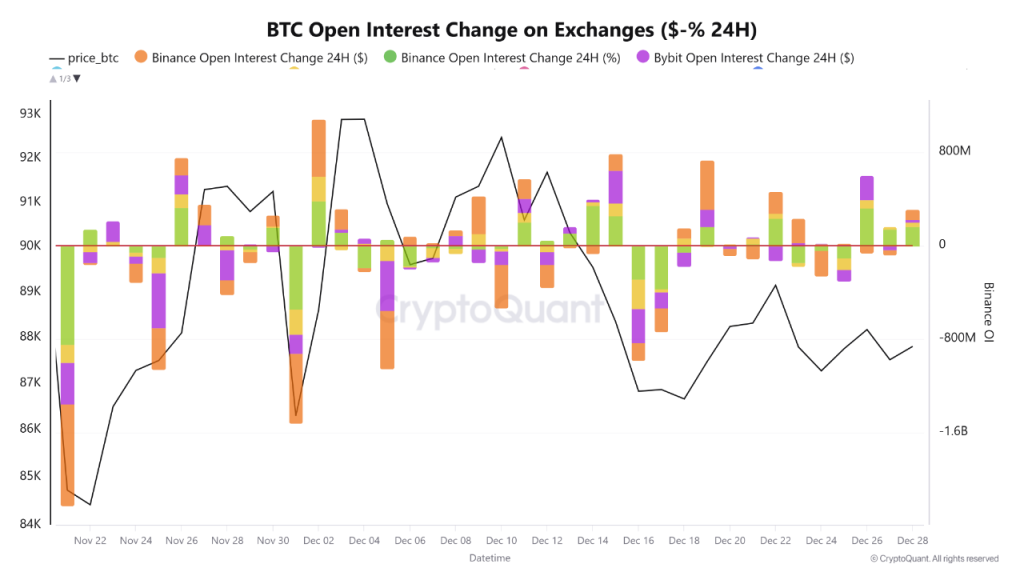

Leverage Builds Despite Fear as $2.4B Added in December

While QCP highlights weak conviction, CryptoQuant analyst data reveals that traders added $2.4 billion in leverage throughout December despite a 40% collapse in activity.

Combined Bitcoin and ethereum futures rose from $35 billion to $38 billion, marking a 7% expansion in leverage amid markets’ expectations of capitulation.

“Bitcoin open interest increased one billion from twenty-two to twenty-three billion. Ethereum added one point four billion climbing from thirteen to fifteen billion,” the analyst wrote.

This happened while Bitcoin’s price stayed near $88,000 and the Fear Index registered 27, suggesting stubborn Optimism persists rather than the despair typically required for a final washout.

The last seven days alone added $450 million in new leverage, with Bitcoin positions growing 2% weekly as traders opened new positions betting on recovery rather than exiting during weakness.

According to the analyst, Binance, Bybit, OKX, and Gate.io all showed steady accumulation, maintaining or growing positions rather than clearing risk during December’s decline.

The analyst warned that this contradicts typical capitulation signals.

“True bottoms form when leverage clears, not builds,” the analyst noted, highlighting that funding stayed positive as traders paid for longs even as whales withdrew 20,000 Bitcoin and professional money exited while retail Leveraged up.

Capital Sidelined as Markets Trade Without Direction

QCP cautioned it may be premature to draw firm conclusions from options positioning alone, noting that open interest dropped roughly 50% following Friday’s expiry.

“This capital may ultimately be reallocated into other asset classes or redeployed across options, spot, or perpetuals, a process that could reintroduce volatility once positioning rebuilds,” the firm said.

The current environment shows Bitcoin holding resilient above $86,000 despite headwinds, while long-term holders recorded just 2,700 BTC in daily sell volume two days ago, the lowest so far in 2025.

Meanwhile, Bitcoin has delivered a 27,701% gain since January 2015, vastly outperforming gold’s 283% and silver’s 405% appreciation during the same period, according to analyst Adam Livingston.

Bitcoin vs. Silver vs. Gold since January 1st, 2015:

Silver: 405%

Gold: 283%

Bitcoin: 27,701%

Even ignoring the first 6 years of Bitcoin's existence for the crybabies who whine about the timeframe comparison…

…gold and silver drastically underperform the APEX ASSET.… pic.twitter.com/vdAnatqRKG

Notably, Coinbase CEO Brian Armstrong recently said Bitcoin plays a constructive role by applying pressure on US policymakers to maintain fiscal discipline.

“Bitcoin provides a check and balance on the dollar,” he told the Tetragrammaton podcast, warning that persistent inflation without growth could cost the dollar its status as a reserve currency.

His comments come as the US national debt climbs to roughly $37.65 trillion, increasing by more than $70,000 per second, according to the US Congress Joint Economic Committee.