Ethereum Network Explodes: Daily New Addresses Surge 110% Post-Fusaka, Adding 292K Wallets Daily

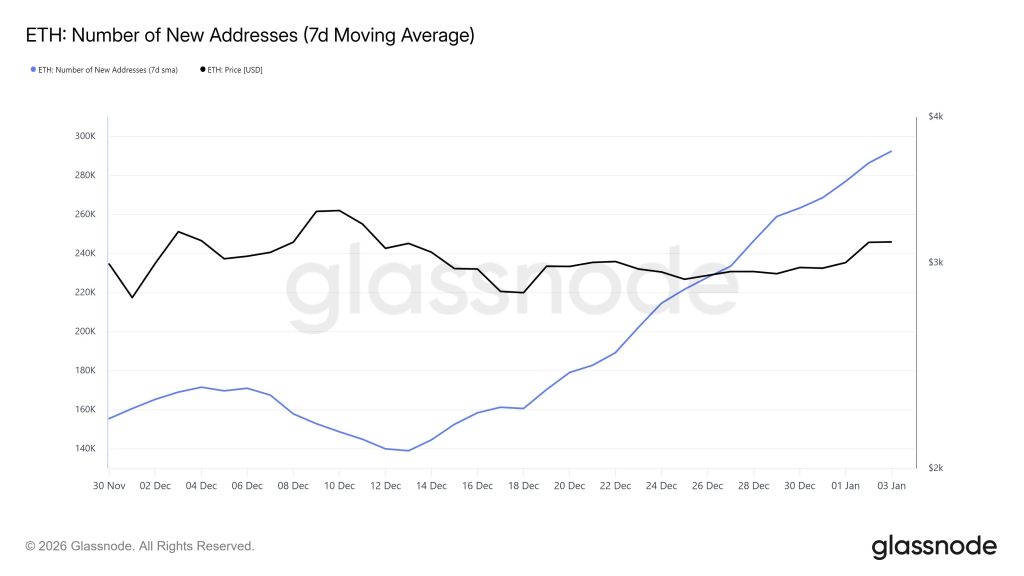

Ethereum's network growth just hit hyperdrive. Since the Fusaka upgrade went live, the creation of new wallets has skyrocketed—up a staggering 110%—pumping nearly 300,000 fresh addresses into the ecosystem every single day.

The On-Chain Surge

Forget gradual adoption; this is a stampede. The 292,000 daily new addresses metric isn't just a vanity number. It's raw, on-chain evidence of capital and users flooding in, likely fueled by Fusaka's promised scalability and lower fees. The network is expanding at a pace that would make even the most bullish analyst do a double-take.

What This Means for ETH

More wallets mean more users, more transactions, and more value accruing to the base layer. This kind of growth is the foundational bedrock for the next leg up in ETH's price discovery. It's the ultimate rebuttal to the 'Ethereum is dead' crowd—you can't argue with the blockchain's own ledger.

While traditional finance is busy debating rate cuts, Ethereum is quietly executing a hostile takeover of the global financial stack, one new wallet at a time. The smart money isn't waiting for permission.

Fusaka Upgrade Drives Surge in Ethereum Network Activity

Fusaka introduced Peer Data Availability Sampling (PeerDAS), a key technical change designed to reduce the cost of posting data to Ethereum. The upgrade directly benefits Layer 2 networks by lowering operational expenses and improving scalability, making it cheaper for users and applications to interact with the ethereum ecosystem.

Since the upgrade went live, Ethereum’s address creation rate has accelerated steadily. Daily new addresses climbed throughout December and into early January, reaching levels not seen since the previous cycle’s expansion phase.

Analysts note that reduced Layer 2 friction typically leads to higher onboarding activity, particularly across DeFi, gaming, and consumer-facing applications. While not every new address represents a long-term participant, sustained growth at this scale is generally viewed as a positive indicator of expanding network usage.

New Address Growth Signals Broader Ethereum Adoption

Rising new address creation has historically preceded increases in transaction volume and liquidity depth on Ethereum. The current trend suggests renewed participation across the network, supported by infrastructure improvements rather than isolated market events.

The Fusaka upgrade was deployed without chain instability or network interruptions, an outcome that has been closely watched by institutional participants. Ethereum’s ability to execute a complex upgrade smoothly has reduced concerns around roadmap risk, particularly as the network continues to rely on Layer 2 scaling solutions.

ETH Price Responds as On-Chain Metrics Improve

Ethereum’s price has begun to reflect improving network fundamentals. ETH recently reclaimed the $3,200 level, moving higher as new address growth accelerated and broader market sentiment improved.

However, on-chain supply data indicates potential resistance ahead. Glassnode data shows a significant concentration of ETH held by investors who entered positions between July and October 2025. Many of these holders are currently NEAR break-even levels, raising the risk of selling pressure if prices continue to rise.

Adoption Trend Faces Key Test in Q1 2026

Market participants are now watching whether elevated address creation translates into sustained transaction demand and Layer 2 usage. Continued growth in wallet activity alongside stable or declining fees WOULD strengthen the case that Ethereum’s post-Fusaka adoption surge is organic.

For now, the data points to a clear shift: Ethereum is seeing its strongest user onboarding rate in over a year, reinforcing the view that protocol upgrades, rather than speculative narratives, are driving renewed network growth.