Polymarket’s Brutal Reality: 70% of Traders Lost Money While Top 0.04% Raked in Profits

Prediction markets just delivered a verdict on themselves—and it's not pretty.

Forget the hype about democratizing finance. Fresh data from Polymarket reveals a landscape where the vast majority of participants are funding the winnings of a tiny elite. It's the ultimate prediction: most people will lose.

The House Always Wins (Even When It's Decentralized)

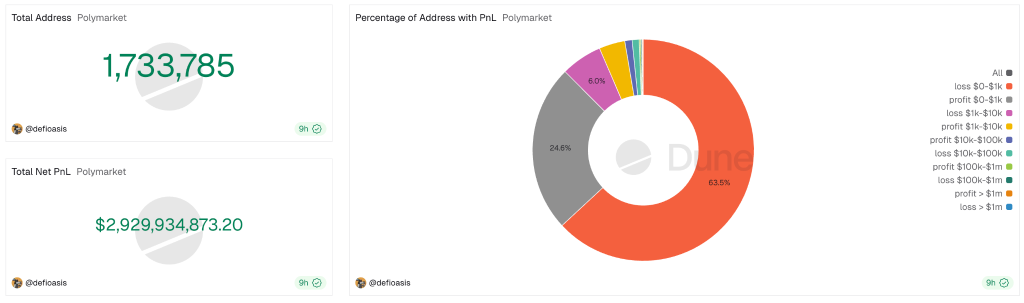

The numbers don't lie. A staggering 70% of traders on the platform ended up in the red. Their losses didn't vanish into thin air—they concentrated into the pockets of a microscopic 0.04% of users who captured the lion's share of all profits.

This isn't a bug; it's a feature of speculative markets, whether they're built on blockchain or the floor of a legacy exchange. A handful of sophisticated players, armed with better information, faster execution, or simply deeper pockets, consistently outperform the crowd. The decentralized ledger just makes the wealth transfer more transparent—and more brutal to witness.

So much for the 'wisdom of the crowd.' More like the capital of the crowd, efficiently redistributed upward. It's a classic finance tale: the promise of easy access obscures the reality of steep odds. The game is open to all, but the rules are written by the few.

Next time someone pitches you on the 'democratization' of trading through crypto, remember this data. The technology changes. The distribution of profits, it seems, does not.

Extreme Profit Concentration Mirrors Traditional Markets

The data shows 668 addresses with profits exceeding $1 million accounted for 71% of all realized gains, while just 2,551 traders earned between $100,000 and $1 million.

At the other end, over 1.1 million addresses, 63.5% of the total, recorded losses between $0 and $1,000, though 149 addresses lost more than $1 million each.

DeFi Oasis noted the calculation method tracks total sale proceeds plus redemption amounts minus purchase costs, excluding unrealized gains or losses.

Traders holding large open positions may show significantly negative realized returns despite potential paper profits.

The skewed distribution reflects broader patterns in prediction markets, where professional traders and sophisticated algorithms typically extract value from retail participants.

This revelation came at a time when Polymarket is facing scrutiny over potential conflicts of interest as platforms, including Crypto.com and Kalshi, build internal market-making desks that trade directly against users.

Platform Growth Continues Despite Concentration Concerns

Polymarket has maintained momentum despite the lopsided profit distribution, with monthly active traders approaching 462,600 and volumes surging past previous records.

The platform completed beta testing for its US relaunch in November after three years offshore following a $1.4 million CFTC settlement in 2022.

Founder Shayne Coplan, now a self-made billionaire at 27, recently participated in a regulatory roundtable convened by the SEC and CFTC.

The platform’s post-money valuation has climbed to $9 billion following significant investments, including a $2 billion commitment from Intercontinental Exchange, owner of the New York Stock Exchange.

Ethereum co-founder Vitalik Buterin recently defended prediction markets against critics who view betting on real-world events as morally questionable.

![]() Ethereum co-founder, Vitalik Buterin, argues prediction markets provide better accountability than social media despite ethical concerns over betting.#Vitalik #PredictionMarkethttps://t.co/YKjWuhM5x0

Ethereum co-founder, Vitalik Buterin, argues prediction markets provide better accountability than social media despite ethical concerns over betting.#Vitalik #PredictionMarkethttps://t.co/YKjWuhM5x0

He argued these platforms offer superior truth-seeking mechanisms compared to social media, where sensationalism faces no accountability.

Buterin noted that financial stakes enforce accuracy, with prices bounded between 0 and 1, reducing the reflexivity effects common in traditional markets.

The defense sparked a heated debate with Quilibrium founder Cassie Heart, who questioned the ethics of profiting from potential deaths and disasters.

Heart suggested prediction markets on catastrophic events explain mainstream hostility toward crypto, though Buterin maintained that stock markets pose similar moral hazards through short positions.

Competition Intensifies as Major Exchanges Enter Space

Google Finance integrated live data from Polymarket and Kalshi in November, surfacing market probabilities directly in search results.

The feature allows users to query future events and track how odds shift over time alongside changes in historical sentiment.

FanDuel launched its FanDuel Predicts platform in December through a partnership with CME Group, offering event contracts on crypto prices, commodities, and economic indicators.

Coinbase filed lawsuits against Michigan, Illinois, and Connecticut in December, challenging state authority over prediction markets ahead of its January 2026 launch with Kalshi.

![]() @Coinbase has filed lawsuits against the US states of Michigan, Illinois, and Connecticut, escalating a growing legal fight.#Coinbase #Cryptohttps://t.co/hTmVsGS8yu

@Coinbase has filed lawsuits against the US states of Michigan, Illinois, and Connecticut, escalating a growing legal fight.#Coinbase #Cryptohttps://t.co/hTmVsGS8yu

The rapid mainstream adoption continues despite regulatory uncertainty.

Combined trading volume across major platforms reached $44 billion in 2024, with on-chain prediction markets climbing from under $100 million monthly in early 2024 to more than $13 billion. Kalshi raised $300 million at a $5 billion valuation.

The concentration data arrives as prediction markets cement their role in retail trading cycles, though the findings suggest most participants subsidize profits for a tiny elite.

As it stands now, whether regulatory clarity and institutional entry will improve outcomes for retail traders remains uncertain.