Telegram Revenue Skyrockets 65% to $870M Fueled by Toncoin Surge, Even as $500M Bond Freeze Looms

Talk about a mixed bag. Telegram just posted a monster revenue jump—a cool 65% surge—all while navigating a half-billion-dollar regulatory speed bump. The driver? Its deep dive into crypto, specifically the Toncoin ecosystem, is paying off in spades.

The Toncoin Engine

Forget ads; the real growth story is Web3. Telegram's pivot to integrating blockchain and digital assets is transforming its financials. User adoption of its crypto-native features isn't just a niche play—it's becoming a core revenue pillar, proving that community and utility can trump traditional monetization models any day.

Navigating the Headwinds

That $500 million bond freeze? A classic case of legacy finance trying to put the genie back in the bottle. While it poses a short-term liquidity puzzle, the market's reaction suggests investors are betting on the platform's long-term vision over regulatory friction. It's a high-stakes game of chicken, and Telegram's user base is its biggest shield.

The message is clear: when you build the infrastructure for the next internet, the money follows—even if the old guard isn't ready to hand over the keys. Just ask any banker still trying to figure out what an NFT is.

Toncoin Decline Drags Telegram to Net Loss Despite Revenue Gains

The revenue growth came despite Telegram posting a net loss of roughly $222 million for the period.

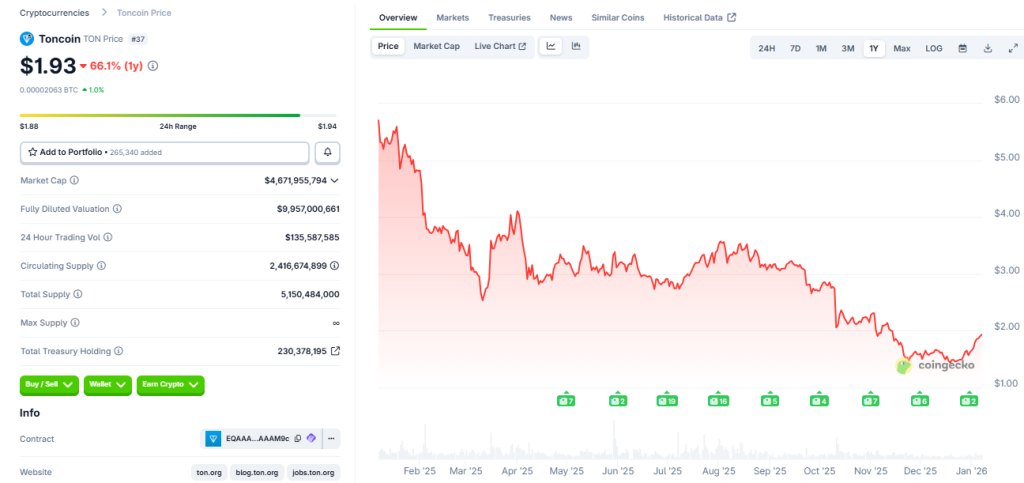

That compares with a net profit of $334 million in the first half of 2024. The swing was largely driven by a write-down in the value of the company’s Toncoin holdings after the token lost about 69% of its value during 2025, data from CoinGecko shows.

Telegram still achieved an operating profit of nearly $400 million, indicating that the underlying business remained profitable before accounting for crypto-related losses.

Toncoin’s role in Telegram’s finances has expanded steadily over the past two years.

Premium subscriptions, which reached $223 million in revenue in the first half of 2025, and various in-app purchases through Telegram’s Fragment marketplace rely heavily on TON for settlement.

Advertising revenue ROSE more modestly to $125 million over the same period as Telegram told investors that it sold more than $450 million worth of Toncoin during the year to date.

At the time of reporting, that amount represented roughly 10% of TON’s total market capitalization, which stands NEAR $4.6 billion.

At the end of June, the total holdings of digital assets of the company decreased to $787 million against $1.3 billion a year ago, due to the sale volumes and the reduction in token prices.

Toncoin also trades at an approximate of $1.93, which is low compared to its all-time high of $8.25 but is still up over 60% over the last year.

Frozen Bonds Cast Shadow Over Telegram’s Financial Gains

Alongside its improving revenue, Telegram is contending with a separate financial strain tied to its debt.

About $500 million of the company’s bonds have been frozen in Russia’s central securities depository due to Western sanctions imposed after Russia’s invasion of Ukraine.

Telegram has launched multiple bond offerings in recent years, including a $1.7 billion issuance in May, partly to buy back existing debt.

![]() @Telegram is raising $1.5 billion through a bond sale backed by BlackRock and Citadel, despite CEO Pavel Durov facing legal restrictions.#telegram #blackrockhttps://t.co/xC2GEkovKf

@Telegram is raising $1.5 billion through a bond sale backed by BlackRock and Citadel, despite CEO Pavel Durov facing legal restrictions.#telegram #blackrockhttps://t.co/xC2GEkovKf

While the company has repurchased most bonds maturing in 2026, the frozen tranche reflects ongoing exposure to Russian capital markets.

Telegram has told bondholders it intends to repay the affected bonds at maturity, leaving it to intermediaries to determine whether payments can reach Russian holders.

The disclosure comes as founder Pavel Durov explores a potential initial public offering, a process that has been slowed by legal proceedings in France.

![]() Pavel @Durov will not appear in person at the @OsloFF after a French court denied his request to travel to Norway.#PavelDurov #telegramhttps://t.co/yREMV7lHmP

Pavel @Durov will not appear in person at the @OsloFF after a French court denied his request to travel to Norway.#PavelDurov #telegramhttps://t.co/yREMV7lHmP

Durov has been under formal investigation since 2024 over allegations that Telegram failed to adequately address criminal content on the platform.

Bondholders are closely watching the outcome, as Telegram’s recent debt offerings include options to convert bonds into equity at a discount if an IPO goes ahead.

Telegram’s revenue growth is underpinned by scale, as the platform has surpassed 1 billion monthly users, around 500 million daily, while paid subscriptions rose to 15 million from 4 million in late 2023.