TRM Labs Exposes How Nation-States Are Weaponizing Crypto to Evade Sanctions

Digital assets are reshaping global finance—and geopolitical warfare. TRM Labs just pulled back the curtain on how nation-states are turning cryptocurrency into a sanctions-evasion toolkit.

The New Financial Battlefield

Forget traditional banking blockades. Sovereign actors are now deploying crypto networks to move capital across borders—instantly, pseudonymously, and beyond the reach of legacy financial controls. They're not just dabbling; they're building sophisticated, state-backed infrastructure.

How the Playbook Works

It starts with obfuscation: laundering funds through mixers and privacy protocols. Then comes the pivot—converting tainted assets into clean, liquid cryptocurrencies on global exchanges. Finally, the exit: cashing out into local fiat or using stablecoins for international settlements. The entire chain cuts through red tape that would stall traditional transfers for weeks.

The Compliance Arms Race

Blockchain analytics firms like TRM are in a constant tech duel with these state-sponsored networks. Every new tracing algorithm sparks a countermove—more complex layering, fresh obfuscation methods, novel cross-chain bridges. It's digital cat-and-mouse with trillion-dollar stakes.

Sanctions? Meet Counter-Sanctions.

Targeted nations aren't just playing defense. They're actively constructing parallel financial ecosystems—state-issued digital currencies, sanctioned-friendly DeFi protocols, and crypto corridors with geopolitical allies. The goal isn't just survival; it's to build a financial system that bypasses Western dominance entirely.

The regulatory response has been predictable: tighter controls, more blacklists, and urgent calls for "travel rules" on every transaction. Yet the flow continues—proving that code moves faster than legislation every time. After all, in high finance, the first rule of sanctions evasion is to make it look like innovation.

The report describes an increasing divide between administrations that use digital resources to evade accountability and those using the same technology to enhance accountability, transparency, and fiscal control.

The Blockchain Cold War: How Crypto Is Reshaping Global Power

As adoption has expanded, digital assets have become relevant to national economic strategies, sanctions enforcement, and state power.

Cryptocurrency poses a threat, as well as opportunities, to governments because, unlike the conventional financial system, which depends on institutions like the U.S. dollar, SWIFT messaging, and correspondent banking networks, value can be transferred across borders without intermediaries.

TRM Labs reported that certain states have resorted to crypto to circumvent limitations and finance operations that otherwise would be limited by sanctions.

There are others that are attempting to use blockchain-based systems to update payments, strengthen fiscal inclusion, and increase regulatory accountability.

This two-fold application has made crypto a strategic tool instead of an unbiased technology. North Korea is by far the most notable case of government-sponsored illegal crypto practices.

Investigations by TRM Labs indicate that in the last five years, cyber divisions of the North Korean government have stolen billions of dollars by hacking exchanges, decentralized fintech protocols, and cross-chain bridges.

A major incident in February 2025, involving the Bybit exchange, showed the scale of these operations.

![]() The funds stolen in the Bybit hack are on the MOVE — and investigators have a clearer idea of how the $1.4 billion in crypto was stolen#Bybit #LazarusGrouphttps://t.co/P9mgdDbkd1

The funds stolen in the Bybit hack are on the MOVE — and investigators have a clearer idea of how the $1.4 billion in crypto was stolen#Bybit #LazarusGrouphttps://t.co/P9mgdDbkd1

According to TRM Labs, proceeds from these thefts are linked to funding the country’s nuclear and ballistic missile programs.

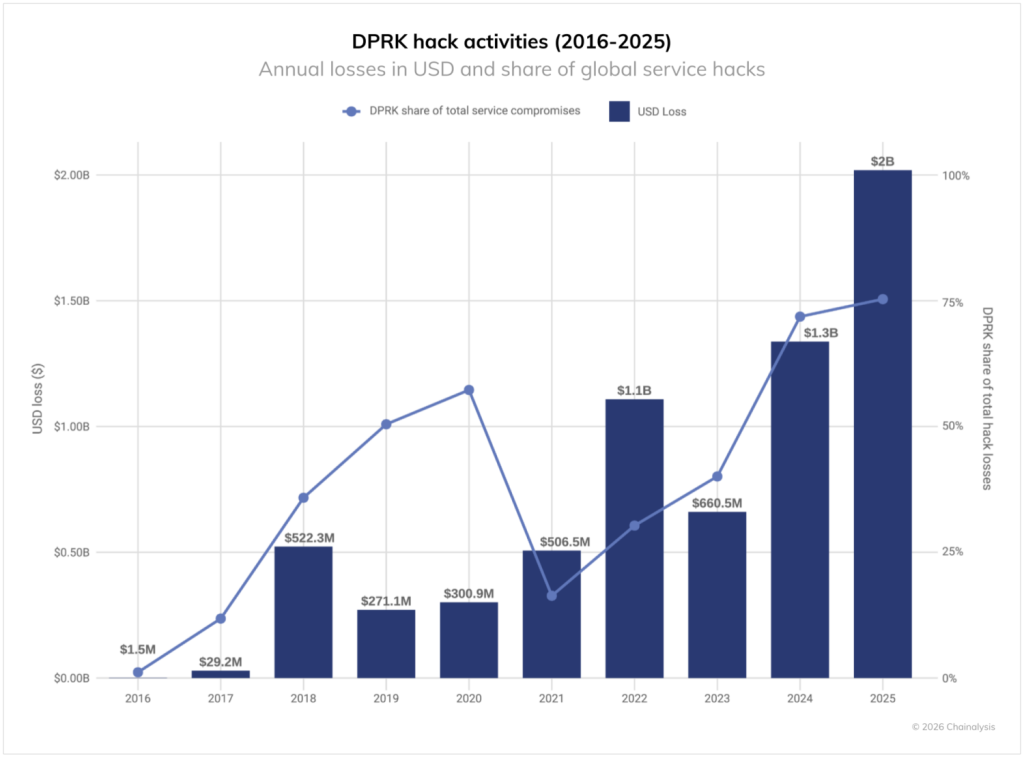

Separate data from a Chainalysis report released in December 2025 underscored the scale of the threat.

North Korean hackers stole at least $2.02 billion in cryptocurrency in 2025, a 51% increase from the previous year, despite carrying out fewer attacks.

The report estimates North Korea’s cumulative crypto theft at $6.75 billion, with DPRK-linked actors responsible for 76% of all service compromises in 2025.

Investigators say the stolen funds are typically laundered through mixers and privacy tools, moved across multiple blockchains, converted into stablecoins, and eventually cashed out through over-the-counter brokers and foreign exchanges, often in Asia.

Crypto Emerges as a Secondary Lifeline for Sanctioned Economies

Russia has also experimented with digital assets following its exclusion from major Western financial systems after the 2022 invasion of Ukraine.

Russian and Iranian intermediaries have tested crypto-based trade to bypass the U.S. dollar, while pro-Russian groups have raised digital assets for military-linked causes.

![]() Russia has increasingly turned to cryptocurrencies to facilitate its oil trade with China and India, allowing it to bypass Western sanctions.#Russia #Chinahttps://t.co/T3bKfCy8fP

Russia has increasingly turned to cryptocurrencies to facilitate its oil trade with China and India, allowing it to bypass Western sanctions.#Russia #Chinahttps://t.co/T3bKfCy8fP

Industrial-scale mining operations have also played a role in converting domestic energy into assets that can be monetized abroad.

Iran has taken a different approach by formally integrating crypto mining into its economic strategy.

The government legalized Bitcoin mining in 2019 and uses domestically mined BTC to pay for imports and mitigate sanctions pressure.

TRM Labs said Iran-based miners contribute a measurable share of global hash rate, with mined assets sold to the central bank and later used in sanctioned trade through regional intermediaries.

At the same time, TRM Labs pointed to broader, non-adversarial adoption of crypto infrastructure.

In Venezuela, worsening economic conditions and a weakening bolívar have driven increased reliance on stablecoins for everyday payments, according to a December 2025 TRM report.

![]() Venezuela’s worsening economy and a weakening bolívar are driving wider stablecoin adoption, TRM Labs says.#Stablecoin #Venezuelahttps://t.co/lF7UbRlu8v

Venezuela’s worsening economy and a weakening bolívar are driving wider stablecoin adoption, TRM Labs says.#Stablecoin #Venezuelahttps://t.co/lF7UbRlu8v

In the U.S., Europe, Japan, and Singapore, regulators are using blockchain analytics to strengthen sanctions enforcement, trace ransomware proceeds, and improve oversight.

Also, initiatives such as the T3 Financial Crime Unit have frozen more than $300 million in criminal assets through coordinated public–private efforts.