Institutional Rotation: $70M Floods into XRP ETPs as Capital Exits Bitcoin

Institutional money is on the move—and it’s chasing a new narrative.

The Big Shift

Forget the old guard. A seismic $70 million has pivoted from the crypto cornerstone into a targeted play on cross-border settlements. This isn't retail FOMO; it's capital reallocating with purpose, betting on utility over pure store-of-value.

Reading the Tape

Exchange-Traded Products don't lie. That volume signals a calculated rotation, not a panic sell. It’s a vote for real-world application—think lightning-fast, low-cost international transfers—over speculative hodling. The smart money is positioning for what comes next, not just what has been.

The New Calculus

Why now? Regulatory clarity acts as a catalyst, turning perceived risk into a structured opportunity. Institutions aren't just buying an asset; they're buying into an operational infrastructure that bypasses traditional banking delays—and fees, much to the chagrin of legacy finance middlemen counting their vig.

The landscape is fracturing. Bitcoin’s dominance faces a legitimate challenge as capital seeks alpha in specialized protocols. This rotation underscores a maturing market: one that allocates based on use case, not just hype. The era of one crypto to rule them all is fading fast.

One cynical finance jab? It’s almost heartwarming to see Wall Street finally embrace a technology that streamlines payments—a concept they’ve been monetizing inefficiencies in for centuries.

Source: CoinShares

Source: CoinShares

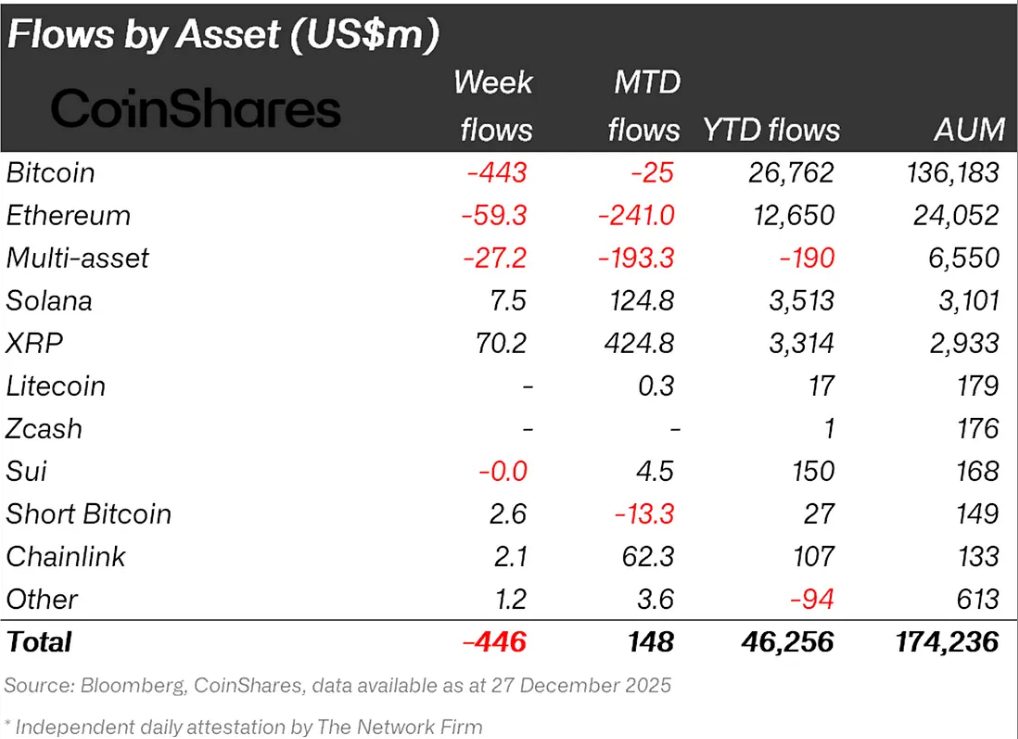

XRP (trading at $1.87, +0.43%) and solana (trading at $125, +1.41%) were the only outliers, with SOL products attracting a modest $7.5 million.

This capital reallocation shows a strategic shift within institutional portfolios, as investors increasingly seek opportunities beyond the established giants like Bitcoin and Ethereum. The robust inflows into XRP products suggest a growing conviction in alternative digital assets that are thought to be emerging from regulatory uncertainty and offering fresh investment avenues.

This strategic diversification reflects a re-evaluation of risk-reward profiles, setting the stage for a closer examination of the specific geographical forces at play in this market-wide recalibration.

The Data: U.S. Sellers, German Buyers

The sell-off was almost entirely U.S.-driven. American funds saw $460 million in withdrawals, likely triggered by lingering macro uncertainty and tariff rhetoric.

Conversely, German investors bought the dip. Germany-based funds posted $35.7 million in inflows, bringing their month-to-date accumulation to $248 million.

“Since the mid-October ETF launches in the US, XRP and Solana have seen $1.07 billion and $1.34 billion of inflows respectively, bucking the negative sentiment seen across other assets,” James Butterfill, head of research at CoinShares, noted.

Specific vehicle data reflects the demand: Franklin Templeton’s recently launched XRP fund alone captured $28.6 million of the weekly volume.

What the Flows Suggest

This isn’t just a “rotation”; it’s a regulatory arbitrage trade. The capital flight from bitcoin ($2.8B outflows since mid-Oct) coincides directly with the launch of spot XRP and SOL ETFs. Institutions are reallocating risk budgets toward assets with fresh regulatory “wrappers” and lower saturation.

The Germany-U.S. split is equally important because European desks are accumulating while U.S. entities de-risk ahead of Q1 fiscal shifts. Expect this bifurcation to persist until the tariff narrative stabilizes.