Solana’s App Revenue Skyrockets to $2.4B as DEX Volume Smashes $1.5T and ETFs Rake In $1B

Solana's ecosystem just posted numbers that make traditional finance look like it's stuck in the dial-up era.

The App Gold Rush

Forget modest growth—Solana's application revenue has blasted into the multi-billion dollar stratosphere. We're talking a figure that would make even the most seasoned Silicon Valley VC do a double-take. The network isn't just hosting apps; it's minting them into revenue-generating powerhouses at a scale that redefines what's possible on a blockchain.

DEXs: The Volume Juggernaut

The decentralized exchanges on Solana aren't just busy—they're processing a tidal wave of capital. The volume flowing through these trustless platforms has eclipsed a mind-bending milestone, proving that users are voting with their wallets for speed and low fees over legacy, permissioned systems. It's a clear signal: the future of trading is automated, on-chain, and relentless.

ETFs: The Institutional On-Ramp

While the crypto-native crowd builds, Wall Street has found its favorite new wrapper. Exchange-traded funds tied to Solana have pulled in a cool ten-figure sum from investors who prefer their exposure with a traditional brokerage account. It's the ultimate irony—the very institutions that once scoffed are now building billion-dollar bridges to the ecosystem they underestimated. A classic finance move: first ignore, then fight, then finally try to commoditize.

The narrative is shifting. This isn't just a blockchain having a good quarter; it's the emergence of a full-stack, high-velocity financial ecosystem operating in internet time. The old guard is left benchmarking against last year's numbers while Solana's machine just keeps printing new ones.

– Apps built on Solana earned $2.39 billion, up 46% y/y for a new ATH

– 7 apps earned > $100m in revenue in 2025:@Pumpfun, @AxiomExchange, @MeteoraAG,… pic.twitter.com/LdMTwd95Ix — Solana (@solana) January 6, 2026

App Revenues Reach New Highs

Applications built on Solana generated a combined $2.39 billion in revenue in 2025 up 46% year-on-year and a new all-time high. Seven applications crossed the $100 million revenue threshold led by Pump.fun, Axiom Exchange, Meteora, Raydium, Jupiter, Photon and BullX.

Beyond the top performers the long tail of Solana apps proved increasingly meaningful, with projects earning under $100 million collectively generating more than $500 million in revenue. The breadth of revenue generation highlights an ecosystem no longer reliant on a small handful of breakout apps.

Network Performance Scales at Low Cost

Solana’s underlying network metrics reinforced this growth. Network REV climbed to $1.4 billion, representing a forty-eight-fold increase over two years.

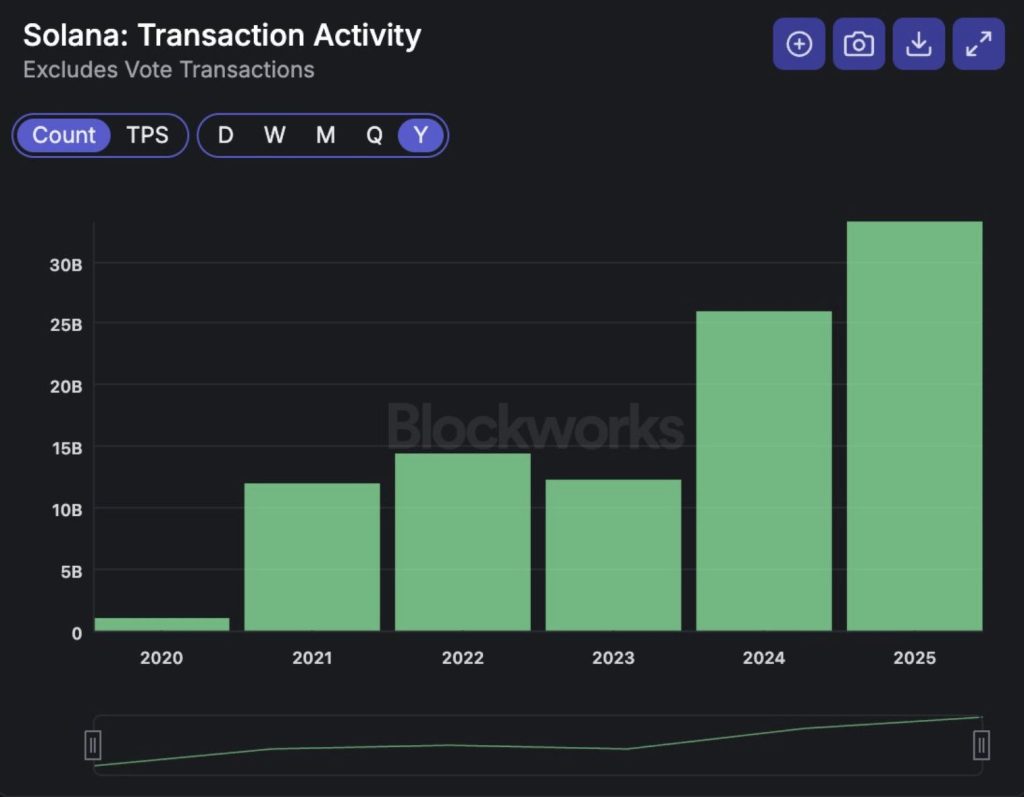

The chain processed 33 billion non-vote transactions during the year, or 116 billion including votes, while averaging over 1,050 non-vote transactions per second.

Daily active wallets averaged 3.2 million, up 50% year-on-year, and more than 725 million new wallets executed at least one transaction. Despite the surge in activity costs continued to fall with average transaction fees dropping to $0.017 and median fees NEAR one-tenth of a cent.

Assets, Stablecoins and Institutional Flows Expand

Asset activity on Solana accelerated sharply. Stablecoin supply ended the year at $14.8 billion more than doubling year-on-year while $11.7 trillion of stablecoins moved across the network.

Tokenised equities debuted with $1 billion in supply and $651 million in trading volume. Bitcoin-related activity also surged, with trading volume rising fivefold to $33 billion and on-chain BTC supply doubling to $770 million.

Staked SOL reached a new high of 421 million tokens and Solana-linked exchange-traded products recorded $1.02 billion in net inflows, underscoring growing institutional engagement.

DEXs, Memecoins and Trading Platforms Drive Volume

Decentralised exchange volume reached $1.5 trillion in 2025, up 57% year-on-year. SOL-stablecoin pairs alone accounted for $782 billion in volume, while twelve DEXs processed more than $10 billion each.

Prop-style automated market makers expanded rapidly, capturing more than half of aggregator volume. Memecoin trading remained intense, generating $482 billion in volume, while launchpads doubled revenues to $762 million and facilitated the creation of 11.6 million tokens.

Meanwhile professional trading platforms earned $940 million in revenue and processed $108 billion in volume, cementing Solana’s position as one of the most active trading venues in crypto.

Taken together 2025 was the year Solana translated scale into substance. Revenue, assets, and trading all reached new highs showing a network that has moved decisively beyond experimentation into economic permanence.