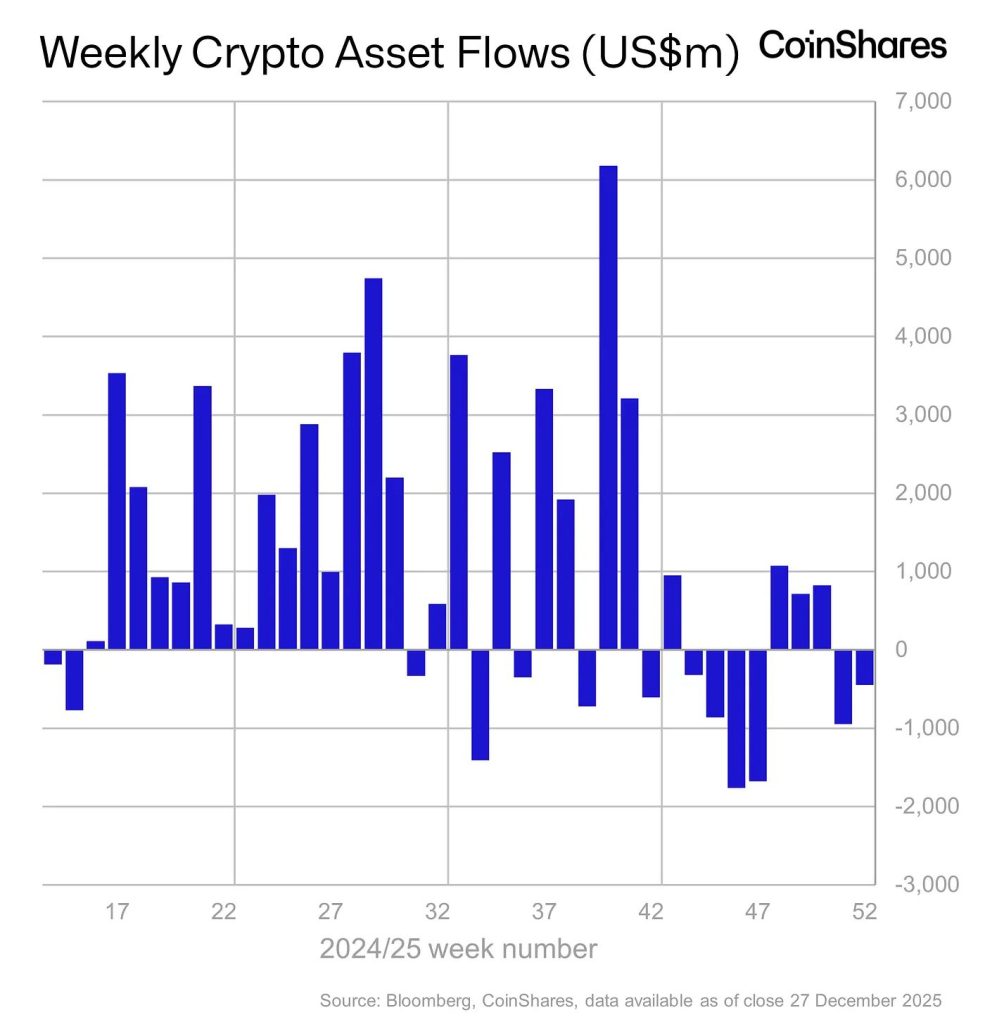

Crypto Funds Bleed $446M in Weekly Outflows as XRP’s Rally Fails to Stem the Tide

Institutional investors are hitting the exit—hard. While XRP's price action grabs headlines, the smart money is quietly moving in the opposite direction, pulling a staggering $446 million from crypto investment products in a single week.

The Great Unwind

Forget the retail-fueled hype. The data tells a colder story: a massive capital flight from regulated crypto funds. This outflow isn't a trickle; it's a wave, suggesting a deeper institutional skepticism that a single asset's rally can't paper over. It's the kind of move that makes you wonder if the pros know something the Twitter charts don't.

XRP's Lone Star Performance

Yes, XRP is up. Significantly. But its surge appears isolated, failing to generate the broader market confidence needed to keep institutional capital parked. The rally looks more like a speculative play on specific news than a vote of confidence in the sector's fundamentals. One asset's green candles can't warm up an entire market winter.

A Reality Check for Crypto Narratives

This divergence exposes a classic market truth: price and capital flows can tell wildly different stories. The headline-grabbing rally masks an underlying weakness, a cautious retreat by the very players whose long-term commitment the space craves. It's a reminder that in crypto, as in traditional finance, sometimes the most important action is happening off the main stage—like watching hedge funds quietly short the euphoria. The final takeaway? When the 'smart money' walks away from the party, it's usually time to check how much punch is left in the bowl.

Source: CoinShares

Source: CoinShares

Regional Flows Show Diverging Investment Patterns

Outflows were concentrated in the United States, where $460 million was withdrawn last week, accounting for the bulk of global withdrawals.

Switzerland posted minor redemptions of $14.2 million, continuing a pattern of measured selling across European markets.

Germany emerged as the notable exception, drawing $35.7 million in fresh capital and recording $248 million in December inflows overall.

The sustained buying suggests German investors have used recent price weakness strategically, accumulating positions while valuations remain below recent highs.

Bitwise chief investment officer Matt Hougan described the current Bitcoin outlook as a prolonged upward trend marked by lower volatility.

“I think we’re in a 10-year grind upward of strong returns,” he told CNBC on Friday, adding that institutional buying has cushioned downside risk compared to previous cycles that saw drawdowns exceeding 60%.

XRP and Solana Buck Broader Market Weakness

XRP and solana recorded the largest inflows last week at $70.2 million and $7.5 million, respectively, extending a streak that began with their mid-October ETF launches in the United States.

Since those debuts, XRP products have attracted $1.07 billion while Solana has drawn $1.34 billion, defying bearish sentiment gripping other assets.

Bitcoin and Ethereum told a different story, posting outflows of $443 million and $59.5 million last week.

Since the launches of the XRP and Solana ETFs, bitcoin products have shed $2.8 billion, while Ethereum vehicles have lost $1.6 billion, highlighting a stark rotation toward alternative assets.

BlackRock’s iShares Bitcoin Trust attracted $25 billion in net inflows this year despite Bitcoin declining roughly 30% from October peaks, ranking sixth among all ETFs by inflows while posting negative returns.

The fund has drawn total net inflows of approximately $62.5 billion since launch, putting it well ahead of competitors, with flows more than five times those of the Fidelity Wise Origin Bitcoin Fund.

According to a Cryptonews report, Bloomberg ETF analyst Eric Balchunas noted that if the fund can raise $25 billion in a weaker year, upside in stronger markets could be significantly larger.

Market Structure Points to Extended Consolidation

Bitcoin traded near $87,800 at press time, trapped between $85,000 support and $93,000 resistance in what analysts call its “” in seven years.

Last week, Perpetual open interest for Bitcoin and Ethereum dropped by $3 billion and $2 billion, respectively, overnight as year-end de-risking pushed traders to the sidelines, according to QCP Capital.

Speaking with Cryptonews, John Glover, chief investment officer at Ledn, expects continued volatility with prices potentially dipping between $71,000 and $84,000 to FORM a fourth-wave bottom before the fifth wave targets $145,000 to $160,000.

“Once the bottom of Wave IV is clearly established, which should be sometime in Q1/Q2 of 2026, then I look for a rally to $145k to $160k in 2026/2027,” he said, adding that only a break below $69,000 WOULD alter his forecast.

Notably, Ethereum staking dynamics also shifted sharply, with fresh inflows overtaking exits for the first time in six months as roughly 745,619 Ether waits to enter staking while the exit queue stands at 360,518 ETH.

The reversal marks a clear change from recent months when withdrawals consistently outweighed deposits, potentially easing persistent sell pressure if current trends hold into early 2026.