Bitwise Unleashes Crypto ETF Onslaught: 11 Filings Flood SEC in Single Day

Wall Street's crypto ambitions just went into overdrive—one firm fired off a barrage of filings that could reshape the entire investment landscape.

### The Paperwork Blitz

Forget dipping a toe in the water. Bitwise Asset Management opted for the firehose approach, submitting a staggering eleven separate applications to the Securities and Exchange Commission in a single 24-hour window. This isn't just a request for permission; it's a coordinated assault on regulatory inertia, designed to force the issue of digital asset accessibility into the mainstream.

### Reading Between the Regulatory Lines

The sheer volume of filings suggests a meticulously planned strategy. By flooding the zone, the firm isn't just betting on one horse—it's covering every conceivable angle, from broad market funds to niche, theme-based offerings. It’s a move that puts immense pressure on regulators, framing hesitation not as caution but as obstruction to financial innovation. One cynical observer might note it's the kind of aggressive paperwork usually reserved for creating tax loopholes for billionaires.

### The Ripple Effect for Investors

Approval of even a fraction of these ETFs would blow the doors wide open. We're talking about a potential floodgate of institutional capital waiting on the sidelines for a clean, regulated on-ramp. This could finally bridge the gap between traditional finance's trillions and crypto's disruptive potential, moving assets from speculative wallets into retirement portfolios.

The message is clear: the industry is done asking nicely. The next move—and the clock—is on the SEC.

Bitwise Targets DeFi, Layer-2s, and Privacy Networks

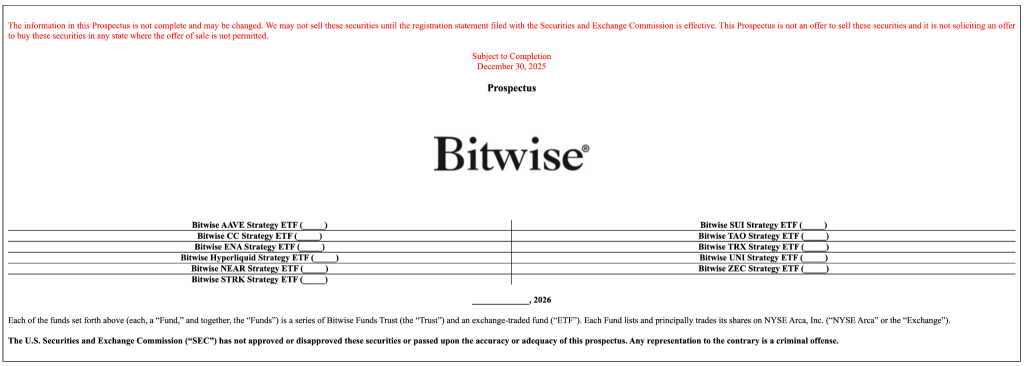

The eleven funds span diverse blockchain sectors, with each targeting a specific protocol.

The BitwiseStrategy ETF focuses on decentralized lending, while the BitwiseStrategy ETF tracks Uniswap’s decentralized exchange and Unichain Layer-2 network.

Infrastructure plays include the BitwiseStrategy ETF, which covers NEAR’s sharded architecture, and the BitwiseStrategy ETF, which targets Mysten Labs’ Move-based blockchain.

Layer-2 scaling solutions feature prominently through the BitwiseStrategy ETF for Starknet’s ZK-STARK technology.

Privacy-focused networks also appear via the Bitwise ZEC Strategy ETF, which tracks Zcash’s zk-SNARK implementation.

Specialized protocols round out the suite, including the BitwiseStrategy ETF for Bittensor’s AI marketplace, the BitwiseStrategy ETF for Ethena’s synthetic dollar protocol, and funds covering Canton Network, Hyperliquid, andblockchain.

Each fund employs identical investment mechanics, with up to 60% in direct token holdings and at least 40% allocated to European ETPs that track token performance through fully collateralized debt securities.

Funds maintain a minimum 80% exposure to designated tokens, related ETPs, and derivatives under normal conditions, with an optional 25% allocation to Cayman Islands subsidiaries for tax compliance and access to derivatives.

Institutional Access and Regulatory Complexity

Bitwise Investment Manager serves as adviser across all funds, with portfolio management shared by Jennifer Thornton, Daniela Padilla, and Gayatri Choudhury.

The Bank of New York Mellon handles administration and custody for traditional securities, while Coinbase Custody Trust Company and BitGo Europe GmbH secure digital assets.

The funds operate under a unitary fee structure, though specific percentages remain undisclosed in the filing.

Despite the professional infrastructure, these products still carry significant risks.

Regulatory uncertainty persists over whether tokens qualify as securities or commodities, with the potential for fund dissolution if classifications shift.

European ETP exposure introduces issuer default risk and valuation challenges due to time-zone differences between the U.S. and European markets.

Notably, the funds intend to qualify as Regulated Investment Companies, avoiding federal taxation at the fund level if income is distributed to shareholders.

Creation and redemption occur primarily through cash rather than in-kind transactions, potentially resulting in higher capital gains distributions than in traditional ETF structures.

Shares trade throughout the day at market prices that may deviate from net asset value.

Wave of Altcoin Products Reshapes ETF Landscape

The filing extends Bitwise’s aggressive ETF expansion following recent launches, including the Bitwise Dogecoin ETF, which has accumulated significant assets despite its non-1940 Act classification and reduced investor protections.

These waves of filling came as Bitwise previously predicted that more than 100 crypto ETFs could launch by 2026 as generic listing standards eliminate approval bottlenecks.

![]() @BitwiseInvest has unveiled the Bitwise dogecoin ETF as investor appetite for altcoin exposure continues to increase.#Bitwise #Dogecoinhttps://t.co/FShBKEVO31

@BitwiseInvest has unveiled the Bitwise dogecoin ETF as investor appetite for altcoin exposure continues to increase.#Bitwise #Dogecoinhttps://t.co/FShBKEVO31

The firm has also filed for products tracking NEAR and Chainlink, with the latter appearing on the DTCC registry, signaling a potential near-term launch.

Market structure shifts continue to accelerate institutional crypto access. Solana, XRP, and Dogecoin ETFs launched throughout 2025, with the Bitwise solana Staking ETF gathering over $660 million in three weeks without experiencing outflows.

Bank of America recently authorized advisers to recommend Bitcoin ETFs to clients, potentially channeling portions of the bank’s $3.5 trillion in managed assets toward digital assets as regulatory clarity improves under new SEC leadership.

Bitwise Maintains Bullish Outlook Despite Market Volatility

Bitwise Chief Investment Officer Matt Hougan maintains that bitcoin will reach new all-time highs in 2026, breaking the traditional four-year cycle pattern through sustained institutional capital inflows.

![]() Bitwise CIO @Matt_Hougan expects steady, lower-volatility Bitcoin gains over the next decade rather than explosive rallies.#Bitwise #Bitcoinhttps://t.co/TjPChydie2

Bitwise CIO @Matt_Hougan expects steady, lower-volatility Bitcoin gains over the next decade rather than explosive rallies.#Bitwise #Bitcoinhttps://t.co/TjPChydie2

The firm argues that Bitcoin’s declining volatility, now lower than Nvidia shares in 2025, reflects a maturing investor base as traditional financial institutions, including Morgan Stanley, Wells Fargo, and Merrill Lynch, prepare allocations.

Hougan also recently said he expects a decade of steady gains from here with reduced volatility rather than explosive rallies, driven by structural market changes and regulatory clarity rather than retail speculation.