Bitcoin Stalls Just Below $90K As Holiday Liquidity Thins - Here’s Why It’s a Bullish Pause

Bitcoin hits a wall just shy of the $90,000 psychological barrier. Thin holiday trading volumes create the perfect storm for a temporary stall—not a reversal.

The Liquidity Crunch

Markets get weird when the big players are on vacation. The usual buy and sell walls thin out, letting even modest orders cause exaggerated price swings. It’s not a lack of demand; it’s a lack of participants. The order book looks anemic—a classic holiday season phenomenon where the market's pulse weakens.

Reading the Tape

This isn't distribution. It's consolidation on low volume—a bullish flag, not a bearish top. Price action coils tightly beneath a major resistance level, building energy for the next leg up. The absence of heavy selling pressure here speaks volumes.

The Path Forward

Watch for a volume surge post-holiday. That’s the signal. A clean break above $90,000 on renewed liquidity could trigger a classic momentum rush, leaving under-positioned traditional funds scrambling to catch up—their annual bonuses, as usual, riding on a trend they were late to spot.

The stall is a feature, not a bug. In crypto, sometimes the market just needs to catch its breath before the next sprint.

ETF Flows and Market Sentiment

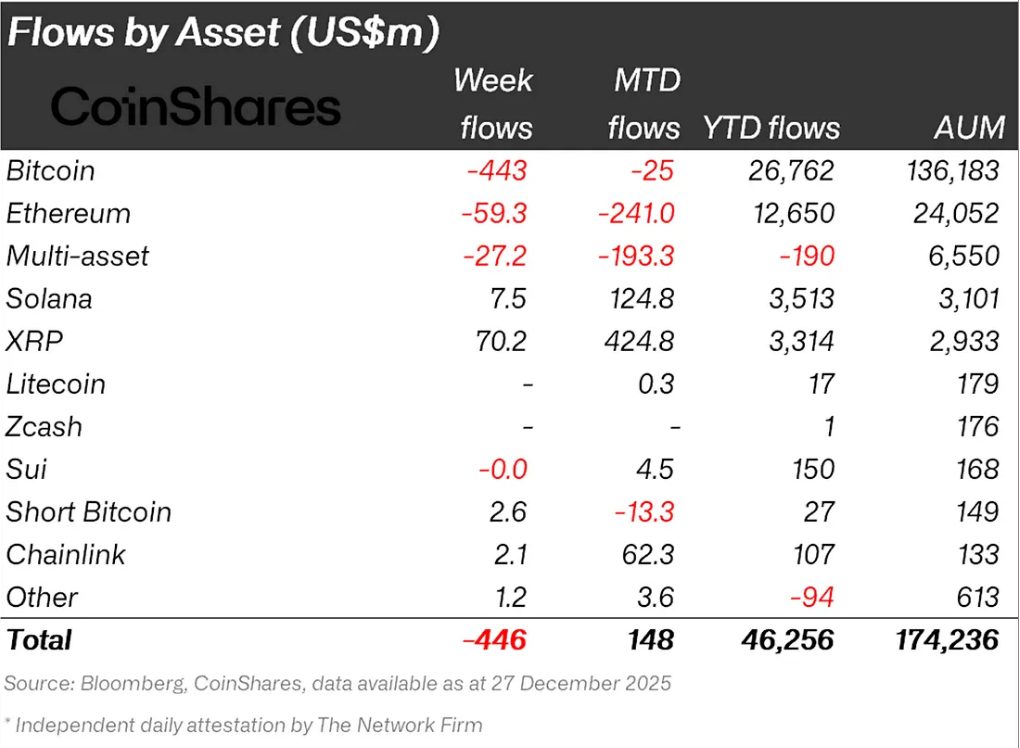

ETF flows line up with the price action, as a CoinShares report noted that digital asset products saw $446 million in outflows in the week to December 29, with Bitcoin products losing $443 million and total post‑October 10 outflows hitting $3.2 billion.

Daily U.S. spot bitcoin ETF prints from Farside and secondary aggregators show a $19.3 million net outflow on December 29, followed by a $355 million net inflow on December 31 that broke a seven‑day outflow streak, with BlackRock’s IBIT adding $143.8 million and ARKB adding $109.6 million. Although flows flickered back to positive, it still wasn’t enough to push BTC through the $90,000 wall.

Macro desks also saw holiday effects. CoinShares noted that ETF trading volumes fell to $24 billion in the late‑November Thanksgiving week versus $56 billion the week before, and similar liquidity compression has appeared across BTC spot and derivatives into New Year’s Eve.

Other risk assets have also shown the same pattern, with EUR/USD stuck and digital-asset indices logging drawdowns of more than 22% in Q4 as December’s “Santa rally” fizzled.

Outlook and Market Positioning

The holiday tape tells you more than the candles. BTC holding $86,500–$90,000 with compressed realized volatility, persistent but moderating ETF outflows, and one strong daily ETF inflow print into year-end sets up a clean positioning reset for January.

Desks that de-risked after the October liquidation shock now face a market where spot is 30% below the $126,279 high, realized vol is dampened, and ETF channels have still attracted tens of billions in 2025 despite recent weekly outflows, which creates room for re‑risking if January flows flip decisively positive.

The practical read for traders: respect $86,500–$90,000 as the holiday range, watch U.S. ETF flow tapes and derivatives basis once full liquidity returns next week, and size with the assumption that the first real break of this band in normal liquidity will set the tone for Q1 risk across crypto books.