Metaplanet’s $450M Bitcoin Buying Spree Pushes Holdings Past $3B — Revenue Skyrockets

Metaplanet just dropped another half-billion on Bitcoin. The corporate treasury play isn't slowing down—it's accelerating.

The New Corporate Playbook

Forget boring bonds and stagnant cash reserves. A growing cohort of public companies is treating their balance sheets like a crypto hedge fund. The strategy is simple: allocate, accumulate, and hold. Metaplanet's latest $450 million purchase is a masterclass in conviction, pushing its total Bitcoin stack north of $3 billion. The move isn't just symbolic; it's fundamentally reshaping their income statement.

Revenue Reimagined

Soaring revenue figures tell the real story. This isn't about selling more software or services—it's about the portfolio working overtime. While traditional CFOs sweat over quarterly sales targets, this model lets digital asset appreciation do the heavy lifting. It turns volatility from a risk into a core revenue driver. A cynical observer might call it financial engineering, but the numbers don't lie.

The Bigger Bet

This isn't a one-off trade. It's a structural shift. Each new purchase reinforces the thesis, creating a feedback loop of growing treasury assets and market confidence. The question for every other boardroom is no longer 'if' but 'how much.' As one asset manager quipped, 'They're not hedging against inflation; they're hedging against irrelevance.' The race to convert float into a digital asset stack is officially on. Metaplanet just lapped the field—again.

Bitcoin Pays Off for Metaplanet as Income Unit Outperforms Expectations

The acquisition capped a quarter marked by continued accumulation through a mix of direct market purchases and Bitcoin option-related activity.

Metaplanet said the strategy reflects its long-standing plan to treat Bitcoin as a Core treasury asset rather than a short-term trade.

Alongside the treasury expansion, the company reported that revenue from its Bitcoin Income Generation business has significantly exceeded expectations.

In a regulatory filing, Metaplanet said operating revenue from the segment is now expected to reach ¥8.58 billion, or about $54 million, for fiscal year 2025.

That figure is well above the company’s initial guidance of ¥3.0 billion and its revised October forecast of ¥6.3 billion.

The income business relies on option-based strategies that use a dedicated pool of Bitcoin to generate recurring cash flow.

According to the company, these activities are fully segregated from its long-term Bitcoin holdings, which are intended to be held indefinitely.

The derivatives portfolio generates revenue through option premiums and trading outcomes, while the CORE treasury remains untouched. Any capital generated may later be added to long-term reserves, but the reverse is not permitted.

However, even with the announcement, Metaplanet’s shares are still trading at ¥405 on Tuesday, down nearly 8% on the day.

The Japan Firm Bitcoin Revenue Takes Off as Treasury Strategy Scales

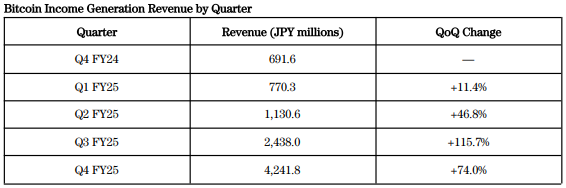

Also, revenue growth accelerated sharply through the year as its Bitcoin income generation revenue ROSE from ¥691.6 million in the fourth quarter of fiscal 2024 to ¥770.3 million in the first quarter of fiscal 2025.

It then climbed to ¥1.13 billion in the second quarter, ¥2.44 billion in the third, and ¥4.24 billion in the fourth quarter.

Over that period, the compounded quarterly growth rate reached about 57%, with the strongest gains recorded in the second half of the year.

Metaplanet’s broader Bitcoin strategy formally began in December 2024, when treasury operations were designated as a core business line.

Since then, holdings have grown from about 1,762 BTC at the end of 2024 to more than 35,000 BTC by late December 2025.

The company tracks its treasury strategy using proprietary metrics such as BTC Yield and BTC Gain, designed to measure Bitcoin accumulation relative to shareholder dilution.

While BTC Yield has declined as the company’s asset and share base expanded, Bitcoin per fully diluted share continued to rise through the end of December, reaching 0.02405 BTC per 1,000 shares.

To fund its expansion, Metaplanet has leaned heavily on capital markets. During the fourth quarter, it entered into Bitcoin-backed credit facilities totaling $280 million under a broader $500 million program.

It also raised ¥21.25 billion through the issuance of Class B preferred shares to overseas institutional investors while fully redeeming outstanding ordinary bonds.

![]() Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury strategy, saying Strategy can withstand 80-90% drawdowns.#Metaplanet #Bitcoinhttps://t.co/pikptcs4nb

Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury strategy, saying Strategy can withstand 80-90% drawdowns.#Metaplanet #Bitcoinhttps://t.co/pikptcs4nb

Metaplanet’s growing exposure has also attracted international attention, with the company recently launching a sponsored American Depositary Receipt program to give U.S. investors easier access to its shares.